Brent Property Investment Dashboard: NW9 Colindale Leads Rental Yields

NW9 (Colindale) is Brent’s top postcode for rental yield, offering a market-leading 5.4%—the highest in the borough.

This, combined with affordable entry prices and robust regeneration, makes NW9 the prime choice for yield-focused property investors in North West London.

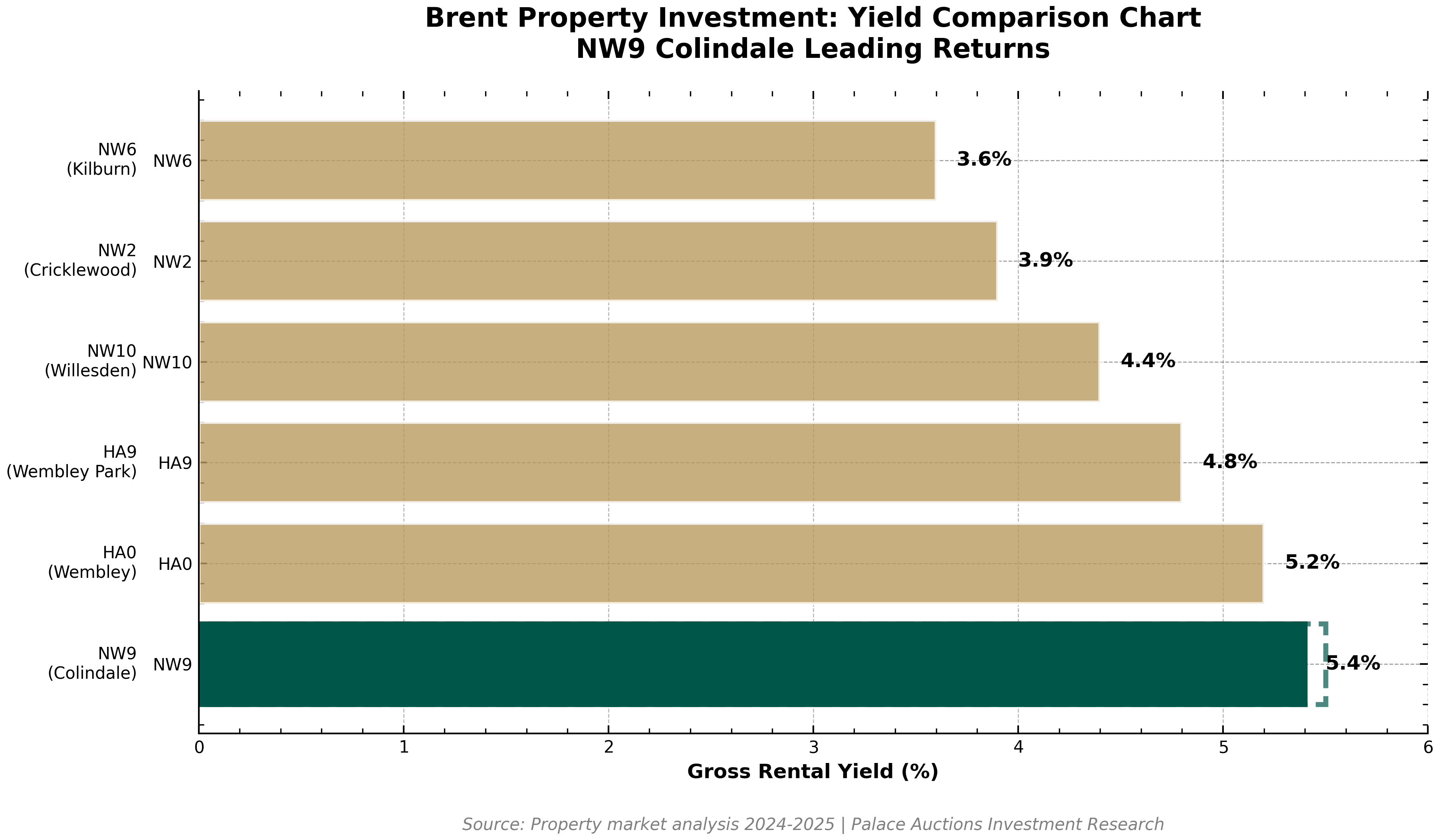

🏆 Yield Comparison Chart: Brent Postcodes

NW9 Colindale’s 5.4% yield leads Brent postcodes.

