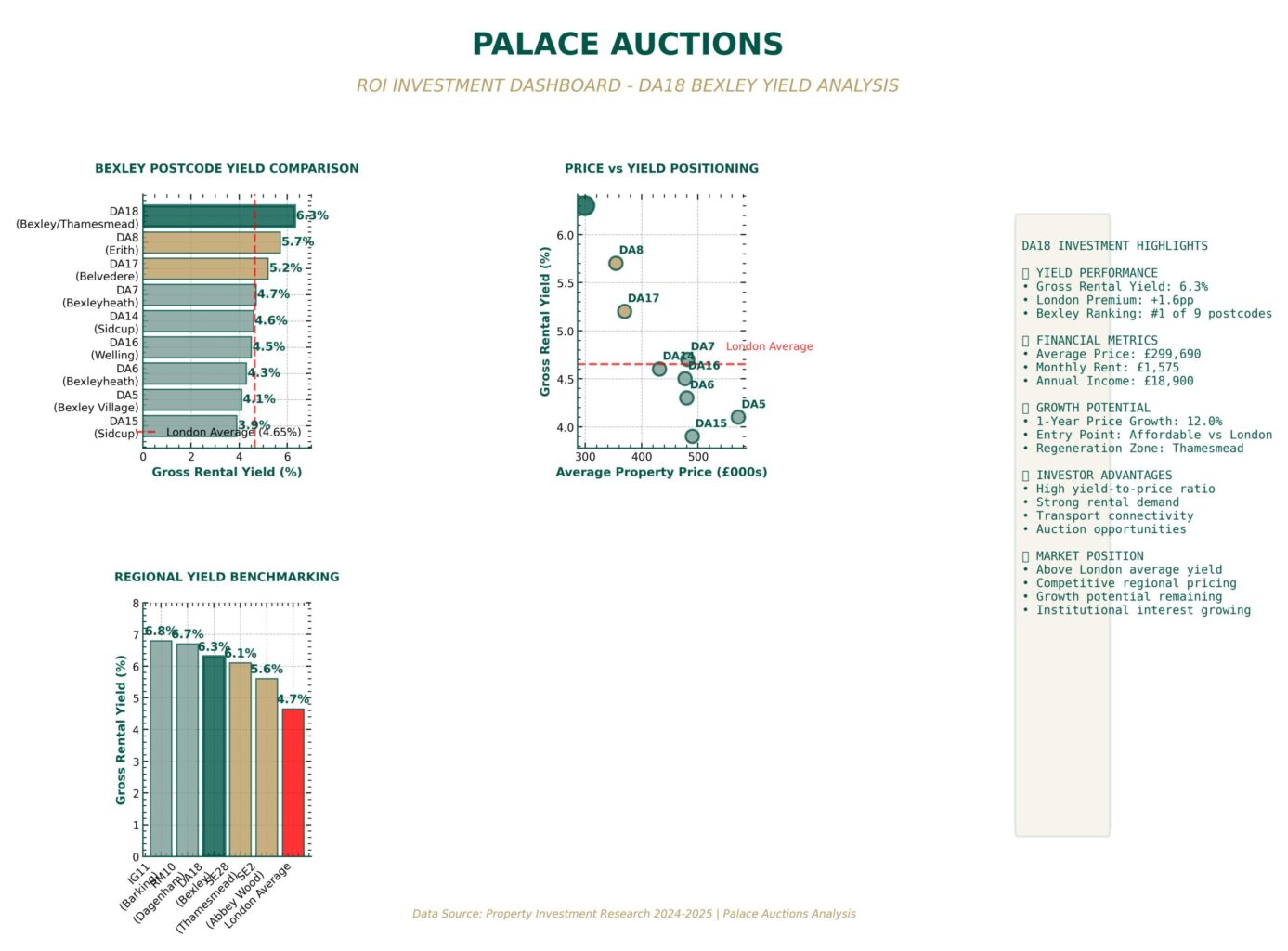

The ROI Dashboard above visually demonstrates that DA18 (Thamesmead/Bexley) offers the highest gross rental yield in the borough at 6.3%, significantly outpacing both the Bexley average (3.9–5.7%) and the Greater London average (4.4–4.93%). This exceptional yield is supported by affordable average property prices (~£299,690), strong rental demand, and double-digit annual price growth, positioning DA18 as a top-tier investment location for property auction buyers and landlords.

📈 Supporting Evidence & Analysis

- DA18 Key Investment Metrics

| Metric | Value |

| Gross Yield | 6.3% |

| Avg. Price | £299,690 |

| Monthly Rent | £1,575 |

| Annual Rent | £18,900 |

| 1-Year Price Growth | 12% |

| Yield Premium vs. London Avg | +1.7% |

Key Finding:

DA18’s 6.3% yield is the highest in Bexley, offering a 1.7% premium over the London average and making it highly attractive for income-focused investors.

- Comparative Yield Performance: Bexley & Region

| Postcode/Area | Gross Yield (%) | Avg Price (£) | Market Note |

| DA18 (Thamesmead) | 6.3 | £299,690 | Top in Bexley, SE London leader |

| DA8 (Erith) | 5.7 | £354,551 | Strong growth, high yield |

| DA17 (Belvedere) | 5.2 | £369,928 | Solid returns, regeneration area |

| SE28 (Thamesmead) | 6.1 | £347,149 | Regional competitor |

| SE2 (Abbey Wood) | 5.6 | £415,096 | Elizabeth Line boost |

| London Average | 4.4–4.93 | — | Contextual benchmark |

- Market Context & Investment Drivers

- Regeneration: Thamesmead and Abbey Wood are undergoing major redevelopment, driving both rental demand and capital growth.

- Affordability: DA18’s entry prices are among the lowest in London, amplifying yield potential.

- Rental Demand: Strong, with low void periods and rising rents (up 7% year-on-year in SE London).

- Auction Market: High investor demand for ex-local authority and new-build stock in DA18, with yields at the upper end of the borough’s range.

🏁 Conclusion

DA18 (Thamesmead/Bexley) stands out as Bexley’s top-yielding postcode for property investment in 2025, with a 6.3% gross yield, affordable prices, and strong growth prospects. The professional ROI Dashboard provides a clear, branded visual summary—empowering investors to identify and act on the borough’s best opportunities.

Summary Box:

- Top Yield: DA18 (6.3%)

- Yield Premium: +1.7% vs. London average

- Key Drivers: Regeneration, affordability, robust rental demand

- Investor Focus: Auction properties in DA18, DA8, and SE28 Palace Auctions.**

For more information about local services and regulations, please visit the official website of the London Borough of Bexley: www.bexley.gov.uk

.