How to Register to Bid at an IRostrum Auctions – Step-by-Step Guidance Note

Four adults sit at a table with laptops displaying online auction registration, identity verification, and payment method screens. One person uses a smartphone as they focus on how to bid at online auctions. All appear focused and engaged in the process. Presented by Palace Auctions

Four adults sit at a table with laptops displaying online auction registration, identity verification, and payment method screens. One person uses a smartphone as they focus on how to bid at online auctions. All appear focused and engaged in the process. Presented by Palace Auctions

Key Takeaway:

Registering to bid at an iRostrum auction is a secure, multi-step process designed for compliance, transparency, and ease of use. By following the steps below and preparing your documents in advance, you can ensure a smooth registration and be ready to participate in property, asset, or art auctions on this leading online platform.

Introduction: Why Register with iRostrum?

iRostrum is a trusted, cloud-based auction platform powering property, art, and asset auctions across the UK and internationally. Registration is mandatory for all bidders and ensures compliance with anti-money laundering (AML) regulations, protects both buyers and sellers, and provides a seamless, secure bidding experience. Whether you’re a first-time buyer, investor, or seasoned auction participant, understanding the registration process is essential for successful bidding.

Step-by-Step Instructions: Registering to Bid at an iRostrum Auction

- Locate the Auction and Access the Registration Portal

- Visit the auctioneer’s website or the dedicated iRostrum auction portal.

- Find the auction event you wish to join.

- Click the “Register to Bid” or “Sign Up” button, usually displayed on the auction page.

- Create Your iRostrum Account

- Enter your full name, email address, and a secure password.

- Provide a contact phone number and your current address.

- Agree to the platform’s terms and privacy policy.

- Verify your email address by clicking the link sent to your inbox (check spam/junk folders if needed).

- Complete Identity Verification (KYC/AML)

- Upload a valid photo ID (passport, UK/EU driving licence, or national ID card).

- Upload proof of address (utility bill, bank statement, or mortgage statement dated within the last 3 months).

- For company bidders: provide company registration details and director IDs.

- The platform uses secure, encrypted technology for document submission.

Key Finding:

Identity verification is a legal requirement under UK AML regulations. Incomplete or unclear documents are the most common reason for registration delays.

- Accept Auction Terms and Conditions

- Carefully review the auction’s terms, including payment deadlines, buyer’s premiums, and bidding rules.

- Accept the terms by ticking the box or clicking “I Agree” during registration.

- Register Your Payment Method and Pay Any Required Deposit – directly with the auctioneers (0207 101 3647)

- Enter your credit or debit card details securely.

- Some auctions require a refundable security deposit or a pre-authorization hold on your card (amounts vary by auction and asset value).

- Ensure your card is valid and has sufficient funds.

- Submit Proof of Funds (If Required)

- For high-value lots or at the auctioneer’s discretion, you may need to upload recent bank statements or a letter from your financial institution.

- This step is more common in property and luxury asset auctions.

- Final Review and Approval

- The auction house will review your registration, documents, and deposit.

- You’ll receive an email confirming your approval to bid and your unique bidder number.

- If there are issues (e.g., missing documents), you’ll be contacted to resolve them.

Best Practice:

Register at least 24 hours before the auction to allow time for verification and troubleshooting.

- Participate in the Auction

- Log in to your account on auction day.

