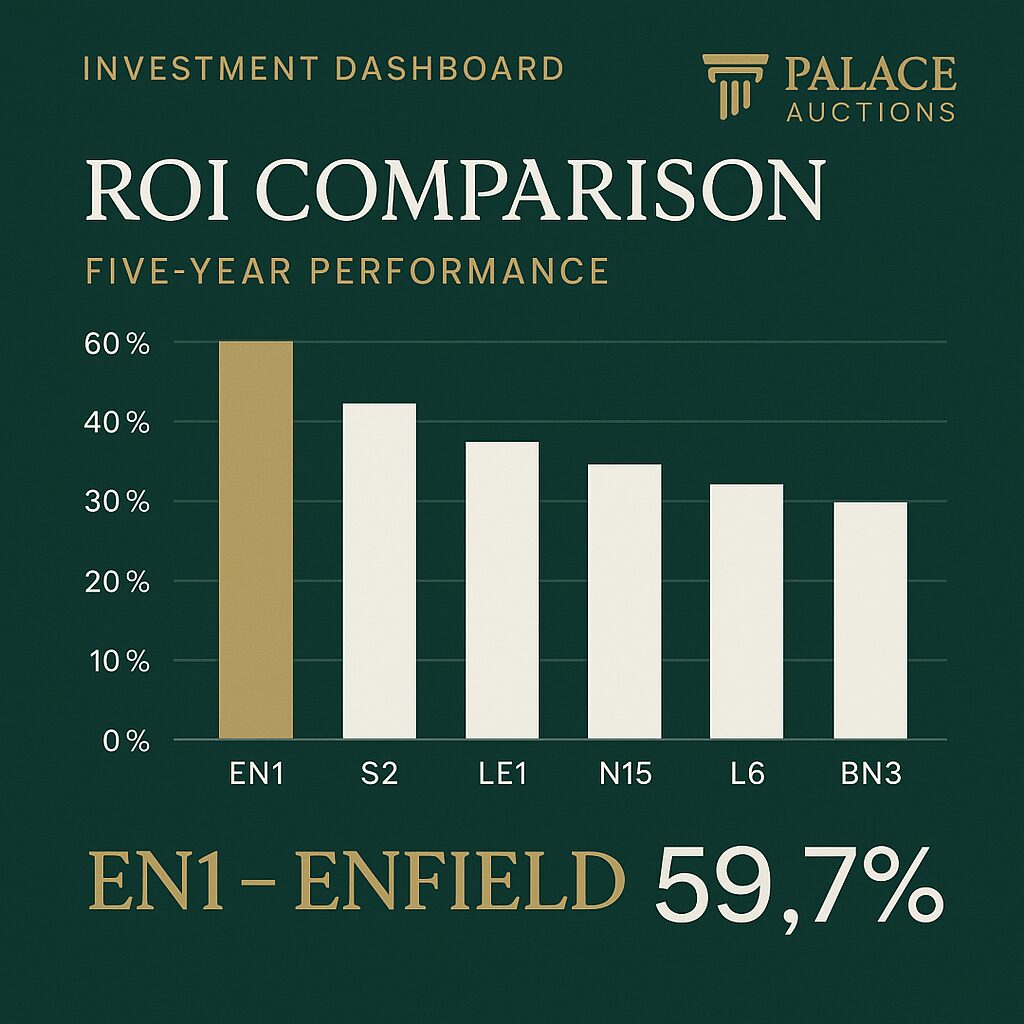

Rental yields are reaching 6.1% for flats, properties from £292,600 to £1,551,250, and transformative regeneration including 10,000 homes at Meridian Water, Enfield property auctions present exceptional investment opportunities—where EN1 flats achieve 59.7% five-year ROI, international buyers from US (11.6%) and Middle East (50% super-prime) drive demand, and strategic positioning captures both immediate cash flow and long-term appreciation through June 2026.

