Description

Clacton hostel investment at 13 Beach Road delivers a rare freehold opportunity in Clacton-on-Sea.

Moreover, it boasts full Sui Generis planning consent (Use Class C1), guaranteeing regulatory security and smooth operations.

It offers 16 well-appointed bedrooms, including seven en-suites, and comprehensive communal areas across 311.23 sq m of building space.

Pricing options

With a guide price of £4,000,000 and a verified net income of £550,720 per annum. The asset yields 13.11% after operating costs of £40,000.

Furthermore, as a proven hostel investment. This freehold hostel Essex asset significantly outpaces traditional HMO returns.

The authority-backed emergency accommodation investment structure secures direct payments for rent and support services, eliminating housing benefit dependencies.

Investors can have confidence in the C1 hostel yield profile.

The building spans 311.23 sq m of total space (258.39 sq m living area) and trades at a highly competitive £13,495 per sq m on total area.

Download the Legal Pack to review planning consents, lease agreements, and operational details.

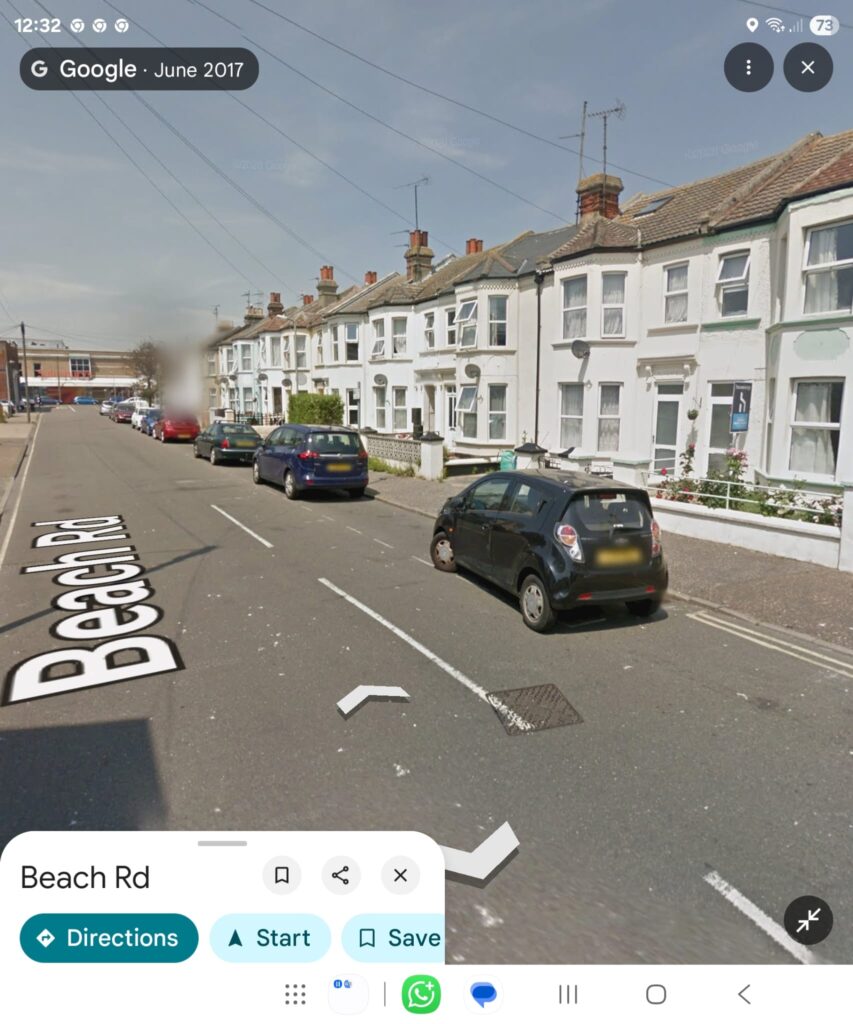

Additionally, the street view image highlights the property’s prime coastal position:

Street view of 13 Beach Road showcasing the hostel exterior and coastal proximity.

Key Investment Highlights:

Freehold hostel with C1 Sui Generis planning consent

16 bedrooms (7 en-suite) and generous communal kitchen and living areas

Authority-backed rental model as emergency accommodation investment

13.11% net yield; £590,720 gross rental income; £550,720 net income

311.23 sq m total area; 258.39 sq m living area; £13,495 per sq m

Seven off-street parking bays; transferable licence until May 2030;

Surrounded by Clacton Pier, local shops, and café culture, the site appeals to a wide range of tenants.