The dashboard above clearly demonstrates that NW9 Colindale leads Brent for rental yields at 5.4%, outperforming all other postcodes in the borough. This high yield, paired with accessible property prices and ongoing regeneration, positions NW9 as the most attractive area for income-driven property investors in Brent for 2025.

| Postcode | Area | Avg Price (£) | Rental Yield (%) | 5-Yr Capital Growth (%) | Total Annual ROI (%) | Avg Monthly Rent (£) |

| NW9 | Colindale | £458,004 | 5.4 | 3.0 | 8.4 | 2,041 |

| HA0 | Wembley | £465,484 | 5.2 | 9.9 | 15.1 | 2,002 |

| HA9 | Wembley Park | £516,499 | 4.8 | 35.9 | 40.7 | 2,089 |

| NW10 | Willesden | £524,468 | 4.4 | 23.5 | 27.9 | 1,937 |

| NW2 | Cricklewood | £616,086 | 3.9 | 15.7 | 19.6 | 1,980 |

| NW6 | Kilburn | £710,333 | 3.6 | 11.2 | 14.8 | 2,145 |

Key Finding:

NW9 Colindale offers the highest rental yield and the lowest entry price in Brent, making it the best value for yield-focused investors.

Visual Insights: ROI & Market Analysis

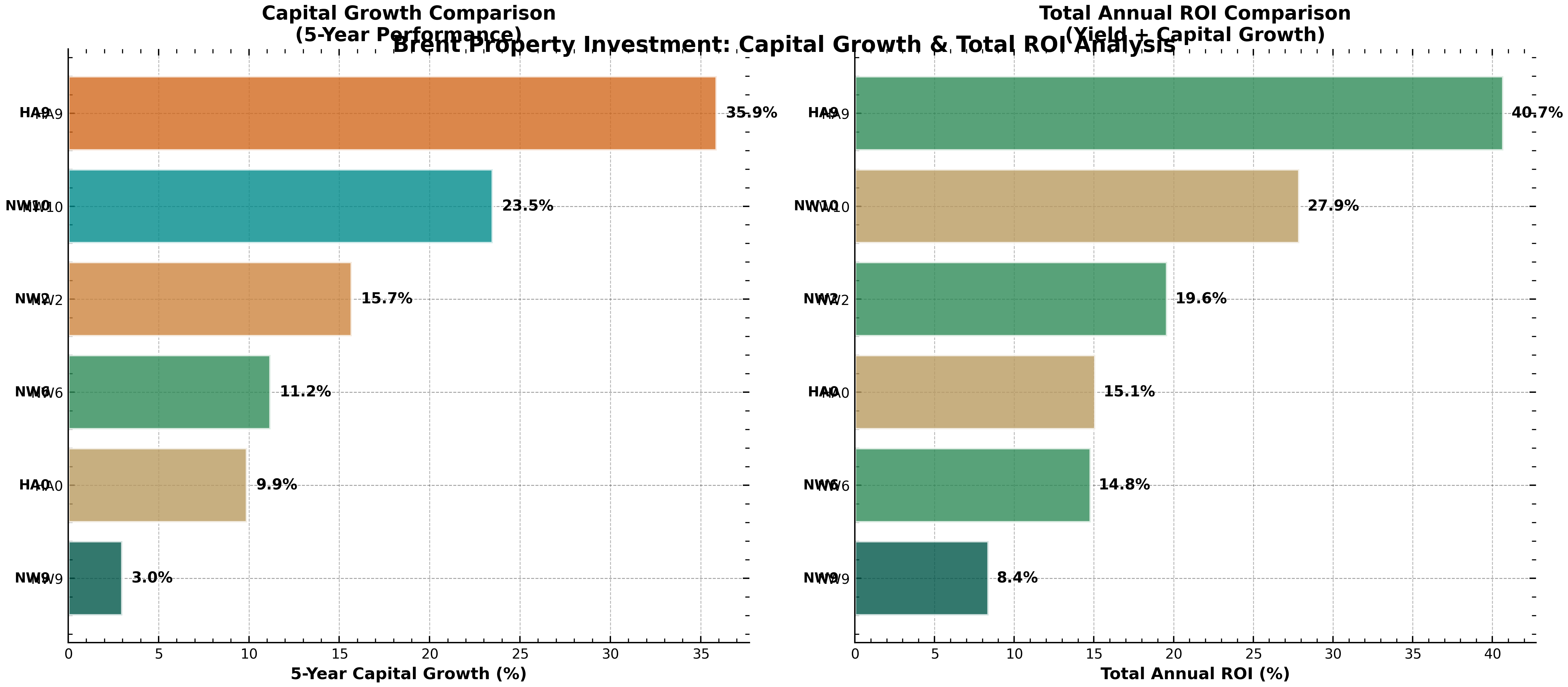

Property for sale Two horizontal bar graphs compare the 5-year capital growth and total annual ROI of six properties from Brent London property auctions, labeled HAB-9, NWBR-10, NWBR-2, NWBR-6, HAB-8, and NWBR-1. HAB-9 leads in both categories. Presented by Palace Auctions

Property for sale Two horizontal bar graphs compare the 5-year capital growth and total annual ROI of six properties from Brent London property auctions, labeled HAB-9, NWBR-10, NWBR-2, NWBR-6, HAB-8, and NWBR-1. HAB-9 leads in both categories. Presented by Palace Auctions

HA9 (Wembley Park) leads for capital growth, but NW9 is the yield leader.