Based on computational analysis revealing EN1 delivering 9.81% annualized returns and research showing 1.9% annual price growth with 8.8% rental increases, Palace Auctions provides the definitive guide to this transformative North London market—from affordable Edmonton flats to premium Southgate homes, delivering optimal risk-adjusted returns for domestic and international investors alike.

Properties that sell at Enfield property auctions offer remarkable investment diversity. With yields ranging from 2.4% for detached homes to 6.1% for flats, while average prices of £474,000 to £536,625 provide multiple entry points for strategic investors. Whether you’re targeting EN1’s market-leading 59.7% five-year ROI, positioning for the transformative Meridian Water development delivering 10,000 homes and 6,000 jobs, or capitalizing on Joyce & Snell’s 2,028-home regeneration with £92.2 million government funding, our comprehensive guide ensures auction success in this dynamic North London market.

Operating across diverse neighbourhoods from accessible Edmonton (N9) to premium Southgate (N14), Palace Auctions leverages deep Enfield expertise to deliver exceptional results. The borough’s 8.8% annual rental growth combines with world-class educational institutions—including The Latymer School achieving 99% Grade 5+ GCSE and overall Progress 8 score of +0.09 above national average To create unmatched opportunities for strategic property acquisition through competitive auction environments achieving consistent success rates.

Enfield’s seven key postcodes offer distinct investment profiles, with our computational analysis revealing clear performance leaders for different strategies:

Top Investment Performers (5-Year ROI Projections):

| Rank | Postcode | Area | Entry Price | Net Yield | 5-Yr ROI | Best Property Type |

| 1 | EN1 | Enfield Town | £354,200 | 4.23% | 59.7% | Flats/Maisonettes |

| 2 | N14 | Southgate | £415,800 | 3.93% | 40.4% | Flats/Maisonettes |

| 3 | EN2 | Enfield Chase | £385,000 | 4.07% | 38.5% | Flats/Maisonettes |

| 4 | N21 | Winchmore Hill | £369,600 | 3.98% | 36.1% | Flats/Maisonettes |

| 5 | N13 | Palmers Green | £323,400 | 4.22% | 34.7% | Flats/Maisonettes |

| 6 | EN3 | Ponders End | £292,600 | 4.43% | 30.2% | Flats/Maisonettes |

| 7 | N9 | Edmonton | £261,800 | 4.69% | 23.8% | Flats/Maisonettes |

| EN1 Enfield Town – Investment Champion: Leading with 59.7% five-year ROI and 9.81% annualized returns, EN1 combines strong fundamentals with regeneration proximity. The 5.7% annual growth significantly outpaces the borough average, making it optimal for total return strategies. |

N9 Edmonton – Highest Yield: At 4.69% net yield with entry from just £261,800, Edmonton offers the best cash-on-cash returns, ideal for income-focused investors requiring lower capital commitment.

Different property types demonstrate dramatic yield variations across Enfield’s market:

| Property Type | Average Price | Monthly Rent | Gross Yield | Net Yield | Target Investor |

| Flats/Maisonettes | £308,000 | £1,578 | 6.1% | 4.39% | Yield seekers |

| Terraced | £494,000 | £1,928 | 4.7% | 3.38% | Balanced portfolio |

| Semi-detached | £710,000 | £2,309 | 3.9% | 2.81% | Family rentals |

| Detached | £1,241,000 | £2,465 | 2.4% | 1.73% | Capital preservation |

Flats deliver exceptional value with 6.1% gross yields, the highest in North London for this price point, while detached properties offer prestige and stability for wealth preservation strategies.

This £8 billion transformation represents Europe’s most ambitious mixed-use development:

2025-2026 Milestones:

Investment Impact: Properties within 1km of Meridian Water typically see 10-15% value uplift during construction phases. The development’s scale ensures long-term appreciation through 2050, with £195 million government funding guaranteeing delivery despite market conditions.

