Kensington and Chelsea: A Prime Investment Destination in West London

Welcome to Palace Auctions London’s comprehensive guide to Kensington and Chelsea, a borough that seamlessly blends rich history with modern opportunity. Whether you’re a seasoned investor, a first-time buyer, or an asset manager looking for the next big opportunity, Kensington and Chelsea offers a unique proposition in London’s dynamic property market.

A Tapestry of History and Culture

Kensington and Chelsea, established in 1965 through the amalgamation of the Metropolitan Borough of Kensington and the Metropolitan Borough of Chelsea, boasts a rich history dating back to medieval times. This royal borough has been a significant cultural and political center since the Middle Ages, evolving into an affluent residential area during the Victorian era – a status it proudly maintains today

Notable Landmarks and Cultural Attractions

The borough is home to numerous iconic landmarks and cultural institutions that contribute to its prestige and desirability:

- Kensington Palace: A royal residence and major tourist attraction, offering insights into British monarchy history

- Royal Albert Hall: An architectural marvel known for its exceptional acoustics and diverse events

- Natural History Museum: Houses extensive collections exploring biodiversity and geological history

- Victoria and Albert Museum (V&A): The world’s leading museum of art and design

- Portobello Road Market: Famous for its vibrant atmosphere and diverse offerings

- Saatchi Gallery: Known for contemporary art exhibitions.

- Leighton House Museum: Offers insights into Victorian art and architecture

Imperial College London, one of the world-renowned institutions in Kensington and Chelsea The borough also hosts several annual events, including the Notting Hill Carnival and the Chelsea Flower Show, which attract visitors from around the world.

Amenities and Lifestyle

Kensington and Chelsea offer a rich tapestry of amenities that contribute to its appeal:

- Education: 78 schools, including 27 state primary schools, 6 state secondary schools, and 38 independent schools. Notable institutions include Holland Park School and Lycée Français Charles de Gaulle

- Healthcare: Served by world-class facilities such as Chelsea and Westminster Hospital, Royal Brompton Hospital, and The Royal Marsden Hospital

- Shopping: Home to luxury shopping destinations like Harrods in Knightsbridge, King’s Road in Chelsea, and Kensington High Street

- Parks and Green Spaces: Despite being densely populated, the borough boasts beautiful green spaces including Holland Park, Kensington Gardens, and Brompton Cemetery

- Transport Links: Well-connected through multiple tube lines (Circle, District, Piccadilly, and Central), numerous bus routes, and overground services. The area also offers easy access to London’s airports.

The iconic Egyptian room in Harrods, a symbol of luxury shopping in Kensington and Chelsea “In Kensington and Chelsea, you’re never far from world-class amenities and green spaces, offering the perfect blend of urban living and tranquility.”

Demographics and Economy

Kensington and Chelsea’s population of approximately 146,154 (as of mid-2022) is characterized by its diversity and affluence

- Age Distribution: The median age is 38.7 years, with the largest age group being 20 to 39 years old, representing 33% of the population

- Ethnic Composition: Predominantly White (63.7%), with significant “Other White” (28%), Asian (11.9%), and Black (7.9%) populations

- Economic Status: The borough ranks among the top 10% of UK local authorities in terms of economic success, wealth, and prosperity

- Employment: The employment rate for those aged 16 and over (excluding full-time students) was 55.1% in 2021, with a high proportion engaged in professional and managerial roles

This diverse demographic profile, combined with the area’s economic prosperity, creates a robust rental market and potential for long-term capital appreciation.

Why Choose Palace Auctions for Your Kensington and Chelsea Investment

At Palace Auctions London, we offer unparalleled expertise in navigating the Kensington and Chelsea property market:

- Potential for Bargains: Our auctions often feature properties at competitive prices, providing opportunities to purchase below market value

- Speed of Transaction: Our auction process expedites property transactions, allowing investors to capitalize quickly on market conditions

- Transparency: Public bidding provides a clear picture of a property’s market value and interest level.

- Variety of Properties: We offer a wide range of properties, including unique opportunities not readily available on the open market.

- Expert Guidance: Our team provides specialized knowledge of the Kensington and Chelsea property market, offering valuable insights for both buyers and sellers.

- Access to Detailed Information: Our auction catalogues and property inspection reports provide comprehensive information to help investors make informed decisions.

“With Palace Auctions, you’re not just buying a property; you’re gaining a partner in your investment journey.”

