Auction Fees, Deposits, and Special Conditions

Your Guide to a Successful Auction Experience with Palace Auctions London

Welcome to Palace Auctions London. We believe in transparency and want to ensure you have all the information you need to participate in our auctions with confidence. Let’s walk through the key aspects of our auction process, including fees, deposits, and special conditions of sale.

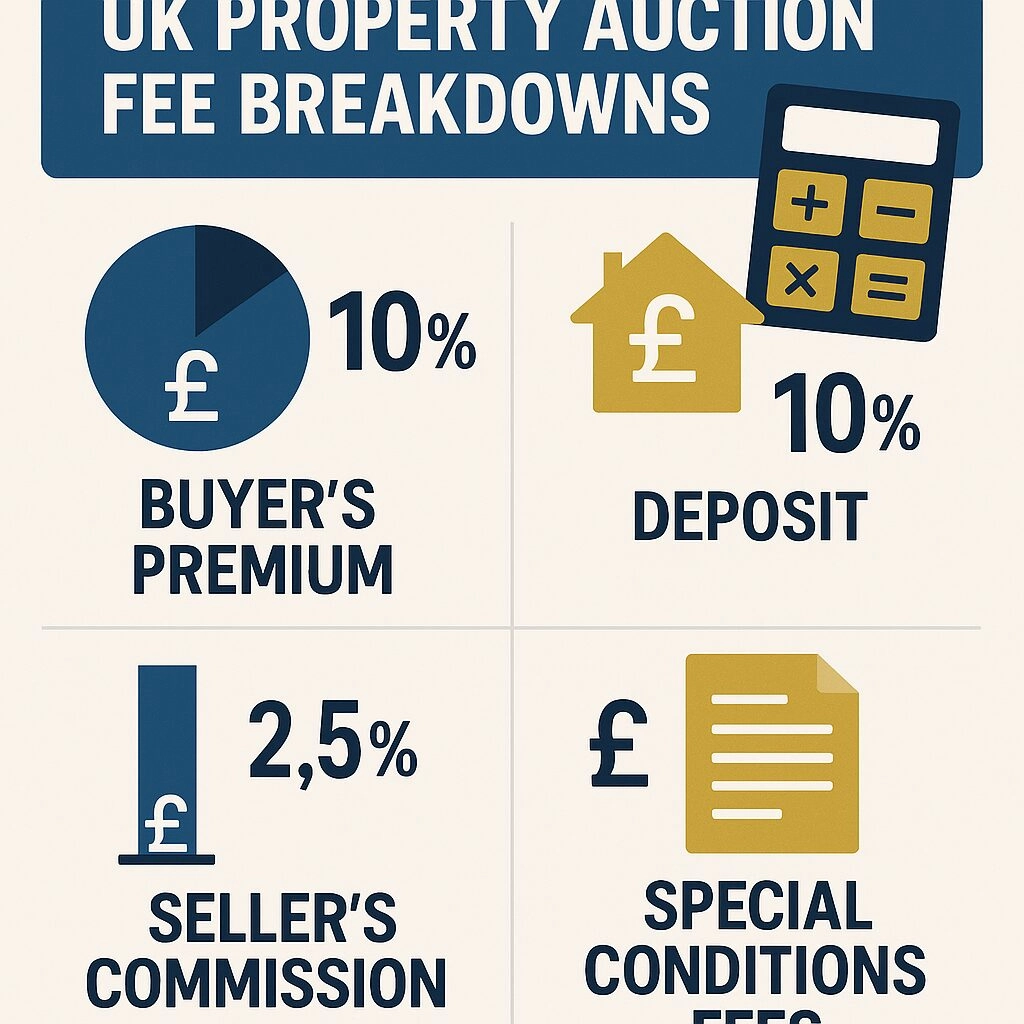

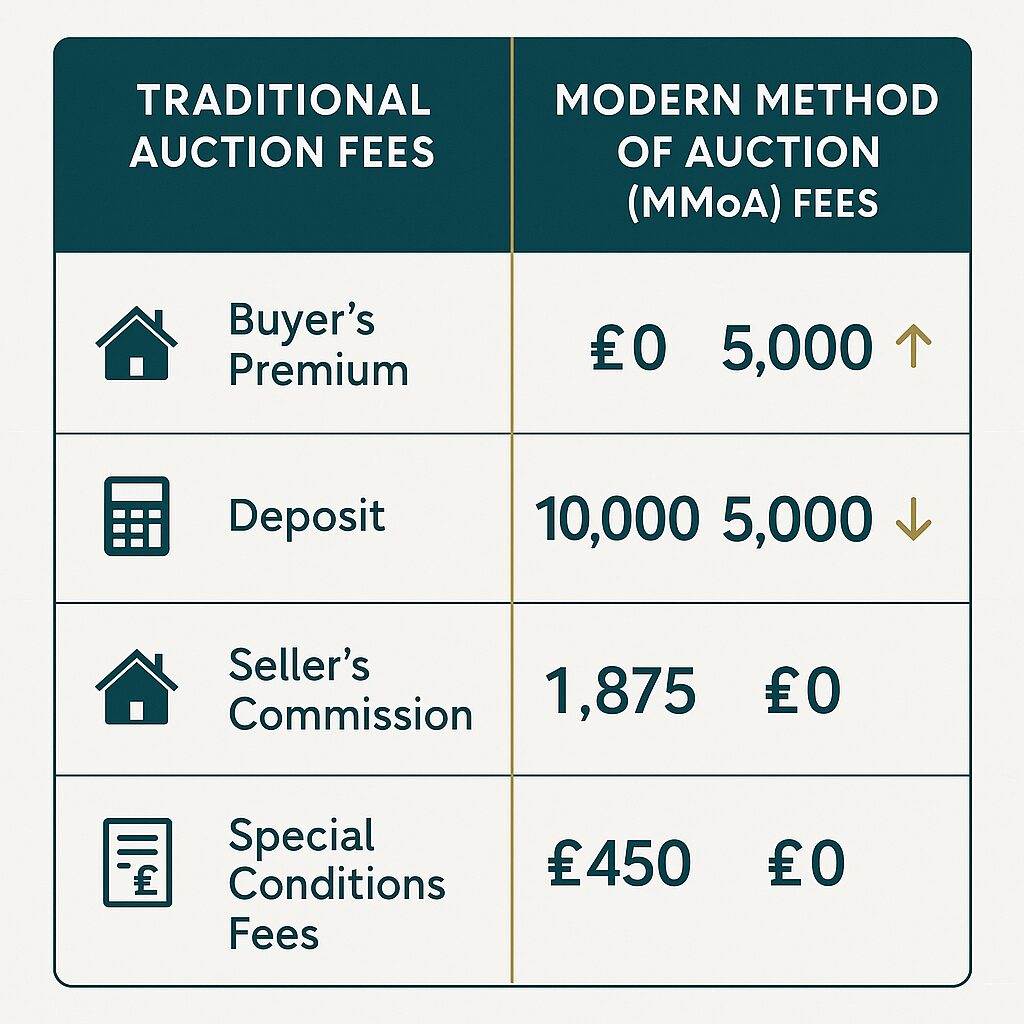

Auction Fees: Understanding the Costs

At Palace Auctions London, we strive to keep our fee structure clear and competitive. Here’s what you need to know:

Property for sale A four-part collage showing a judge’s gavel, a stack of old books, coins on dollar bills, and a blank black square, representing law, money, justice—and alluding to buying costs at auction like property auction deposits and auction house fees UK. Presented by Palace Auctions

Property for sale A four-part collage showing a judge’s gavel, a stack of old books, coins on dollar bills, and a blank black square, representing law, money, justice—and alluding to buying costs at auction like property auction deposits and auction house fees UK. Presented by Palace Auctions

For Sellers:

- Auctioneer’s Commission: We charge a competitive rate of 2% + VAT of the final sale price. This fee is only payable upon successful sale of your property.

