Understanding guide prices is the first step to confident property auction bidding. Our Guide Prices Explained page gives you the clarity you need—whether you’re a first-time buyer or a seasoned investor. For instant budgeting, try our Guide Price & Bid Calculator to see your total costs, including premiums and fees, before you bid.

Have questions? Our Quick FAQ below covers the top five guide price topics:

- How accurate is the guide price, and will the property sell for this amount?

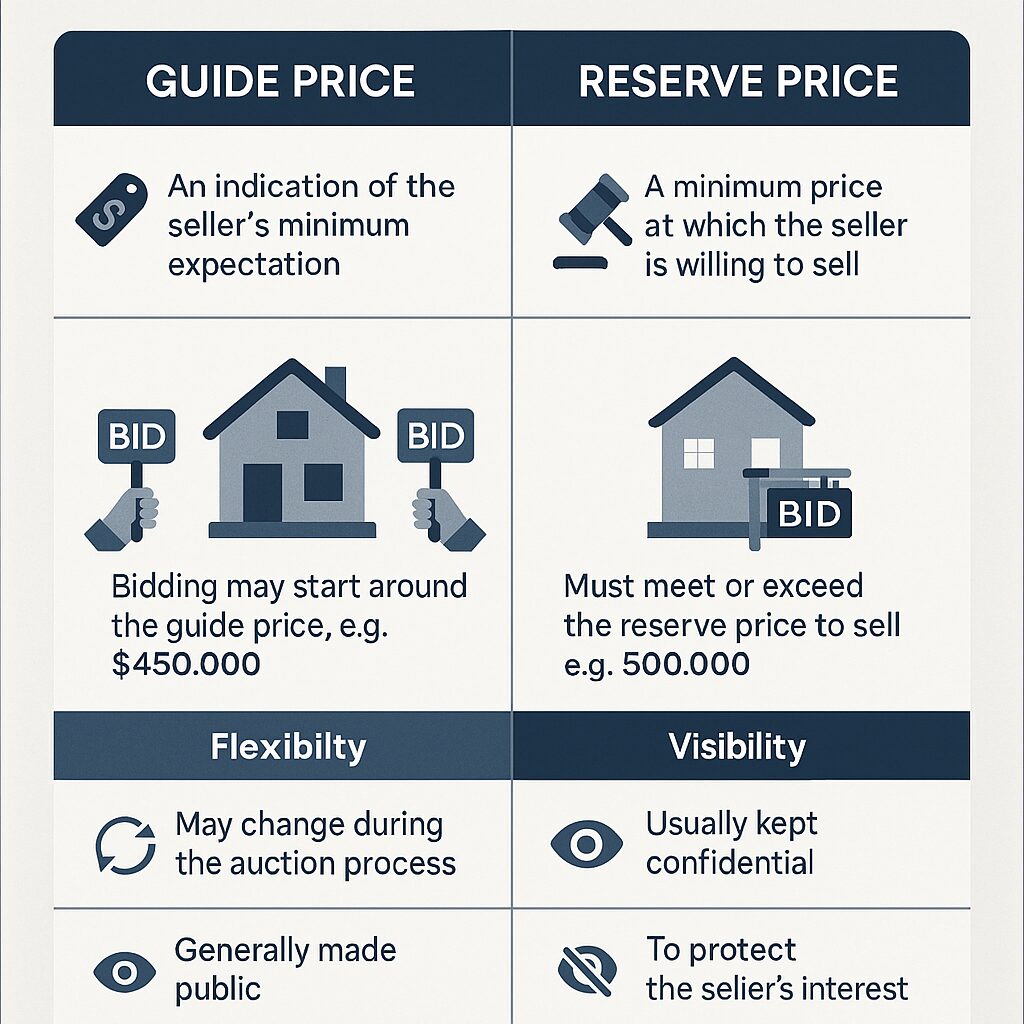

- What is the difference between the guide price and the reserve price?

- Do guide prices include auction fees or other costs?

- Can the guide price change before the auction?

- How should I use the guide price to plan my bidding strategy?

Stay ahead of the market—sign up for our newsletter to get weekly auction results and expert guide price analysis delivered straight to your inbox. Join thousands of successful buyers and investors who rely on Palace Auctions for the latest insights.

Resources and menu links

-

UK Auction Results Database – /auction-results

Regional Price Calculator – /regional-price-calculator

Guide vs Reserve Explained – /guide-reserve-comparison

Auction Finance Options – /auction-finance

Live Auction Calendar – /auction-calendar

First-Time Buyer Guide

Download Premium Analysis – /market-report-2025