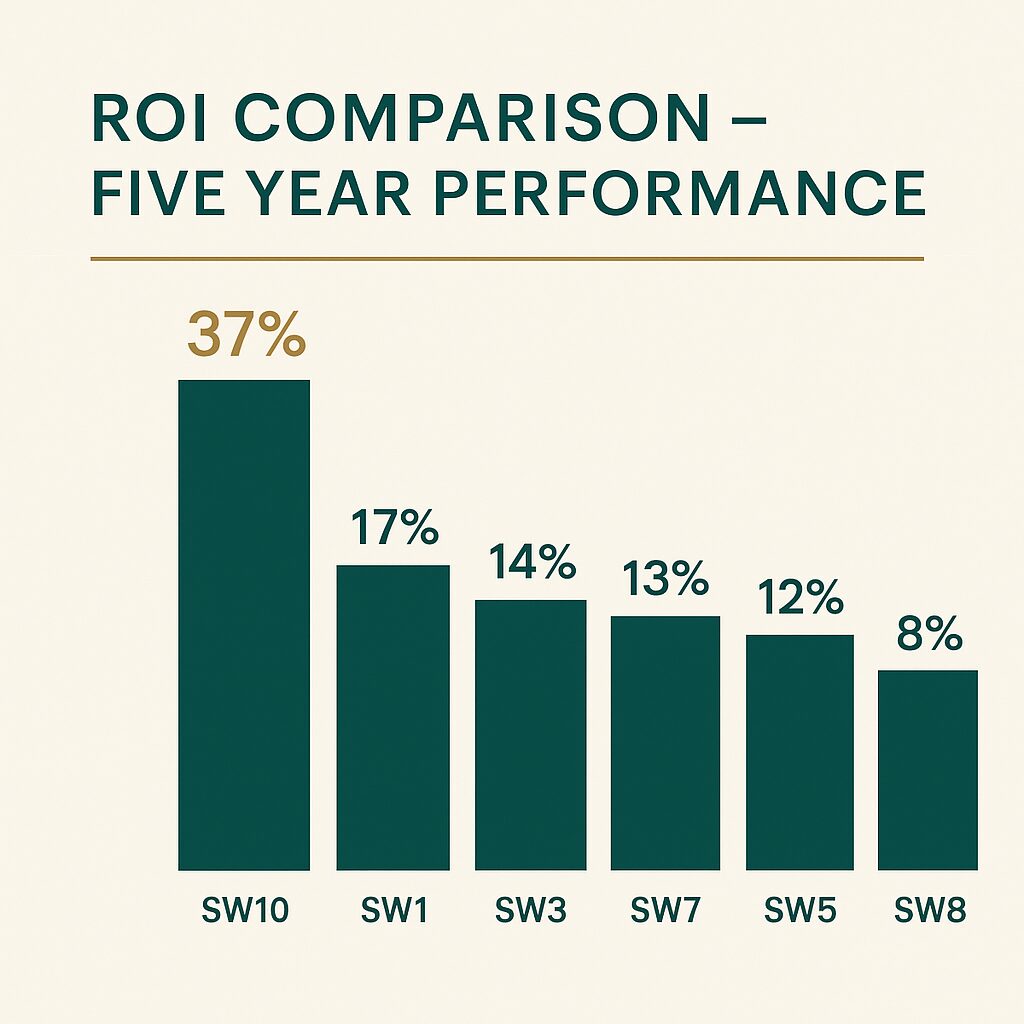

Case Study: Maximizing ROI Through Auctions

While not specific to Kensington and Chelsea, a relevant case study demonstrates the potential of auction-based investments: A Kensington flat was offered at auction for £100,000 due to an extremely short lease. This example highlights how properties with specific conditions can be acquired at auctions for potentially lower prices, offering unique investment opportunities

Looking Ahead: The Future of Kensington and Chelsea

As we move towards 2026 and beyond, Kensington and Chelsea are poised for continued growth and transformation. While the property market has seen a recent decline in average prices, the robust growth in the rental market suggests a shift in demand dynamics. The borough’s enduring appeal, world-class amenities, and cultural significance indicate a positive long-term outlook for property investors. As the broader UK market shows signs of recovery, Kensington and Chelsea’s prime location and prestigious status position it well for future growth. “Investing in Kensington and Chelsea today is about seeing the potential of tomorrow. It’s about being part of one of London’s most iconic communities.”

Conclusion

Kensington and Chelsea represent a unique opportunity in the London property market. Their combination of historical charm, cultural richness, excellent amenities, and strong community appeal make them an attractive proposition for a wide range of investors. As the borough continues to evolve, those who invest wisely today stand to reap substantial rewards in the future. At Palace Auctions London, we’re excited to guide you through the opportunities that Kensington and Chelsea present. Whether you’re looking for your first investment property, expanding your portfolio, or seeking to capitalize on the area’s prestige.

We have the expertise and local knowledge to help you make informed decisions. Ready to explore the potential of Kensington and Chelsea? Contact our expert team at Palace Auctions London today, and let’s embark on your next investment journey together.

[View Upcoming Auctions in Kensington and Chelsea]

Palace Auctions London: Your Gateway to Prime Property Investments in Kensington and Chelsea

For more information about local services and regulations, please visit the official website of the Royal Borough of Kensington and Chelsea: www.rbkc.gov.uk.

London Area Investment Guides

-

Hammersmith & Fulham Property Auctions

Wandsworth

Southwark Property Auctions: Your Expert Investment Guide for 2025-2026

Tower Hamlets

🏠🔨📈🗺️ Hackney Property Auctions: Your East London Investment Guide

Islington Property Auctions: 5% Yields Investment Guide 2026

Camden Property Auctions: Investment Guide & 5.4% Yields 2026

Brent Property Auctions: Investment Guide & 5.4% Yields 2025/6

Ealing Property Auctions: 5.9% Yields Investment Guide 2025

Hounslow Property Auctions: 5.67% Yields Investment Guide 2025

Kingston upon Thames

Merton

Redbridge

Richmond upon Thames

Sutton

Waltham Forest Property Auctions: Buyer & Investor Guide 2025

City of London

Westminster

The Worlds Key Real Estate Locations

UK City Guides