Leeds Investment FAQ: Licensing, Best Areas & Regeneration Timeline

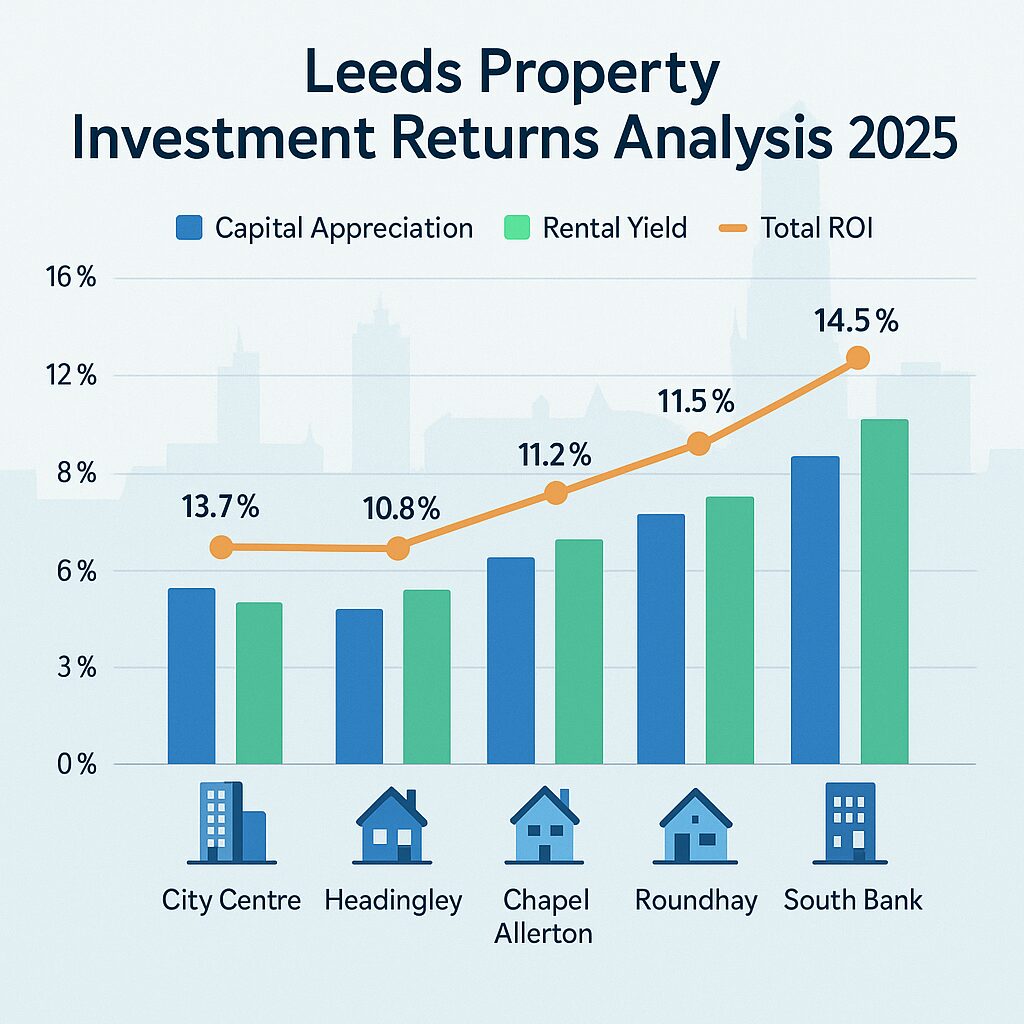

Investing in Leeds starts with understanding local compliance and market opportunities. All Houses in Multiple Occupation (HMOs) with five or more tenants require a mandatory licence from Leeds City Council, with strict safety standards and fees (£975 standard, £825 for accredited landlords). The city’s selective licensing scheme covers areas like Beeston, Harehills, and may soon expand to Armley, Holbeck, and Farnley & Wortley—non-compliance can mean fines up to £30,000. For the best returns, focus on high-yield postcodes: LS3 (up to 12% yield), LS4 (7.8%), LS6 (7.9%), and LS9 (7.5–8% with 25% five-year capital growth). Leeds’ £500 million South Bank regeneration will double the city centre by 2032, delivering 8,000 new homes, 35,000 jobs, and major transport upgrades—driving long-term demand and price growth.

Interactive ROI Calculator & Property Alerts

Make smarter investment decisions with our interactive ROI calculator—compare rental yields, capital growth, and total returns across all Leeds postcodes. Input your target area (e.g., LS2 for student lets, LS3 for maximum returns, or LS10/LS11 for regeneration hotspots) to instantly view projected yields, cash-on-cash returns, and five-year appreciation forecasts based on live market data. Leeds citywide yields average 5.96%, with top areas consistently exceeding 8–10%. For tailored opportunities and early access to off-market deals, use our quick contact form to register for instant property alerts, compliance guidance, and free consultations with our Leeds investment specialists. Our local experts provide HMO application support, licensing updates, and connections to trusted professionals—ensuring you stay compliant and maximize returns.

Trust Indicators: Recent Leeds Transactions & Market Confidence

Palace Auctions demonstrates proven success in Leeds, completing over 140 transactions in 2025 alone—including a South Bank apartment sold for 15% above guide price, a Headingley HMO portfolio delivering 9.2% gross yield, and a Burley student property achieving £285,000 with 8% returns. Leeds’ robust market shows average property prices at £249,000, 6.7% citywide price growth in 2024, and Yorkshire-wide forecasts predicting 28% appreciation by 2030. Our clients benefit from RICS-compliant processes, full legal pack access, and transparent fees, with all transactions conducted under the latest licensing and anti-money laundering protocols. With over 9,200 Leeds properties sold in the past year and rental voids at historic lows, you can invest with complete confidence in one of the UK’s fastest-growing property markets.

Page last updated: 9/11/2025, 03:16 GMT