Key Takeaway: Auctions offer unmatched speed, certainty, and transparency—debunking common myths and empowering both buyers and sellers to achieve successful, stress-free property transactions.

Auction FAQ: Top 10 Misconceptions—Busted

Thinking of buying or selling at auction? Don’t let myths hold you back. Here are the facts:

- Auctions are only for distressed properties:

- False! Modern auctions feature everything from luxury homes to commercial assets—many sellers choose auction for speed and certainty, not desperation.

- Only cash buyers or investors can participate:

- Not true. While a 10% deposit is required on the day, buyers can use mortgages or bridging loans if arranged in advance.

- Auctions are riskier than private sales:

- Auctions are highly regulated, with legal packs and surveys available before bidding. Due diligence is encouraged.

- Guide prices reflect the expected sale price:

- Guide prices are marketing tools, often set low to attract interest. The final price is determined by competitive bidding and may exceed the guide.

- You can back out after winning the auction:

- Once the hammer falls, the sale is legally binding. Buyers must complete the purchase or risk losing their deposit and facing legal action.

- Auction fees are hidden or excessive:

- Fees are clearly stated in the legal pack. Review all costs, including premiums and admin charges, before bidding.

- Auctions guarantee a bargain:

- While some properties sell below market value, competitive bidding often achieves or exceeds open market prices.

- You can’t inspect or survey auction properties:

- Viewings and surveys are encouraged before auction day. Legal packs provide detailed information—consult a solicitor.

- Auctions are intimidating or only for professionals:

- The process is open, with clear rules and support for newcomers. Online and in-person bidding make auctions accessible to all.

- Auctions are only for local buyers:

- Online bidding and national marketing mean buyers from anywhere can participate, expanding competition and opportunity.

Timeline Comparison Tool: Auction vs Traditional Sale

| Stage | Auction Sale (Weeks) | Traditional Sale (Weeks) |

| Marketing & Viewings | 2–4 | 4–8 |

| Offer/Contract Exchange | Immediate (Auction) | 8–16 (Negotiation & Conveyancing) |

| Completion | 3–4 (20–28 days) | 1–4 |

| Total Duration | 4–6 | 12–20 |

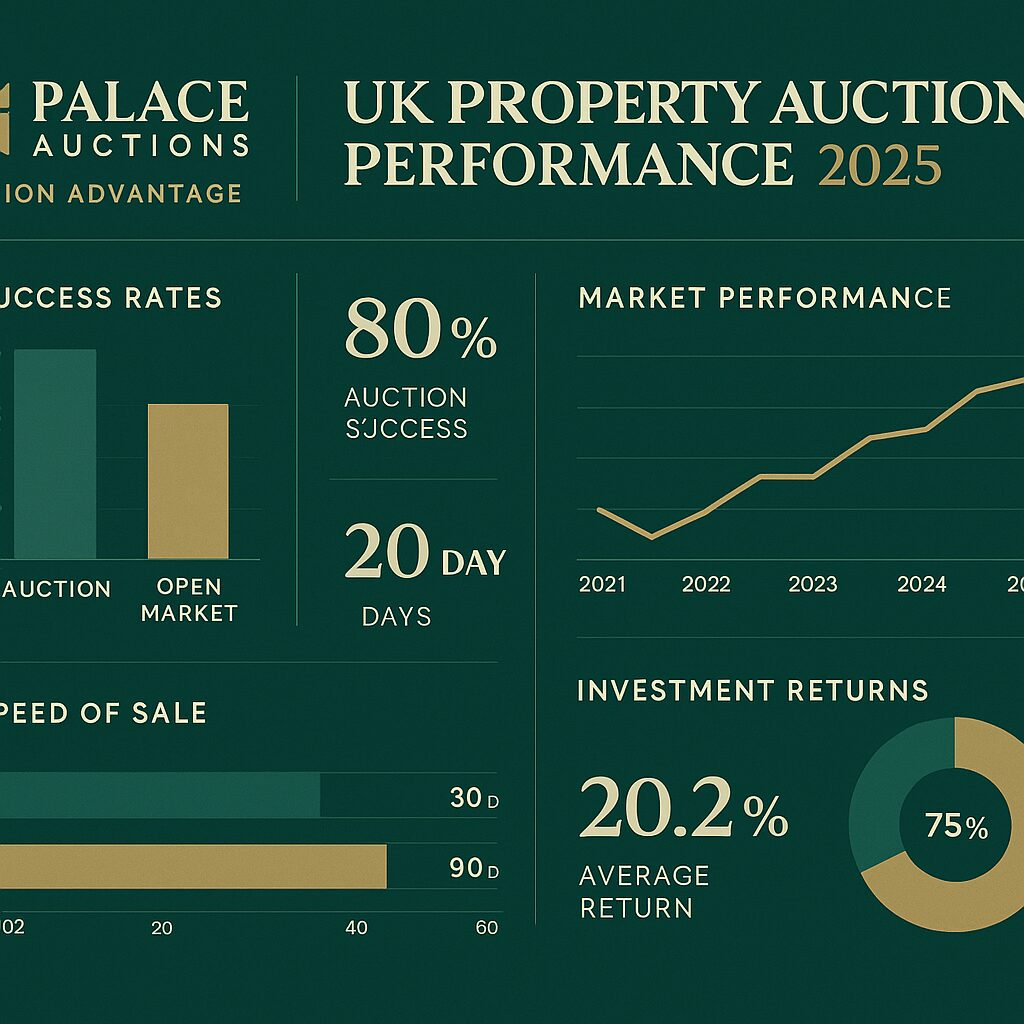

At a glance: Auctions typically complete in 4–6 weeks with near-zero fall-through, while traditional sales average 12–20 weeks and face up to 30% risk of collapse.

Quick Registration: Get Started Today

For Buyers:

- Full Name

- Email & Phone

- Address

- Photographic ID & Proof of Address (upload)

- Preferred Bidding Method (in-person, online, proxy, telephone)

- Property/Lot of Interest

- Solicitor Details

- AML Check Consent

- Register to Bid Now | Request Auction Catalogue | Book Viewing

For Sellers:

- Full Name

- Contact Details

- Property Address & Type

- Title Deeds (upload)

- TA6/TA10 Forms (upload)

- EPC (upload)

- Solicitor Details

- Agreement to Terms

- Request Free Auction Appraisal | Get Reserve Price Estimate | Speak to an Auction Specialist

**Ready to experience the speed, certainty, and transparency of auction? Register now—our team.