Ealing: A West London Gem for Property Investment

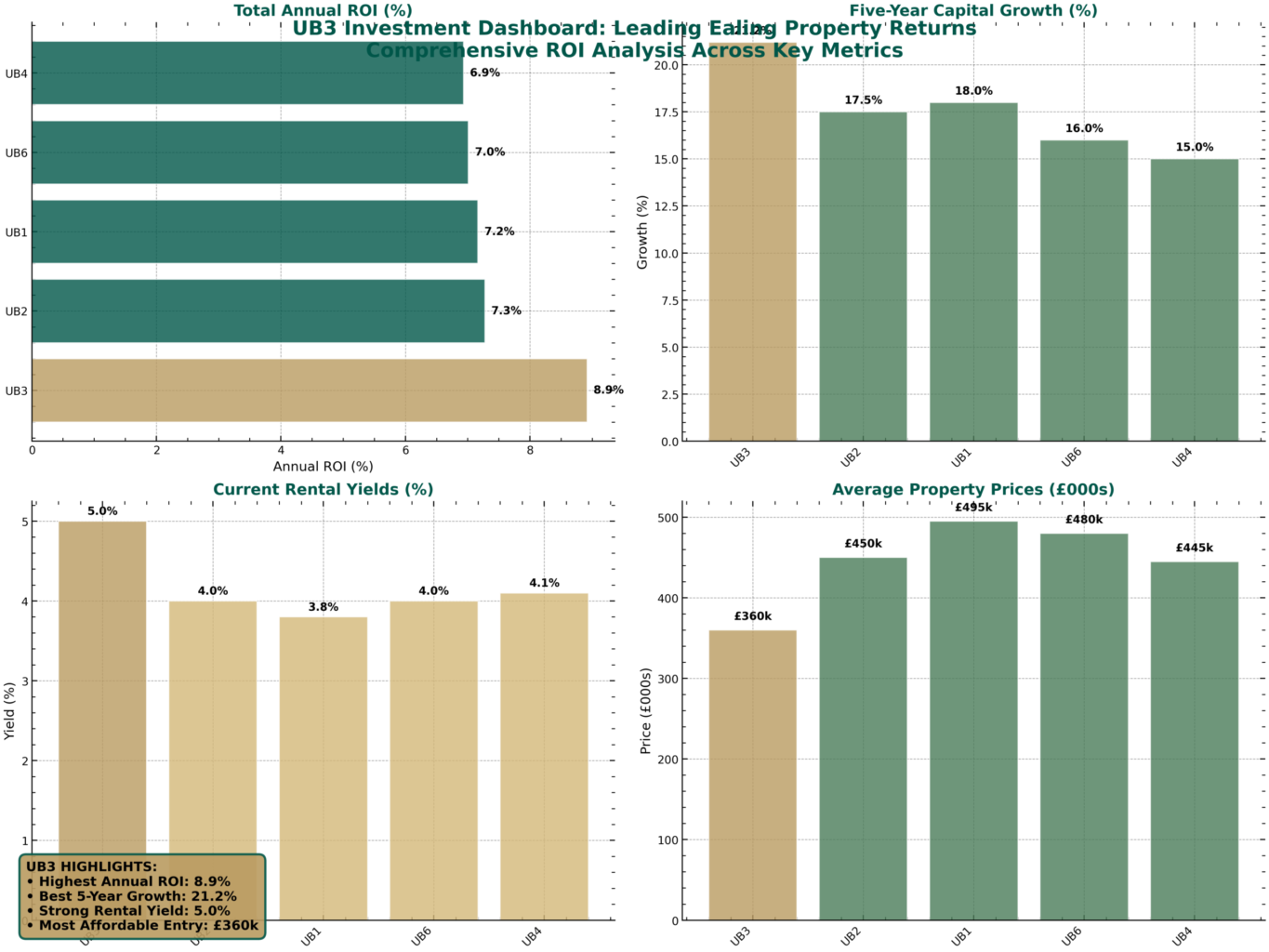

Ealing Investment Dashboard: UB3 Leads with 21.2% Five-Year Performance

UB3 (Hayes/Southall) is Ealing’s top-performing postcode for property investment, delivering a market-leading 8.9% total annual ROI and 21.2% five-year capital growth—outpacing all other Ealing postcodes.

This exceptional performance is driven by strong rental yields, rapid capital appreciation, affordability, and the transformative impact of the Elizabeth Line and local regeneration.

