Thanks for reading Palace Auctions London’s comprehensive guide to Lewisham, a borough that seamlessly blends rich history with modern opportunity. Whether you’re a seasoned investor, a first-time buyer, or an asset manager looking for the next big opportunity, Lewisham offers a unique proposition in London’s dynamic property market.

A Tapestry of History and Progress

Lewisham’s history dates back to at least 862 CE, with its name derived from Old English, meaning “the house among the meadows”

_-_Lewisham.jpg/500px-John_Cleveley_Junior_-_A_View_at_Lewisham_(print)_-_Lewisham.jpg)

A historic view of Lewisham, showcasing its rural past. The construction of suburban railways in the mid-19th century marked a turning point, transforming Lewisham into a middle-class residential area with thriving commercial districts

The modern London Borough of Lewisham, formed in 1965 by merging the metropolitan boroughs of Lewisham and Deptford, has continued to evolve, becoming one of 35 major centers in Greater London as identified in the London Plan.

Key Historical Events and Landmarks

- Battle of Lewisham (1977): A significant event where anti-fascist demonstrators clashed with the National Front, marking a pivotal moment in the area’s social and political history

- Horniman Museum: Known for its extensive collection of ethnography and musical instruments, this museum is a cultural cornerstone of the borough

- Blackheath: A large open space with historical significance, now a popular recreational area

- Broadway Theatre: Opened in 1932 in Catford, this theatre remains a key cultural venue.

- Lewisham Shopping Centre: Opened in 1977, it’s one of the largest commercial areas in southeast London.

.jpg/500px-Lewisham_Town_Hall_(9175916169).jpg)

Lewisham Town Hall, a symbol of the borough’s civic pride and governance

Amenities and Lifestyle

Lewisham offers a rich tapestry of amenities that contribute to its appeal:

- Shopping and Dining: The area boasts a large indoor shopping centre and a bustling outdoor market. Diverse dining options include popular eateries like Sparrow, Meze Mangal, and Enish

- Entertainment and Culture: The Rivoli Ballroom and Broadway Theatre offer a range of performances, while the community-run Deptford Cinema provides unique film experiences

- Green Spaces: Residents enjoy access to numerous parks, including Blackheath, Greenwich Park, and Hilly Fields

- Education: From primary schools to higher education institutions like Goldsmiths, University of London, Lewisham caters to all educational needs

Transport Links

Lewisham’s excellent connectivity is a major draw for residents and investors:

- Rail and DLR: Frequent services to central London locations, complemented by the Docklands Light Railway

- Bus Services: Comprehensive network connecting to nearby areas and central London

- Cycling: Cyclist-friendly routes and plans for further improvements

- Road Access: Easy access to the A205 South Circular and M25

“In Lewisham, you’re never far from world-class amenities and excellent transport links, offering the perfect blend of urban living and convenience.”

Demographics and Economy

Lewisham’s population of approximately 300,600 (as of 2021) is characterized by its diversity and growth:

- Population Growth: 8.9% increase between 2011 and 2021, outpacing London’s overall growth

- Age Distribution: Median age of 35 years, with a significant increase in residents aged 50 to 64 years

- Income Levels: Median gross weekly pay for full-time workers is £763.6, slightly lower than the London average but higher than the national average

- Employment Sectors: Key industries include human health and social work activities (20.6%), education (13.2%), and wholesale and retail trade (11.8%)

This diverse demographic profile creates a robust rental market and potential for long-term capital appreciation.

Why Choose Palace Auctions for Your Lewisham Investment

At Palace Auctions London, we offer unparalleled expertise in navigating the Lewisham property market:

- Potential for Cost Savings: Our auctions often feature properties at 10-30% below market value, maximizing return on investment potential [[20]].

- Speed of Transaction: Our auction process expedites property transactions, allowing investors to capitalize quickly on market conditions.

- Transparency and Competitive Bidding: Our public bidding process ensures fair market value and provides a clear picture of property interest levels.