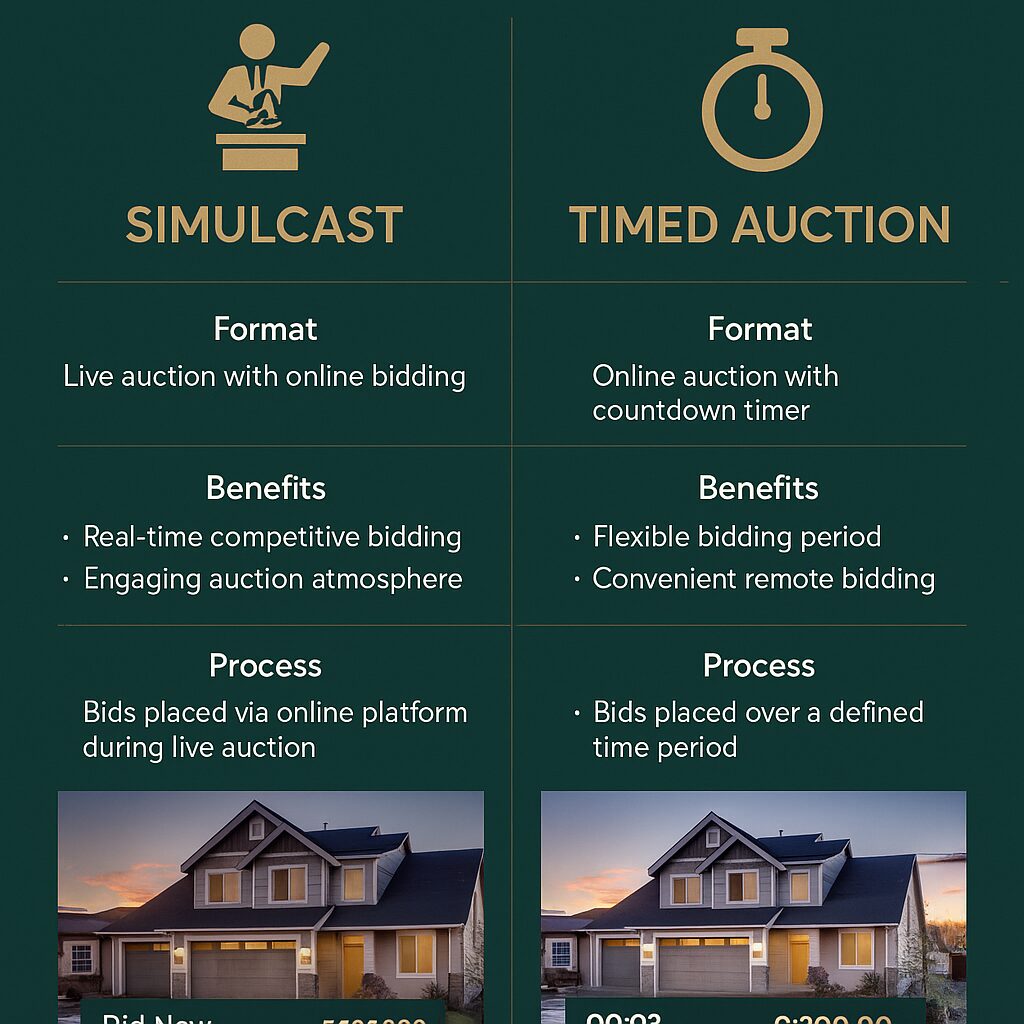

- Access the live or timed bidding interface.

- Place bids in real time, set maximum bids, and monitor your lots.

Troubleshooting & Best Practices

Common Issues and Solutions

| Issue | Solution |

| Didn’t receive verification email | Check spam/junk folder; use “resend” option; verify email address. |

| ID or address proof rejected | Ensure documents are clear, current, and match your registration details. |

| Card declined for deposit | Check funds, card validity, or contact your bank. |

| Registration delayed | Register early; respond promptly to requests for more information. |

Tips for a Smooth Registration

- Prepare documents in advance: Have digital copies of your ID and proof of address ready.

- Use a modern browser: Chrome, Firefox, Safari, or Edge are recommended.

- Stable internet connection: Essential for live bidding.

- Read auction terms: Each auction may have unique rules and deadlines.

- Contact support: If you encounter issues, reach out to the auctioneer or iRostrum support promptly.

Documentation Checklist

- Valid photo ID (passport, driving licence, or national ID)

- Proof of address (utility bill, bank statement, or mortgage statement, dated within 3 months)

- For companies: company registration and director IDs

- Credit/debit card or bank transfer for deposit

- Proof of funds (if required)

- Solicitor’s details (for property auctions)

Legal and Compliance Notes

- All iRostrum auctions comply with UK Money Laundering Regulations 2017.

- Data is handled in accordance with GDPR and the auctioneer’s privacy policy.

- Registration may be refused for incomplete, invalid, or mismatched documentation.

Summary Table: iRostrum Registration Steps

| Step | Action Required |

| 1. Access Auction | Find auction and click “Register to Bid” |

| 2. Create Account | Enter personal details, verify email/phone |

| 3. Identity Verification | Upload photo ID and proof of address |

| 4. Accept Terms | Review and accept auction terms and conditions |

| 5. Payment/Deposit | Register card and pay any required deposit |

| 6. Proof of Funds | Upload bank statement (if required) |

| 7. Approval | Await confirmation and bidder number |

| 8. Bid | Log in and participate in the auction |

Conclusion

Registering to bid at an iRostrum auction is straightforward if you prepare your documents and follow each step carefully. Early registration, attention to detail, and prompt responses to any requests from the auctioneer will ensure you’re ready to bid with confidence. Should you need assistance, iRostrum and its auction partners offer responsive support to guide you through the process.

For further assistance, consult the auctioneer’s website, the iRostrum help centre, or contact customer support directly.

Guidance on the legal Requirements and Regulatory Updates for Online Property Auctions in the UK (as of October 2025)

Property for sale A group of professionals in formal attire sit at a table with a gavel, contract, and laptop showing how to bid at online auctions. Text above them offers guidance on legal and regulatory updates for UK property auctions. Presented by Palace Auctions

Property for sale A group of professionals in formal attire sit at a table with a gavel, contract, and laptop showing how to bid at online auctions. Text above them offers guidance on legal and regulatory updates for UK property auctions. Presented by Palace Auctions

- Core Legal Requirements

Seller and Auctioneer Obligations

- Disclosure Duties: Sellers and auctioneers must provide comprehensive disclosure of material defects that could affect property values. This obligation has been reinforced by recent case law (notably SPS Groundworks v Mahil [2022] EWHC 371 (QB)), which requires that material defects are not only included in legal packs but also specifically highlighted in auction catalogues and announcements.