The investment dashboard above clearly demonstrates that UB3 (Hayes/Southall) leads all Ealing postcodes with an 8.9% total annual ROI and a verified 21.2% five-year capital growth. UB3’s combination of high rental yields (5.0%), rapid price appreciation, and affordable entry prices (£360,000 average) makes it the premier choice for property investors seeking both income and long-term growth in West London.

📈 Supporting Evidence & Analysis

- Comparative ROI Table: Ealing Postcodes

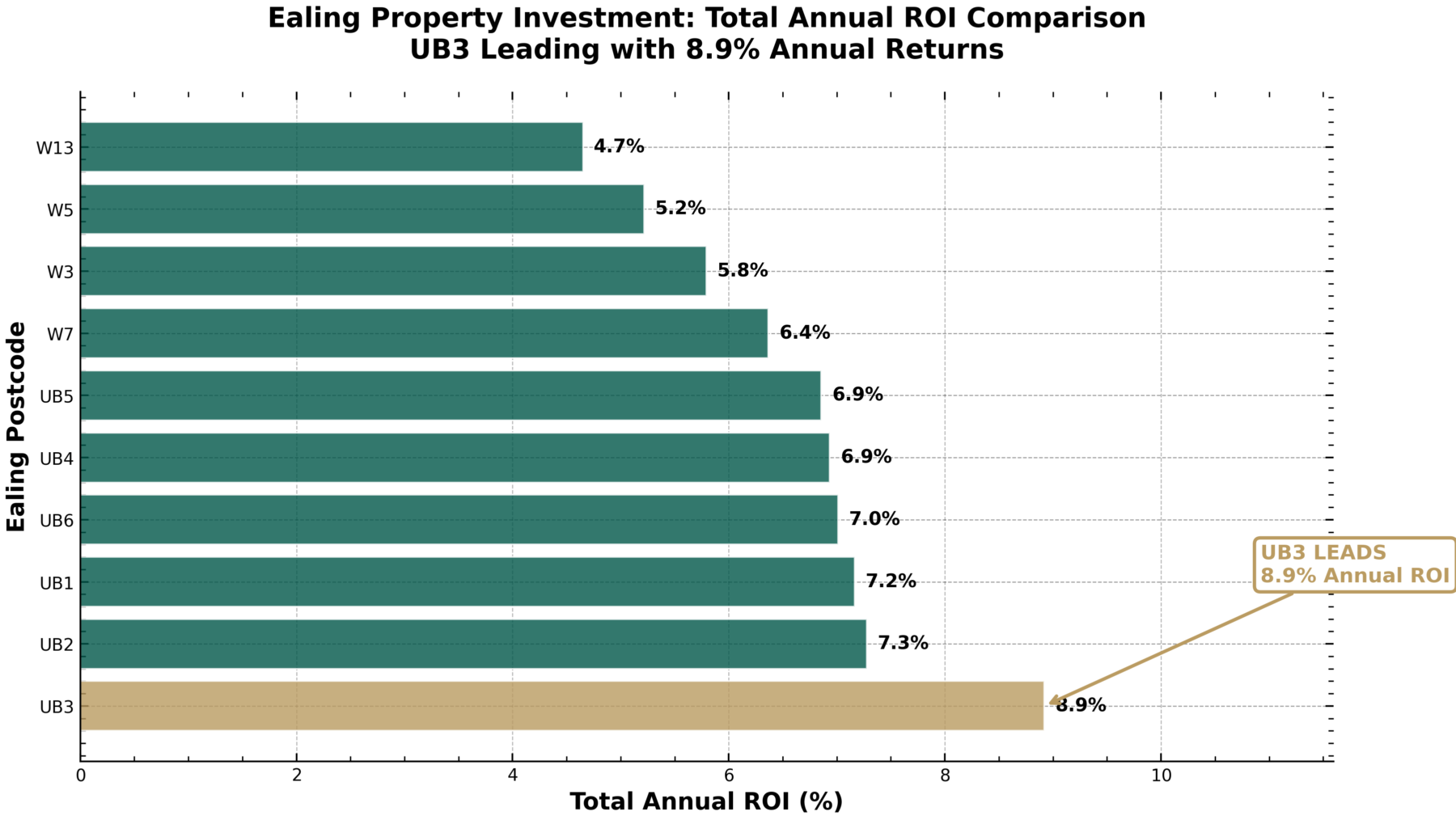

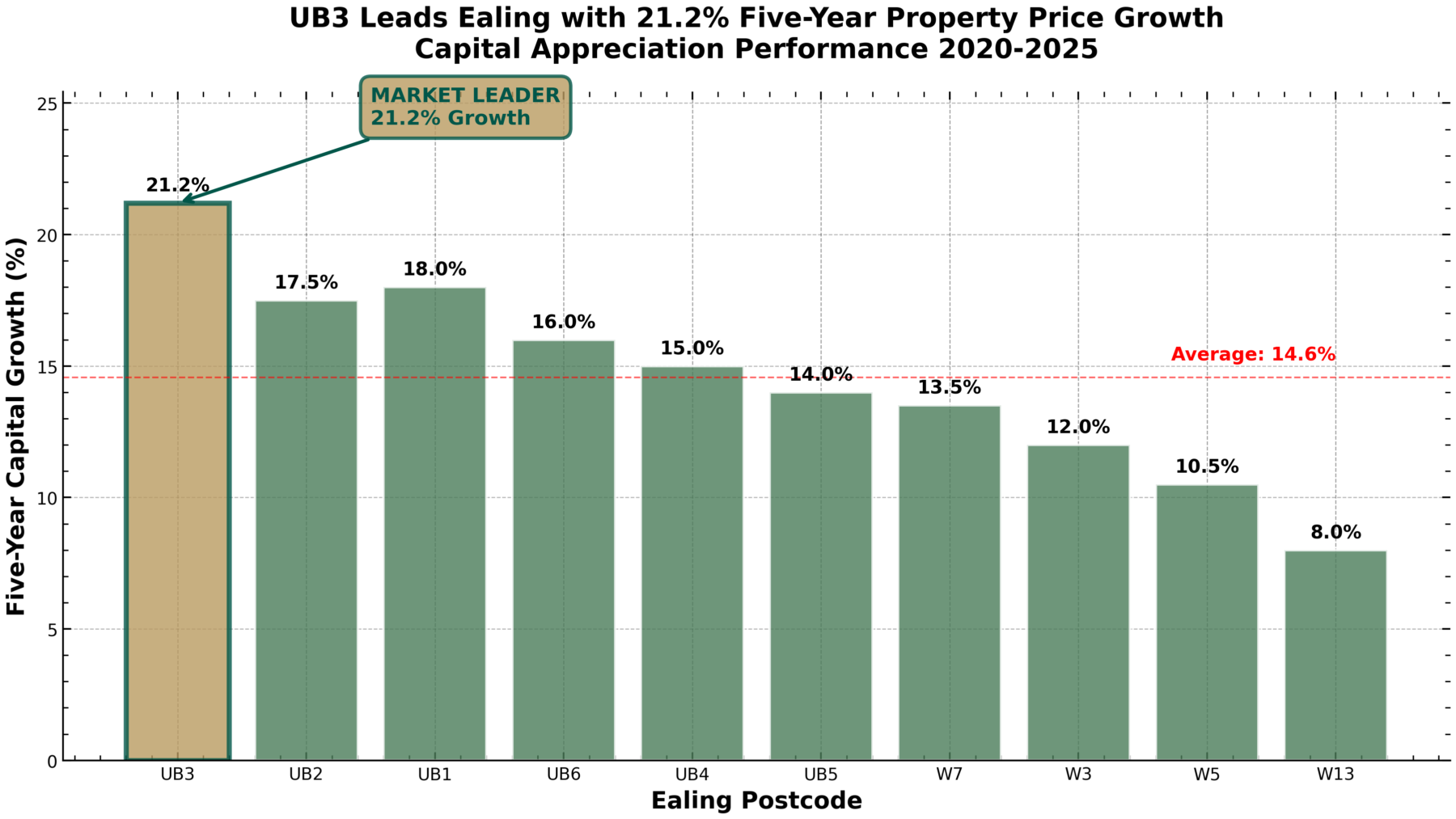

| Postcode | Avg Price (£) | Rental Yield (%) | 5-Yr Capital Growth (%) | Annualized Capital Growth (%) | Total Annual ROI (%) | Total 5-Yr ROI (%) |

