Newcastle Investment FAQ: Three-Tier Licensing, Article 4 Map & Regeneration Timeline

Investing in Newcastle means understanding the city’s robust three-tier licensing system. All HMOs with five or more tenants require a mandatory licence, while additional licensing covers smaller HMOs (three or more tenants) citywide, and selective licensing applies in designated wards like Arthur’s Hill, Heaton, and West Fenham. Each scheme has its own application process, fees, and compliance standards—non-compliance can result in fines up to £30,000 per property. Article 4 Directions are in force across key areas such as Jesmond, Heaton, Sandyford, and Shieldfield, removing permitted development rights for HMO conversions and requiring planning permission. Use our interactive Article 4 Areas Map to check any address for restrictions and avoid costly surprises. For the latest boundaries and licensing updates, consult Newcastle City Council’s resources or our live map tool.

Regeneration Timeline & Investment Opportunities

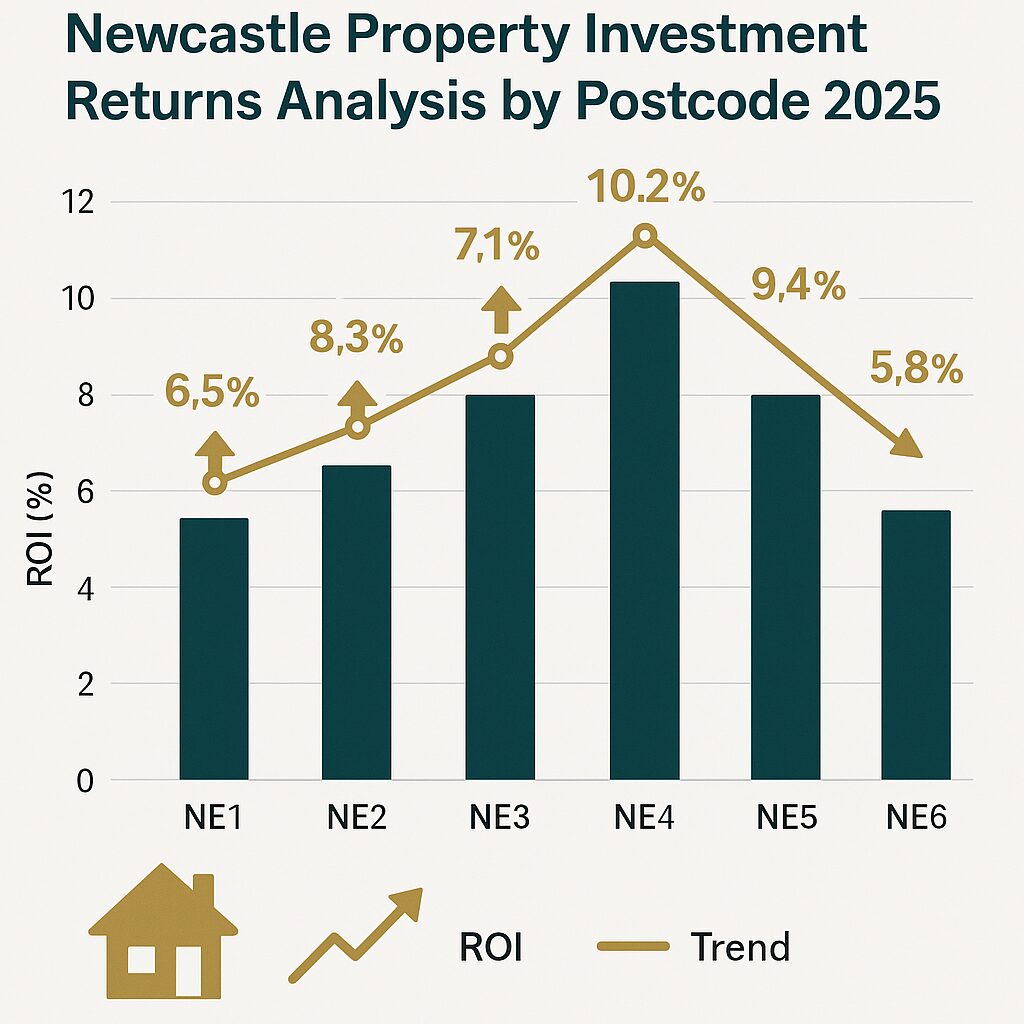

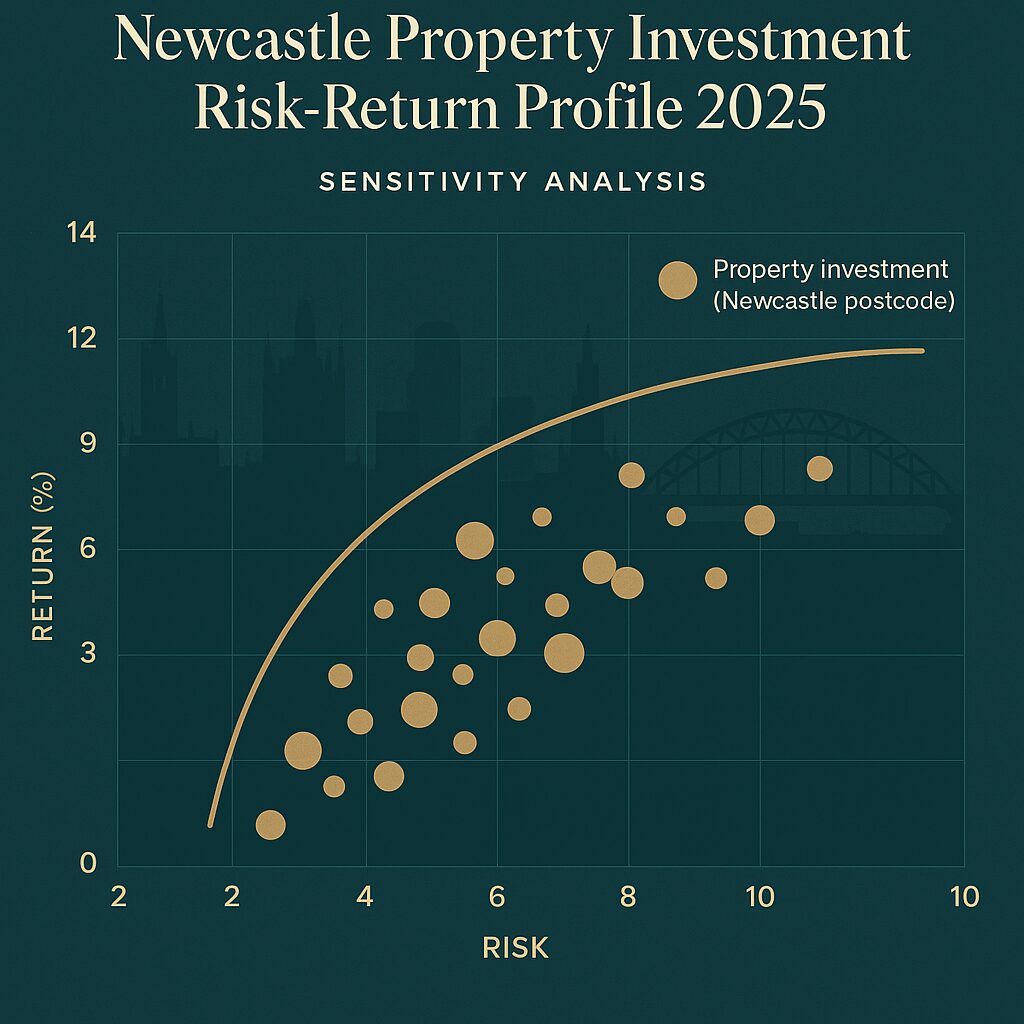

Newcastle’s property market is being transformed by major regeneration projects, making timing and location critical for investors. The £350 million Newcastle Helix innovation district, £121.8 million Quayside West/Forth Yards development, and the Stephenson Quarter expansion are delivering thousands of new homes, jobs, and amenities through 2030. Infrastructure upgrades—including the Northumberland Line reopening and Metro modernisation—are boosting connectivity and rental demand in areas like Ouseburn, Heaton, and the West End. Our regeneration timeline highlights key milestones and