Description

Introducing Our “East Molesey hotels investment” offers a rare chance to acquire two freehold hotels under one title in Surrey’s most sought-after riverside town. Situated beside Hampton Court Palace and the River Thames, this package combines stable income with immediate scope for asset enhancement.

Secondly, in 2024, UK hotel transactions reached £3.9 billion in H1, the strongest first half since 2015. Surrey’s hospitality sector is forecast to grow at 5.8% annually through 2030, driven by both leisure and business travel. In addition the portfolio achieves full occupancy through dynamic pricing aligned with the market ADR (£124) and an average 77.4% occupancy rate. Such dynamics make East Molesey hotel ventures an appealing investment opportunity.

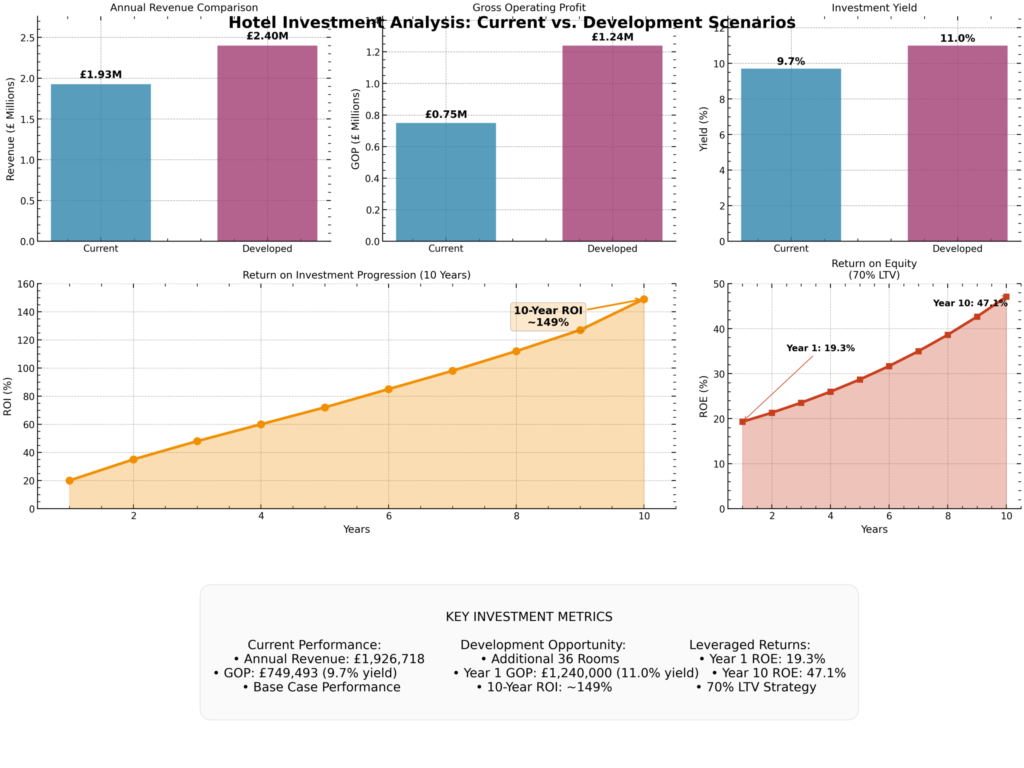

Thirdly, based on market benchmarks, the two-hotel block is estimated to generate £1.93 million in annual revenue and £750,000 in gross operating profit—a current yield of approximately 9.7%. Investors can leverage local planning precedents, such as the 84-bed hotel approval at the former Jolly Boatman site, to expand by 22–52 rooms, boosting year-one yields above 11% and delivering 10-year cumulative ROI nearing 149%.

East Molesey benefits from Hampton Court station (Zone 6), offering direct trains to London Waterloo in 24–38 minutes, multiple bus routes (111, 216, 411, R68, 461), and immediate access to the M3/M25. The town’s heritage attractions—Hampton Court Palace, Bushy Park—and boutique retail along Bridge Road underpin year-round demand. Investing in local hotels can enhance returns.

For full details, consult our Surrey Area Guide or view upcoming dates in our Auction Calendar. Planning documentation is available via the Elmbridge Borough Council Planning Portal.

Key Takeaways:

• Prime dual-hotel package adjacent to Hampton Court Palace and the River Thames

• Immediate cash flow (~9.7% gross yield) and strong long-term upside via expansion

• Guide Price: £7.7 million for freehold title under one SPV

Guide Price

£7,700,000 represents a strategic entry point for those eyeing East Molesey hotel projects.

Income & Investment Analysis

- Estimated Annual Revenue: £1,926,718

- Estimated Gross Operating Profit: £749,493 (9.7% yield)

- Moderate Development (add 36 rooms): Year 1 GOP £1.24 million (11.0% yield); 10-Year ROI ~149%

- Leveraged (70% LTV) Year 1 ROE: 19.3%; Year 10 ROE: 47.1%

Figure: ROI scenarios and leveraged returns for a moderate development strategy.

Location

- East Molesey, Surrey (adjacent to Hampton Court Palace: hrp.org.uk/hampton-court-palace)

- Rail: Hampton Court station (Zone 6) – direct to London Waterloo

- Road: M3 & M25 access; Heathrow Airport ~9 miles

- Bus: 111, 216, 411, R68, 461

- Amenities: Riverside dining, boutique shops, Bushy Park, annual festivals make East Molesey perfect for hotel investments.

Finally, Note : Last updated: Sunday, September 07, 2025, 12:18