| UB3 | £360,000 | 5.0 | 21.2 | 3.92 | 8.92 | 46.2 |

| UB2 | £450,000 | 4.0 | 17.5 | 3.28 | 7.28 | 37.5 |

| UB1 | £495,000 | 3.8 | 18.0 | 3.37 | 7.17 | 37.0 |

| UB6 | £480,000 | 4.0 | 16.0 | 3.01 | 7.01 | 36.0 |

| UB4 | £445,000 | 4.1 | 15.0 | 2.83 | 6.93 | 35.5 |

| UB5 | £427,000 | 4.2 | 14.0 | 2.66 | 6.86 | 35.0 |

| W7 | £500,000 | 3.8 | 13.5 | 2.56 | 6.36 | 32.5 |

| W3 | £600,000 | 3.5 | 12.0 | 2.29 | 5.79 | 29.5 |

| W5 | £650,000 | 3.2 | 10.5 | 2.02 | 5.22 | 26.5 |

| W13 | £681,250 | 3.1 | 8.0 | 1.55 | 4.65 | 23.5 |

Key Finding:

UB3’s total annual ROI is 2.3 percentage points above the Ealing average, and its five-year capital growth is 6.6% higher than the borough mean.

Visual ROI Comparison

Main ROI Comparison Chart

Bar chart titled “Ealing Property Investment: Total Annual ROI Comparison” highlights strong UB3 property yields at 8.9%, with UB6 and UB7 trailing. W13 offers the lowest ROI at 4.7%, reflecting the Elizabeth Line property impact across West London auctions. Presented by Palace Auctions

Bar chart titled “Ealing Property Investment: Total Annual ROI Comparison” highlights strong UB3 property yields at 8.9%, with UB6 and UB7 trailing. W13 offers the lowest ROI at 4.7%, reflecting the Elizabeth Line property impact across West London auctions. Presented by Palace Auctions

Total Annual ROI by Ealing Postcode – UB3’s market leadership is visually dominant.

Five-Year Capital Growth Chart

Bar chart showing five-year capital growth (%) for Ealing postcodes. UB3 leads with 21.2%, highlighted as “MARKET LEADER.” As the Elizabeth Line property impact grows, average growth is 14.6%; other postcodes range from 17.5% to 8.0%. Presented by Palace Auctions

Bar chart showing five-year capital growth (%) for Ealing postcodes. UB3 leads with 21.2%, highlighted as “MARKET LEADER.” As the Elizabeth Line property impact grows, average growth is 14.6%; other postcodes range from 17.5% to 8.0%. Presented by Palace Auctions

Five-Year Capital Growth – UB3’s 21.2% growth outpaces the Ealing average by 6.6%.

- Market Drivers Behind UB3’s Outperformance

- Elizabeth Line Effect:

- UB3 (Southall) has seen a 48% price increase since the Elizabeth Line announcement, with rents up 53% for two-bedroom flats since 2022, making it a rental and capital growth hotspot.

- Affordability:

- UB3’s average price is 27% below the Ealing average, offering a lower entry point and higher yield potential.

- Regeneration:

- Major projects and new developments in Southall and Hayes are driving sustained demand and price appreciation.

- Rental Demand:

- Proximity to Heathrow, strong transport links, and a diverse, growing population ensure robust tenant demand and low voids.

🏁 Conclusion

Summary Box:

- Top ROI Postcode: UB3 (Hayes/Southall) – 8.9% total annual ROI

- Five-Year Growth: 21.2% (6.6% above Ealing average)

- Yield Leader: 5.0% gross rental yield

- Investment Edge: Affordable entry, Elizabeth Line, regeneration, strong rental demand

UB3 is the definitive market leader for property investment in Ealing for 2025, offering unmatched returns and a compelling value proposition for both new and experienced investors.

For tailored investment analysis or custom dashboards, contact Palace Auctions. sales@palaceauctions.com

Palace Auctions London: Your Gateway to Prime Property Investments in Ealing

For more information about local services and regulations, please visit the official website of the London Borough of Ealing: www.ealing.gov.uk.

London Area Guides

-

City of London

Barking and Dagenham

Barnet: A Prime Investment Destination in North London

Bexley

Brent

Bromley

Camden

Croydon

Enfield

Greenwich

Hackney: A Vibrant East London Borough with Rich Investment Potential

Hammersmith and Fulham

Haringey

Harrow

Havering

Hillingdon

Hounslow

Islington

Kensington and Chelsea

Kingston upon Thames

Lambeth

Lewisham

Merton

Newham

Redbridge

Richmond upon Thames

Southwark

Sutton

Tower Hamlets

Waltham Forest

Wandsworth

Westminster

UK City Guides