emerging hotspots, helping you target areas with the strongest capital growth and yield potential. Use our interactive ROI calculator to compare projected returns across Newcastle’s top postcodes, from city centre apartments (NE1, 8.5–8.9% yields) to high-demand student HMOs in Jesmond and Heaton.

Trust Indicators, ROI Tools & Instant Property Alerts

Palace Auctions is committed to transparency and investor success, underpinned by recent Newcastle transactions—such as city centre flats sold for 12% above guide price and Jesmond HMO portfolios achieving 8.9% gross yields. In 2024–2025, over 7,000 Newcastle properties were sold, with average prices up 3% year-on-year and rental yields in top areas consistently exceeding 7%. All transactions are conducted under RICS regulation and The Property Ombudsman membership, ensuring the highest professional standards and full legal compliance. For tailored investment opportunities, compliance support, or early access to off-market deals, use our quick contact form to register for instant property alerts and free consultations with our Newcastle specialists. Our local experts provide HMO application support, Article 4 planning advice, and connections to trusted legal and financial professionals—ensuring you invest with complete confidence in one of the UK’s most dynamic region.

Investment Guides and areas

-

Property for sale by Auction

Area & City Location and Investment Guides

Manchester City and Area Property investment Guide

Birmingham City and Area Investment

Investment Property advice – Cardiff

Glasgow Property investment Guide

Leeds Property investment Opportunities

Luton City Property Market Advice for worldwide investors