South East Investment FAQ: Regional Variations, Licensing & Compliance

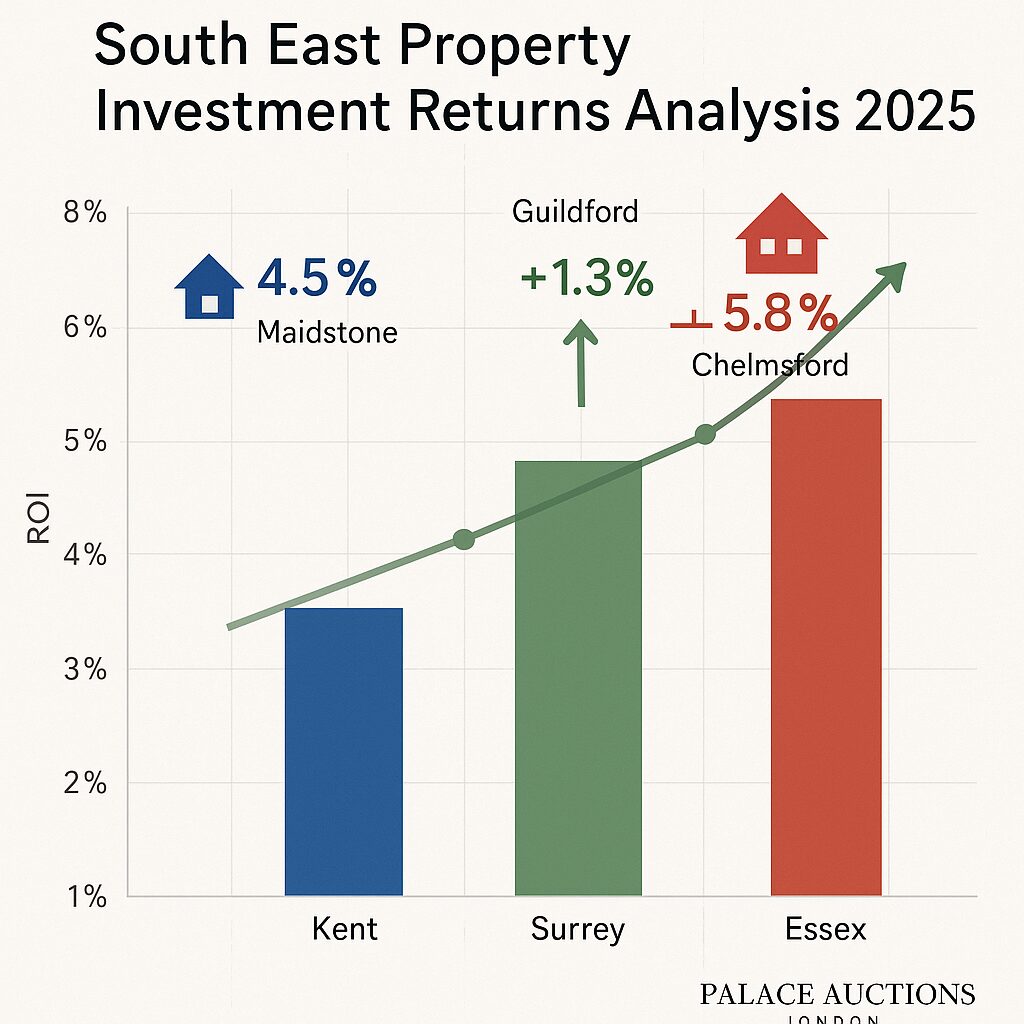

Investing across South East London, Kent, Surrey, and Essex means navigating distinct property markets and local regulations. Average prices range from £423,000 in Essex and Kent to £584,000 in Surrey, with yields highest in Kent (5–6.5%) and select SE London postcodes (up to 7.2%). Each area has unique licensing rules: South East London boroughs like Lewisham require both HMO and selective licences for many rentals, while Croydon currently mandates only HMO licensing for five or more tenants. Kent, Surrey, and Essex generally follow national HMO rules (licensing for five or more unrelated tenants), but fees, application processes, and compliance checks vary by council. Always check the latest local authority guidance before purchase or letting to avoid fines and ensure legal compliance.

