AML Checks at Palace Auctions London

Understanding Anti-Money Laundering Requirements in Property Auctions

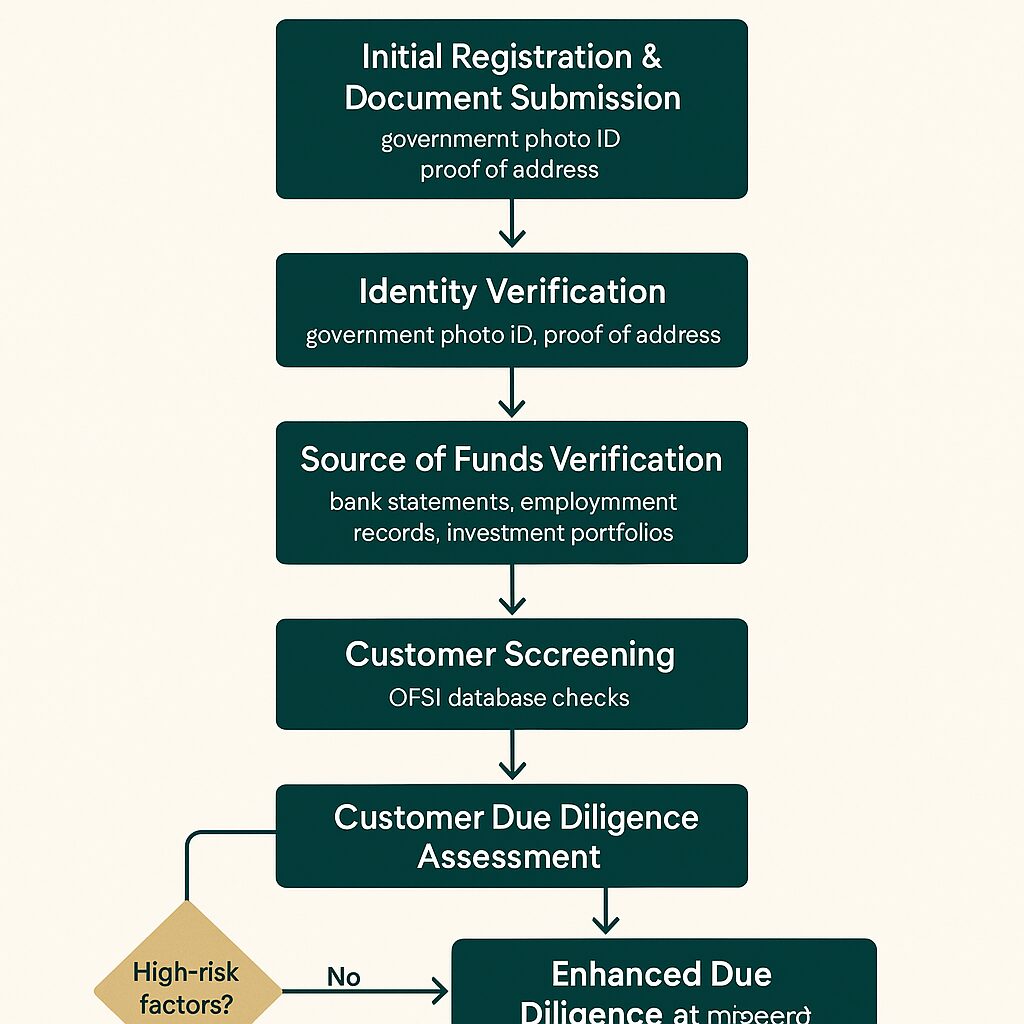

At Palace Auctions London, we take our legal obligations seriously. Anti-Money Laundering (AML) regulations are essential in maintaining the integrity of property transactions Let’s explain what this means for you and why these checks are so important.

Why We Need to Check

“Think of AML checks as your property’s passport control – they protect everyone involved in the transaction. “The law requires all property professionals to verify the identity of their clients and understand the nature of their business. This helps:

- Prevent money laundering

- Combat terrorist financing

- Protect the property market’s integrity

- Ensure legal compliance

- Safeguard your interests

What We Need From You

For Individual Buyers and Sellers

Proof of Identity

We’ll need one of these:

- Current passport

- UK/EU photo driving license

- National identity card

Proof of Address

One of these dated within the last three months:

- Utility bill (not mobile phone)

- Bank or building society statement

- Council tax bill

- Recent mortgage statement.

For Companies and Business Entities

When you’re buying or selling through a company, we need:

- Company registration details

- Proof of registered address

- Directors’ identification

- Proof of trading address

- Ultimate beneficial owner information

“Working through a company? We’ll guide you through the additional requirements step by step.”

Source of Funds

For buyers, we need to understand where your purchase funds come from. This might include:

- Bank statements

- Savings account information

- Investment portfolio details

- Evidence of property sale

- Inheritance documentation

- Business sale proceeds

“Being open about your funding sources helps us process your registration quickly and smoothly. It also strengthens your position as a buyer.

When Do We Need This?

For Sellers

- When you first instruct us to sell

- Before we can market your property

- Prior to auction entry.

- For Buyers

- During registration

- Before bidding rights are granted

- Prior to exchange of contracts

How We Handle Your Information

Your privacy matters to us. Here’s our commitment:

- Secure digital storage

- Restricted access

- Compliance with GDPR

- Regular data reviews

- Professional confidentiality

Making It Easy For You

We’ve streamlined our AML process to be as convenient as possible:

Digital Verification

- Upload documents securely online

- Quick verification process

- Available 24/7

- Mobile-friendly platform

In-Person Verification

- Visit our London office

- Same-day verification possible

- Personal assistance available

- Professional guidance

Common Questions

How long does verification take?

Typically 1-2 hours during business hours if all documents are in order.

Can I bid without completing AML checks?

No – it’s a legal requirement that must be completed before bidding.

How long are checks valid for?

Usually 6 months, unless your circumstances change.

Need Help?

Our dedicated compliance team is here to assist:

- Document queries

- Verification issues

- General guidance

- Special circumstances

Contact Our AML Team

📞 AML Helpline: 0207 101 36 47

✉️ Compliance Email: [aml@palaceauctions.com]

🌐 Online Support: Available during office hours

“Let us help you navigate the AML requirements smoothly and efficiently.”

Ready to Get Started?

Begin your AML verification now: [Start Verification Process]

Useful Resources

Download our guides:

- AML Documentation Checklist

- Company Verification Guide

- Source of Funds Evidence Guides

Palace Auctions London: Ensuring Security and Compliance in Property Auctions