Additionally, it stands just a 5-minute walk from Clacton Pier and 15 minutes from Clacton Station, ensuring strong demand year-round.

For planning and council information, refer to Tendring District Council. Explore more opportunities in our Current Auction or browse related listings for similar investment options.

Finally, this emergency accommodation investment combines market-leading yield, planning certainty, and a prime seaside location to deliver an attractive, resilient asset. Consequently, investors seeking a high-yield, secure freehold hostel Essex opportunity should act swiftly to secure this Clacton hostel investment.

Investment Highlights

Current Gross Income: £276,160 to Jan 2026

Current Net Income: £227,000 to Jan 2026, paid quarterly

Licence Validity: Hostel licence (HMO) transferable until May 2030

Vacant Possession: From Jan 2026 (or earlier on request)

Long-Term Security: Tenanted by local council since 2002

Upside Potential: Council or Clearsprings contracts post-2026

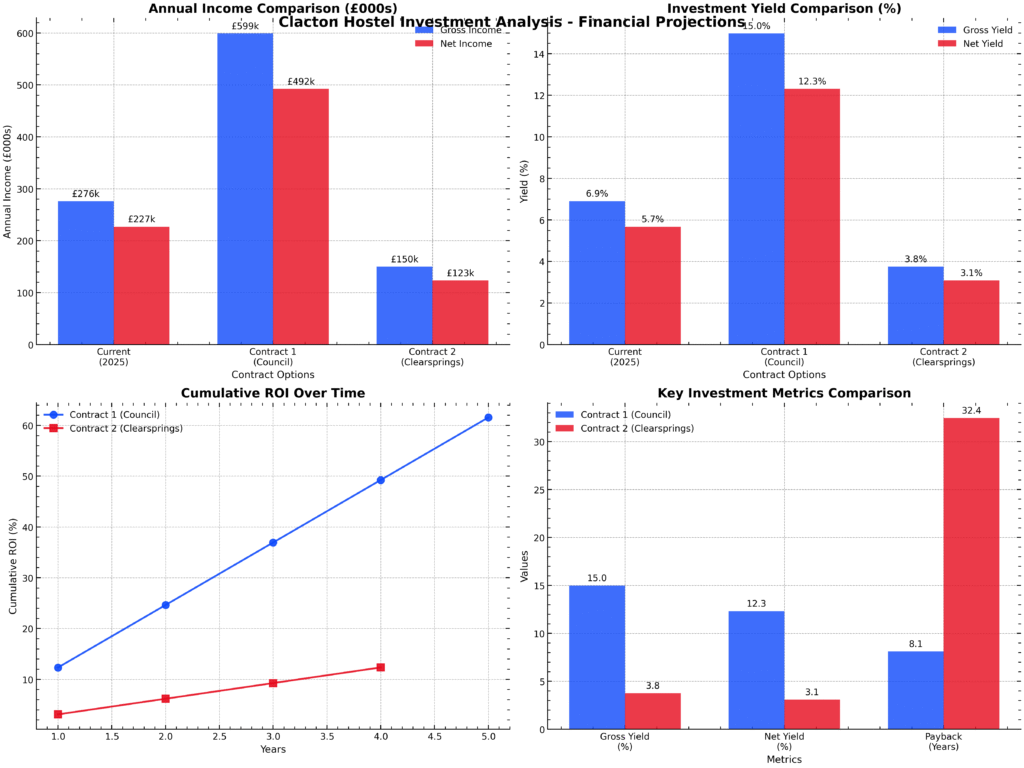

Figure: Annual income, yield comparison, ROI projections and payback periods for current tenancy vs. future contracts.

| Scenario | Gross Yield | Net Yield | Payback |

|---|---|---|---|

| Current (to Jan 2026) | 6.90% | 5.67% | 17.6 yrs |

| Contract 1: Council (5 yrs) | 14.98% | 12.31% | 8.1 yrs |

| Contract 2: Clearsprings (4 yrs) | 3.75% | 3.08% | 32.4 yrs |

Contact & Viewing

Status: Available – Vacant from Jan 2026

Guide Price: £4,000,000 (Freehold)

Strictly by appointment.

Palace Auctions

Tel: +44 0207 101 3647 | Email: enquiries@palaceauctions.comSecure

This Clacton licensed hostel investment now—combine immediate cashflow with significant upside potential.

Last Updated: Sunday, 03 August 2025