Infrastructure Timeline & Regeneration Hotspots

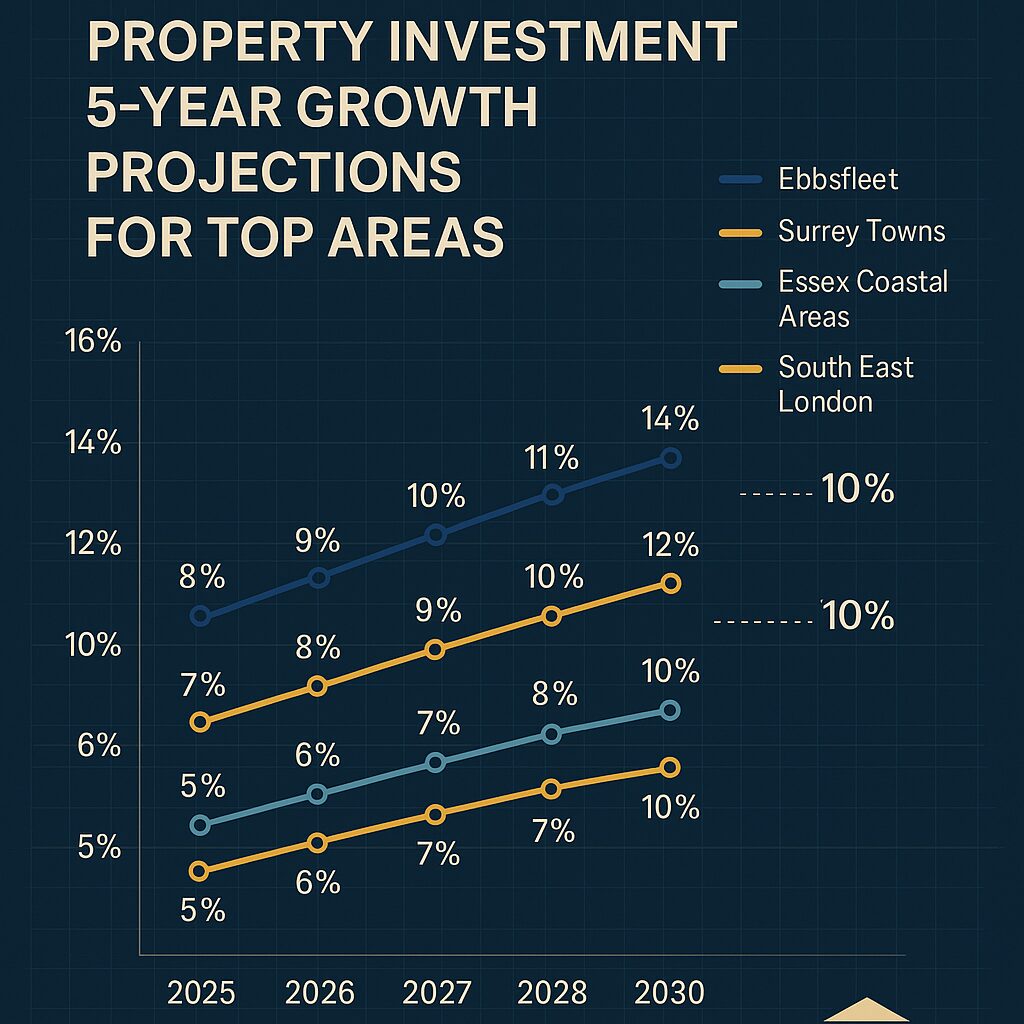

Major infrastructure and regeneration projects are transforming the region and driving property value growth. The Elizabeth Line (Crossrail) has boosted prices and rents by up to 120% near stations in Abbey Wood, Woolwich, and Romford, with further upgrades and a potential Ebbsfleet extension on the horizon. Ebbsfleet Garden City (Kent) is delivering 15,000 new homes and 32,000 jobs by 2035, while Basildon (Essex) and Thamesmead (SE London) are undergoing multi-year regeneration, adding thousands of homes and new amenities. The £9 billion Lower Thames Crossing will further enhance Kent-Essex connectivity. Investors should focus on areas within 5 km of new transport links or regeneration zones, as these typically command 10–15% price premiums and above-average rental demand.

Interactive ROI Calculator & Investor Support

Compare investment opportunities instantly with our interactive ROI calculator—analyze rental yields, capital growth, and total returns across Kent, Surrey, Essex, and South East London. Input your target area to view projected yields (e.g., 6.5% in Medway, 5.5% in Basildon, 4% in Guildford, or 7.2% in Barking), five-year appreciation forecasts, and live market data. For tailored opportunities, compliance support, or early access to off-market deals, use our quick contact form to connect with local experts. All transactions are conducted under RICS regulation and The Property Ombudsman membership, ensuring transparency, legal compliance, and investor confidence in one of the UK’s most dynamic property market in 2025