Description

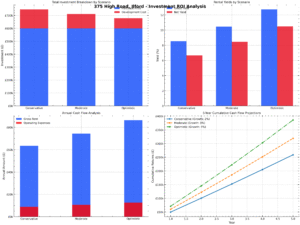

Key Takeaway: Secure a freehold mixed-use asset on Ilford High Road for £600,000. Planning consent for 4 studio flats and vacant retail space offers projected 10.5% gross yield (8.5% net) with a payback period as short as 9.5 years.

Introduction

The Ilford mixed-use investment at 375 High Road, IG1 1TF presents a rare freehold opportunity on one of East London’s busiest high streets. Priced at £600,000 plus fees, this property includes vacant ground-floor retail with basement and approved planning for four self-contained studio apartments above. Consequently, developers and investor-operators can capitalize on strong rental demand in Ilford, plus immediate vacant possession and clear planning consent.

Sale Details

• Sale Type: Private Treaty – For Sale

• Guide Price: £600,000 plus buyer’s fees

• Tenure: Freehold (vacant possession on completion)

• Planning Permission: Ref. RB2024/375 – 4 self-contained studios

• Status: Vacant commercial unit ready for conversion

Investors seeking a high‐impact London project will appreciate this Ilford mixed-use investment. On the ground floor, a generously glazed retail frontage captures foot traffic from Ilford Station and the new Elizabeth Line services. Above, the first and second floors can be reconfigured into four studio apartments, each with its own kitchenette and bathroom. Moreover, the vacant basement provides secure storage or potential ancillary space.

With planning consent in place, the conversion timeline can be as short as 6–9 months. Furthermore, typical studio rents in IG1 exceed £1,100 pcm, generating a combined gross income of £74,400 pa once fully let. After an 8% vacancy allowance and 15% operating costs, the net operating income is £60,078 pa, equating to an 8.5% net yield on a total investment of £710,400 (including development).

Therefore, buyers benefit from both attractive cash flow and capital appreciation driven by Ilford’s regeneration, transport links, and rental demand. Transitioning this asset from vacant retail to multi-unit residential underscores its developer appeal and hands-on investor suitability.

Investment Analysis

| Scenario | Total Investment | Gross Rent (£ pa) | Net Income (£ pa) | Gross Yield | Net Yield | Payback Period |

|---|---|---|---|---|---|---|

| Conservative | £746,050 | £63,600 | £49,735 | 8.5% | 6.7% | 15.0 yrs |

| Moderate | £710,400 | £74,400 | £60,078 | 10.5% | 8.5% | 11.8 yrs |

| Optimistic | £678,880 | £86,400 | £71,237 | 12.7% | 10.5% | 9.5 yrs |

Figure: 5-Year Cumulative Cash Flow & ROI Scenarios

Income

• 4 Studio Flats: 4×£1,100 pcm = £52,800 pa

• Retail Unit: £1,800 pcm = £21,600 pa

• Gross Annual Income: £74,400

• Net Operating Income: £60,078 (after vacancy & expenses)

Location

375 High Road, IG1 sits at the heart of Ilford’s retail and transport hub:

- Ilford Station (Elizabeth Line & TfL Rail) – 5-min walk

- Bus routes 366, 169 along High Road

- Redbridge Council planning: redbridge.gov.uk/planning/

- Ilford Area Guide: /areas/ilford

- Redbridge – Palace Auctions Global Real Estate Auctions: Uncover Exceptional Property insights in London and Beyond

Media Links

- Ilford market trends: rightmove.co.uk/area-guides/Ilford-property-market/

- TfL Ilford Station: https://tfl.gov.uk/modes/rail/ilford

- Redbridge regeneration: redbridge.gov.uk/business/regeneration/

Updated: Sunday, August 17, 2025 14:45