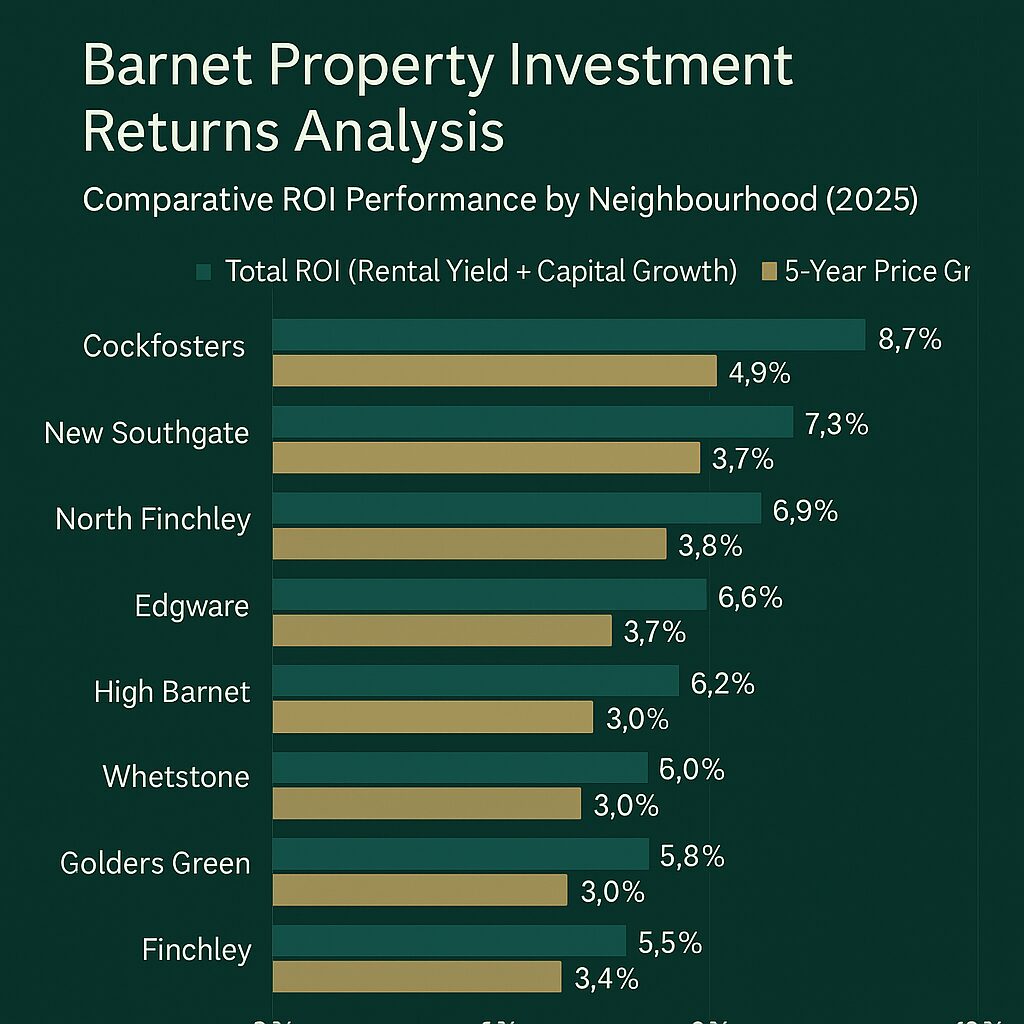

Unlock Barnet’s full investment potential with our powerful ROI Comparison Tool—an interactive calculator that lets you compare projected returns across every Barnet neighbourhood. Instantly see how areas like Cockfosters deliver yields up to 4.7%, while New Southgate boasts 18.6% capital growth over five years. Whether you’re a first-time buyer or a seasoned investor, our tool provides real-time yield calculations, capital growth forecasts, and neighbourhood analytics to help you make confident, data-driven decisions in one of North London’s most dynamic markets.

Find the perfect location for your family or tenants with our postcode-based School Finder and Transport Timer. Discover why 91% of Barnet schools are rated ‘Outstanding’ by Ofsted and easily locate top-performing primaries and secondaries near your chosen address. Plan your daily commute with the Transport Timer, which calculates journey times from any Barnet postcode to key London destinations—most under 40 minutes via the Northern Line or mainline rail. From Queen Elizabeth’s School to direct access to King’s Cross, Barnet offers the educational excellence and connectivity that modern families and professionals demand.

Stay ahead in the North London property market by subscribing to “North London Property Intelligence”, our exclusive monthly newsletter. Get early access to auction listings, regeneration updates like the £8 billion Brent Cross Town project, and expert insights on yield trends, school catchment changes, and transport improvements. Join over 5,000 property professionals and homebuyers who rely on our data-driven analysis and actionable market intelligence—sign up now for free and never miss your next high-performing investment opportunity.

London Area Investment Guides

-

Current Barnet Auctions – /barnet-auction-properties

Neighbourhood Guides – /barnet-area-profiles

School Catchments – /barnet-schools-map

Transport Links – /barnet-stations-guide

Regeneration Updates – /brent-cross-development

Investment Calculator – /barnet-yield-calculator

Property Market reports – Barnet