Navigating Property Auction Deposits with Confidence

At Palace Auctions London, we know that understanding auction deposit procedures is crucial for a smooth and successful property purchase. Our complete guide demystifies every step, from payment methods to legal obligations, ensuring you’re fully prepared for auction day. Whether you’re a first-time bidder or a seasoned investor, our expert team is committed to providing the clarity and support you need to bid with confidence in London’s fast-paced property market.

Your Trusted Partner in London Property Auctions

With a proven track record across the capital, Palace Auctions stands as a leader in transparent auction processes and secure deposit management. We work closely with legal and financial professionals to uphold the highest standards of compliance and client care. Our in-depth resources and hands-on guidance mean you can trust us to safeguard your interests and help you navigate every aspect of the auction process.

Expert Support Every Step of the Way

From your initial enquiry to the final exchange, Palace Auctions London is by your side. Our comprehensive deposit guide, combined with our responsive auction team, ensures you have all the information and assistance you need—before, during, and after the auction. We believe that informed buyers make confident decisions, and we’re dedicated to supporting you at every stage of your property journey.

Frequently Asked Questions – Auction Deposits

Can I pay deposit by credit card?

Credit card acceptance for auction deposits varies by auction house. Some, including many in London, do accept credit card payments (often with a surcharge, typically around 2.1%), while others do not. We recommend contacting our auction team at least 48 hours before the auction to confirm accepted payment methods. Always prepare alternative options such as bank transfer, banker’s draft, or debit card, as cash is not accepted due to anti-money laundering regulations.

What happens if seller withdraws?

Once the auctioneer’s hammer falls, both buyer and seller are legally bound to complete the transaction. If the seller withdraws after this point, it constitutes a breach of contract and may result in legal action and compensation for the buyer. Seller withdrawal before the auction is permitted, but post-auction withdrawal is extremely rare due to these serious legal implications.

How quickly must deposit be paid?

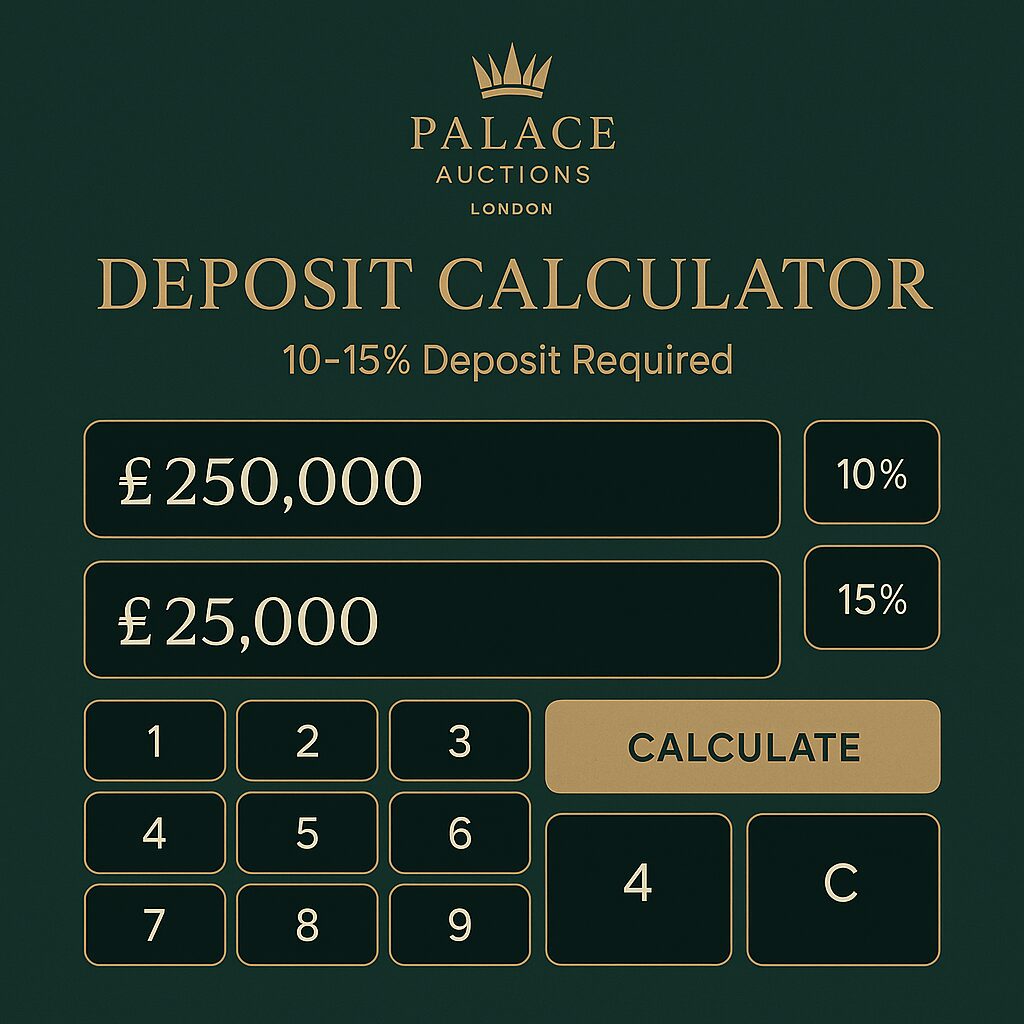

The deposit—usually 10% of the purchase price—must be paid immediately after a successful bid, typically before leaving the auction room. This is a legal requirement, as contracts are exchanged at the fall of the hammer. Ensure you have cleared funds and your chosen payment method ready before attending the auction.

Are deposits protected?

Auction deposits are not covered by government-backed deposit protection schemes. Instead, they are held by the auctioneer as a stakeholder or agent for the seller, in accordance with professional standards and anti-money laundering regulations.

Deposits are managed in client accounts and are subject to oversight by regulatory bodies such as NAEA and RICS, providing a strong framework of professional protection.

🚨 Emergency Auction Day Support

Emergency Hotline: 020 7101 3647

Available during all auction events and for 2 hours post-auction

If you experience payment difficulties or technical issues on auction day, our dedicated support team is ready to help. Please have your bidder registration number, property lot number, and payment details available when you call.

Email: emergency@palaceauctions.com

Text: Send “URGENT” + your bidder number to 07971 033276

Key Finding:

Palace Auctions London is committed to providing secure, transparent, and supportive auction experiences—ensuring your deposit and your interests are always protected.

Palace Auctions London – Your trusted partner in property auctions. Regulated by laundering requirements.