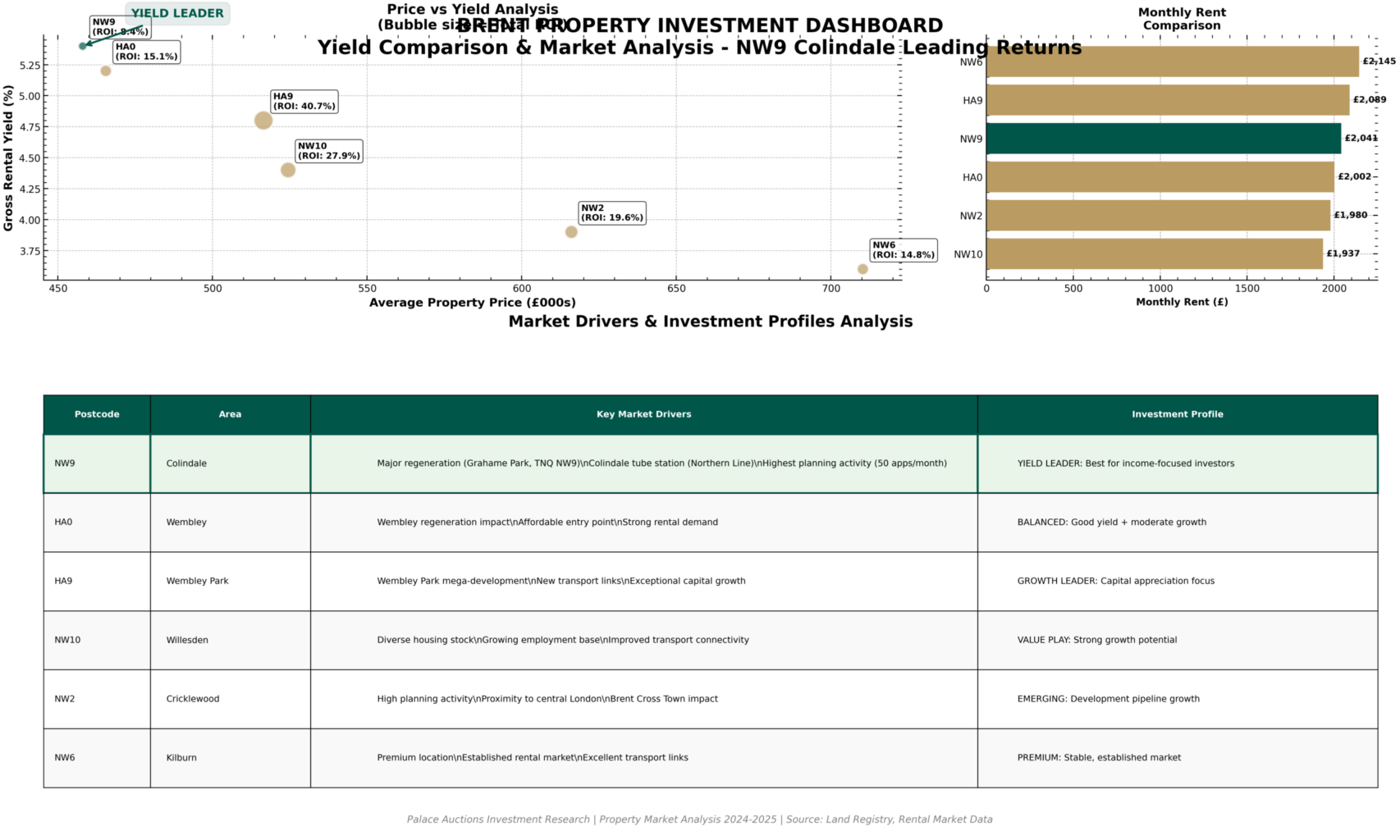

Property for sale Dashboard showing a yield comparison scatter plot for NW London postcodes, bar chart comparing monthly rents, and a table summarizing key market drivers and investment profiles—ideal for those considering Brent London property auctions. Presented by Palace Auctions

Property for sale Dashboard showing a yield comparison scatter plot for NW London postcodes, bar chart comparing monthly rents, and a table summarizing key market drivers and investment profiles—ideal for those considering Brent London property auctions. Presented by Palace Auctions

yield, capital growth, ROI, and price analysis for all major postcodes.

- Market Drivers Behind NW9’s Performance

- Regeneration: Major projects (Grahame Park, Heybourne Park, TNQ NW9) are transforming Colindale, delivering thousands of new homes, jobs, and amenities.

- Transport Links: Colindale tube (Northern Line) offers direct access to central London in under 25 minutes.

- Affordability: NW9’s average price (£458k) is the lowest in Brent, maximizing yield and accessibility.

- Rental Demand: High demand from young professionals, families, and international residents ensures strong occupancy and rental growth.

- Development Pipeline: NW9 has the highest planning activity in Brent, supporting future growth and modern housing supply.

- Market Analysis Summary Table

| Metric | Winner | Value |

| Highest Rental Yield | NW9 Colindale | 5.4% |