- Buyer’s Premium: If as the seller you prefer not to pay a commission. Then we the auctioneers can offer to charge our commission as a “Buyers Premium”. Should the seller chose or prefer this option.

- Entry Fee: A modest upfront fee of £400 + VAT covers the cost of listing your property in our auction catalogue and our comprehensive marketing efforts.

- Legal Pack Preparation: You can Expect to pay your appointed Solicitor around £500 for the preparation of the essential auction legal pack. This cost may vary depending on the complexity of your property.

For Buyers:

- Buyer’s Premium: A fee of 2% + VAT of the hammer price, with a minimum of £4,000 + VAT. This premium ensures we can continue to provide high-quality auction services.

-

Please note that: buyer’s premium is chargeable in most cases. However it may not be (if the seller has elected to pay all or part of the Auctioneers commission) Please check each lot you intending to bid on.

- Administration Fee: A flat fee of £1000 + VAT, payable upon exchange of contracts. This covers the administrative costs associated with processing your purchase

“We believe in fair pricing for both buyers and sellers. Our fee structure is designed to offer value while maintaining the high standards you expect from Palace Auctions London.”

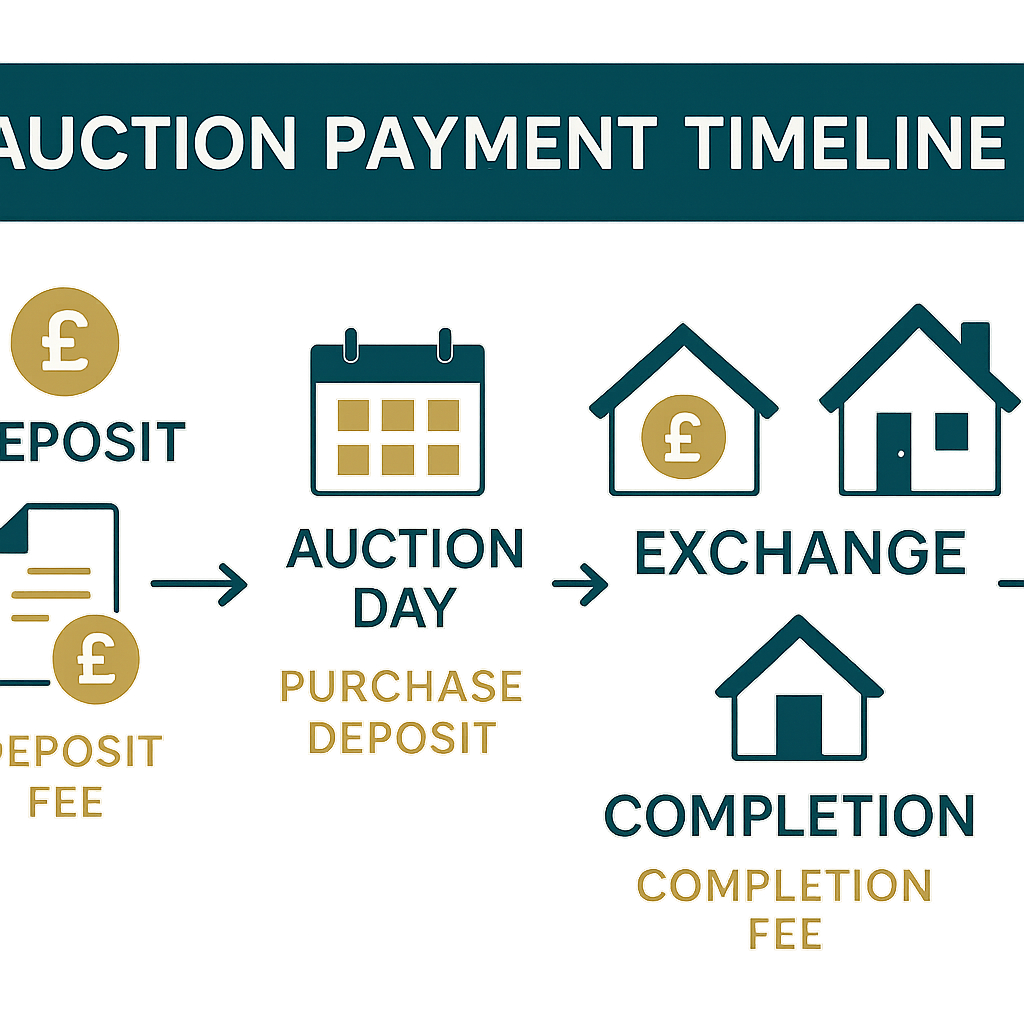

Deposits: Securing Your Bid

Deposits are a crucial part of the auction process, demonstrating your commitment and ensuring a smooth transaction.

Deposit Requirements:

- Amount: We require a deposit of 10% of the purchase price, payable immediately if you’re the successful bidder

- Payment Methods: We accept bank transfers, debit cards, or banker’s drafts. Please note that we do not accept cash or credit cards for deposit payments.

- Timing: Be prepared to pay your deposit on the day of the auction if you’re successful. This forms part of the legally binding contract.

- Buyers Premium and Administration fees: You will also be asked to pay the Auctioneers Buyers premium (If Any) and any Auction administration fees – at the time of paying your deposit.

“Having your deposit ready shows you’re a serious buyer. It’s the first step towards securing your new property.”

What Happens to Your Deposit?

- If you’re successful, your deposit is held as part of the purchase price.

- If you’re unsuccessful, any deposit paid during registration will be fully refunded within 2 working days.