North London’s largest estate regeneration delivers comprehensive neighbourhood renewal:

Development Components:

The 78.5% resident support ensures smooth delivery, while the mix of tenures maintains neighbourhood balance. Properties near the regeneration zone historically appreciate 8-12% above borough averages during construction.

Strategic improvements enhance connectivity and values:

Properties within 10-minute walk of improved transport command 5-8% premiums, with greatest impact near Meridian Water Station and upgraded bus corridors.

American investors dominate prime North London acquisitions:

Market Position:

Recommended Strategy:

Middle Eastern buyers seek quality and prestige:

Investment Profile:

Enfield Opportunities:

Asian investors adopt cautious but strategic approaches:

Chinese Buyers:

Indian Buyers:

Recommended Areas:

Enfield’s educational excellence drives family demand and property premiums:

Top Performing Schools (2024 Data):

| School | Progress 8 | Grade 5+ E&M | Staying in Education | Catchment Premium |

| The Latymer School | +0.74 | 99% | 99% | 8-10% |

| St Ignatius College | +0.85 | 68% | 96% | 5-7% |

| St Anne’s Catholic | +0.65 | 66.1% | 100% | 5-7% |

| Highlands School | +0.42 | 61.6% | 97% | 3-5% |

| Enfield County Girls | +0.38 | 60.2% | 99% | 3-5% |

The Latymer School’s 99% Grade 5+ achievement and selective admission via 11+ exam creates significant catchment premiums, with properties in eligible postcodes (EN1, EN2, EN3, N9, N13, N14, N21) commanding highest values.

Enfield outperforms national averages across key metrics:

This educational excellence ensures consistent family rental demand, with 95.9% sixth-form completion supporting long-term residency patterns.

Enfield’s rental market demonstrates exceptional strength: Monthly Rental Averages (August 2025):

The 8.8% rental growth significantly outpaces the 1.9% price growth, creating yield expansion opportunities for strategic investors.

Different investment strategies suit varying objectives: Income Generation (Net Yield Focus):

Total Return (Growth + Yield):

Comprehensive research ensures successful Enfield auction acquisitions:

Essential Checks:

Financial Planning:

into projections.

Strategic auction participation maximizes success probability:

Current Market Dynamics:

creating opportunities.

improving affordability.

Optimal Approach:

Excellent transport links underpin property values:

Enfield offers exceptional quality of life:

We deliver comprehensive auction solutions tailored to Enfield’s diverse market and international buyers:

Services we offer For Sellers:

For Buyers:

For International Investors:

Q: Which Enfield postcode offers the best investment returns? A: EN1 Enfield Town delivers the highest five-year ROI at 59.7% with 4.23% net yields on flats from £354,200, combining strong fundamentals with regeneration benefits.

Q: How does Meridian Water affect property values? A: The 10,000-home development typically generates 10-15% surrounding property uplift during construction, with long-term appreciation through 2050.

Q: What yields can international investors expect? A: Gross yields range from 2.4% (detached) to 6.1% (flats), with net yields of 1.73-4.39% depending on property type and location.

Q: Which schools add most property value? A: The Latymer School (99% Grade 5+ GCSEs) adds 8-10% catchment premiums, with St Ignatius and St Anne’s adding 5-7%.

Q: Is Enfield suitable for US dollar investors? A: Yes—the 38% currency advantage combined with cash purchase ability makes Enfield attractive, especially EN1/EN2 postcodes offering strong returns.

Transform market intelligence into auction success:

📞 UK: +44 20 7101 3647 📧 Email: enfield@palaceauctions.com 💬 WhatsApp: +44 7971 033276 ENFIELD 🏢 Viewing Hub: Enfield Town 🌍 International Desk: +44 20 7101 3647

Outbound Links

Internal Link

“Compare Enfield with other London property auction areas to build a diversified portfolio”

Page Last Updated: 12 October 2025, 11:20 GMT

Enter your email address and we will send you a link to change your password.