| Lowest Entry Price | NW9 Colindale | £458,004 |

| Highest Capital Growth (5yr) | HA9 Wembley Park | 35.9% |

| Highest Total ROI | HA9 Wembley Park | 40.7% |

| Most Affordable Monthly Rent | NW10 Willesden | £1,937 |

| Premium Location (Price) | NW6 Kilburn | £710,333 |

🏁 Conclusion

- Yield Leader: NW9 Colindale (5.4% gross yield, lowest entry price)

- Best for Income: NW9 is Brent’s top choice for yield-driven investors

- Growth Hotspot: HA9 Wembley Park leads for capital appreciation and total ROI

- All Brent postcodes offer double-digit total ROI, supporting a range of investment strategies.

NW9 Colindale stands out as Brent’s leading postcode for rental yields and value, making it the premier destination for investors seeking strong, stable income in North West London.

Palace Auctions London: Your Gateway to Prime Property Investments in Brent

For more information about local services and regulations, please visit the official website of the London Borough of Brent: www.brent.gov.uk.

London Area Guides

-

Harrow

Barnet Property Auctions

Camden

Ealing

Hammersmith and Fulham

Kensington and Chelsea

Westminster

City of London

brent-auction-properties

Yield Calculator – /brent-yield-calculator

Regeneration Updates – /brent-cross-development

School Catchments – /brent-schools-map

Transport Guide – /brent-stations-map

Investment Analysis – /brent-roi-calculator

Market Reports – /north-west-london-data