- Legal Pack Contents: While not strictly mandated by statute, best practice and legal precedent require auction legal packs to include:

- Land Registry title documents

- Special Conditions of Sale (often referencing RICS Common Auction Conditions)

- Local authority, environmental, drainage, and water searches

- The TA6 Property Information Form (5th Edition, 2024)

- Energy Performance Certificates (EPCs)

- Planning permissions, lease documents, tenancy agreements, and specialist searches as relevant.

Buyer Due Diligence

- Caveat Emptor Principle: Buyers are still expected to conduct thorough due diligence, but the scope of seller disclosure has expanded, especially regarding material defects and information that could affect value or use.

- Registration and Verification: Buyers must register with the auction platform, complete anti-money laundering (AML) checks, and provide identification before bidding.

Contractual Process

- Binding Nature of Bids: Winning bids at online auctions are legally binding, requiring immediate payment of a deposit (typically 10%) and completion within a set period (often 20–28 days).

- Transparency: Auctioneers must provide clear terms and conditions, including reserve prices, bid increments, and all associated fees, before the auction begins.

- Key Regulatory Updates (2024–2025)

Digital Markets, Competition and Consumers Act 2024 (DMCCA)

- Consumer Protection: The DMCCA, effective from April 2025, consolidates and strengthens consumer protection, replacing the Consumer Protection from Unfair Trading Regulations 2008. It mandates that all material information required for an informed decision must be provided clearly and prominently, with severe penalties for omission or misleading practices.

- Drip Pricing and Transparency: All mandatory fees and taxes must be included in the advertised price or, if variable, the method of calculation must be clear and as prominent as the headline price. Misleading advertising, including the use of edited images or unsubstantiated claims, is subject to enforcement.

- Fake Reviews: Publishing or failing to remove fake reviews is now an unfair commercial practice, requiring auction platforms to have compliance policies for review authenticity.

- Direct Enforcement: The Competition and Markets Authority (CMA) now has direct powers to investigate and fine businesses (up to 10% of global turnover or £300,000, whichever is higher) for breaches, without needing to go to court.

- Material Information Guidance: Ongoing government consultation (ending December 2025) is shaping new guidance on what constitutes “material information” in property listings, aiming for earlier and clearer disclosure to speed up transactions and reduce disputes.

Leasehold and Freehold Reform Act 2024

- Leasehold Auctions: Effective January 2025, leaseholders can extend leases or buy freeholds immediately after purchase, removing the previous two-year ownership requirement. This increases the attractiveness and value of leasehold properties at auction.

Other Notable Regulatory Developments

- Biodiversity Net Gain: From April 2024, all new development sites must achieve at least a 10% net gain in biodiversity, affecting the types of land and property available at auction.

- Capital Gains Tax: The Spring Budget 2024 reduced CGT on property from 28% to 24%, making property investment via auction more attractive.

- Compliance and Enforcement

- Professional Diligence: Auctioneers and agents must act with reasonable care and skill, ensuring all required information is provided and not obscured or omitted.

- Vulnerable Consumers: The DMCCA extends protections to contextually vulnerable consumers (e.g., those experiencing bereavement or financial stress), requiring higher standards of care in marketing and sales practices.

- Ongoing Guidance: The CMA and industry bodies (e.g., RICS, Propertymark) are issuing updated guidance and expect businesses to implement robust compliance procedures, including staff training and regular review of marketing and sales practices.

- Practical Implications for Online Auctions

- Increased Transparency: There is a strong regulatory focus on upfront, clear, and accessible information for buyers, with legal packs and marketing materials scrutinized for completeness and accuracy.

- Technological Integration: Online platforms must ensure secure registration, AML checks, and transparent bidding processes, with compliance to data protection and consumer law.

- Market Impact: Regulatory changes have contributed to a surge in online auction activity, with a broader and more diverse pool of buyers, including younger and international participants.

Summary Table: Key Legal and Regulatory Requirements as at (2024–2025)

| Requirement/Update | Description | Effective Date/Status |

| Seller Disclosure Duties | Must highlight material defects in catalogues/announcements, not just legal packs | Ongoing (post-2022 case law) |

| Legal Pack Standards | Title, searches, TA6, EPC, leases, planning, etc. | Best practice (2024–2025) |

| DMCCA Consumer Protections | Mandatory clear disclosure, ban on fake reviews, direct CMA enforcement | April 2025 |

| Leasehold Reform | Immediate lease extension/freehold rights for buyers | Jan 2025 |

| Drip Pricing Ban | All fees/taxes must be clear and prominent | April 2025 |

| Biodiversity Net Gain | 10% net gain required for new developments | April 2024 |

| Capital Gains Tax Reduction | CGT on property reduced from 28% to 24% | Spring 2024 |

| Material Information Consultation | Ongoing government review to define disclosure standards | Ends Dec 2025 |

Conclusion

The UK legal and regulatory framework for online property auctions has undergone significant strengthening in 2024–2025, with a focus on transparency, consumer protection, and fair trading. Sellers and auctioneers must ensure comprehensive, clear, and timely disclosure of all material information, comply with new consumer law standards, and adapt to enhanced enforcement powers wielded by the CMA. Ongoing consultations and evolving guidance will continue to shape best practices in the sector.

Page Last Updated: 17 November 2025, 05:00 GMT