- Please see below for the way we handle auction deposits.

Special Conditions of Sale: The Fine Print That Matters

Special conditions of sale are unique to each property and form a crucial part of the auction contract. They protect both buyers and sellers by clearly outlining specific terms of the sale.

Key Elements Often Included:

- Completion Timeframe: Typically set at 28 days from the auction date, unless otherwise specified.

- Additional Costs: Any extra fees or charges specific to the property. Which have been set and are usually required by the seller upon completion.

- Property-Specific Clauses: Information about current occupancy, rights, or covenants affecting the property.

- Environmental and Legal Disclosures: Known issues that could affect the property’s value or use.

“We strongly recommend reviewing the special conditions thoroughly before bidding. They’re not just formalities – they’re crucial to understanding exactly what you’re bidding on.”

Accessing Special Conditions:

- Available in the legal pack for each property

- Downloadable from our website once you’ve registered interest in a specific lot

- Our team is always available to clarify any points in the special conditions.

Preparing for Auction Day

To ensure you’re fully prepared for auction day:

- Register Early: Complete your registration at least 48 hours before the auction.

- Review Documents: Carefully read the legal pack and special conditions for your chosen property.

- Arrange Finances: Ensure you have funds available for the deposit and that you are confident of being ready to complete within the specified timeframe.

- Seek Professional Advice: We recommend having a solicitor review the legal pack before you bid, If you are unsure of anything.

“Preparation is key to auction success. Let us help you get ready for a smooth and exciting auction experience.”

Need More Information?

Our experienced team is here to guide you through every step of the auction process. Whether you have questions about fees, deposits, or special conditions, we’re just a call or email away.

📞 Auction Enquiries: [0207 101 3647]

✉️ Email Support: [sales@palaceauctions.com]

🏢 Visit Our Office: [Palace Auctions London, 11 Old Bond Street, Mayfair London]

[Register for Our Next Auction]

Palace Auctions London: Transparency, Expertise, and Support at Every Step