- Diverse Property Options: We offer a wide range of properties, including unique opportunities not readily available on the open market.

- Expert Guidance: Our team provides specialized knowledge of the Lewisham property market, offering valuable insights for both buyers and sellers.

- Immediate Possession: Once a property is won at auction, the transfer of ownership is typically swift, allowing investors to begin renovations or leasing processes without delay.

“With Palace Auctions, you’re not just buying a property; you’re gaining a partner in your investment journey.”

Looking Ahead: The Future of Lewisham

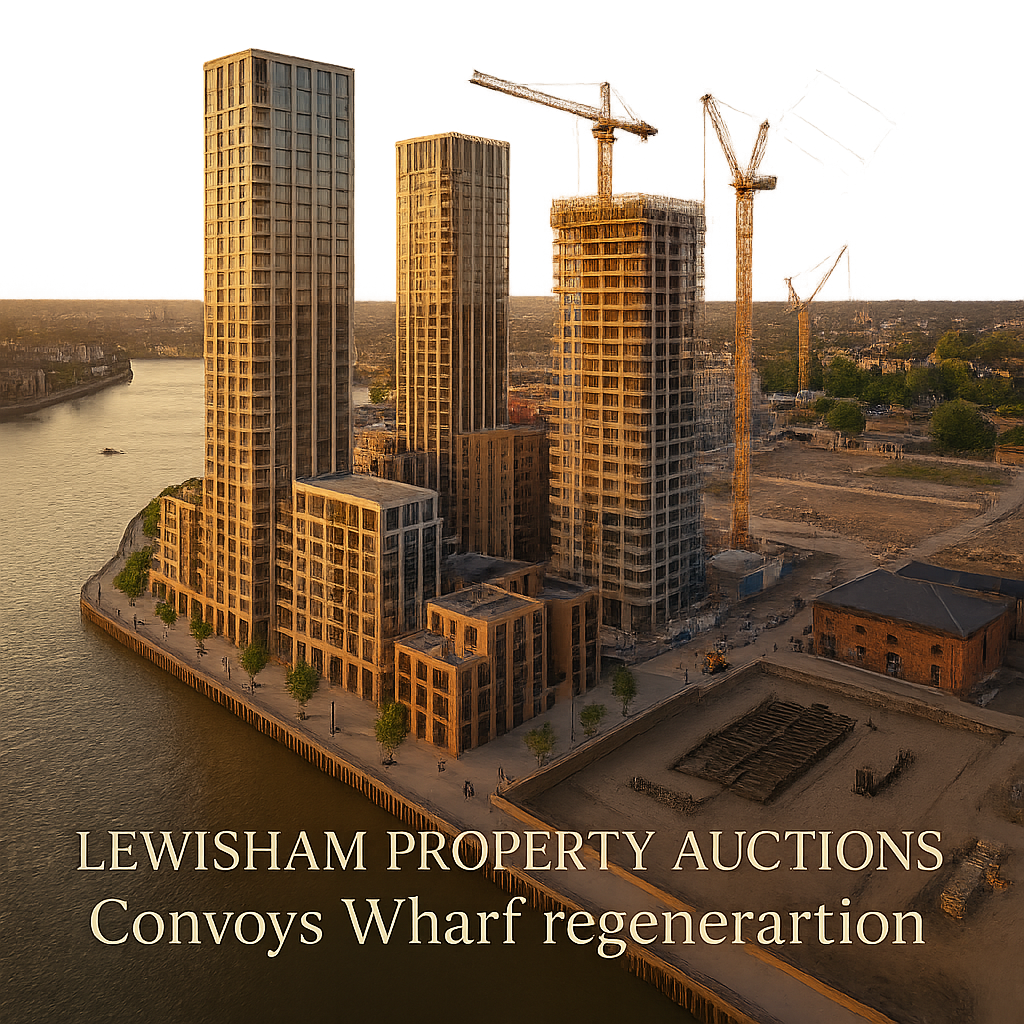

As we move towards 2026 / 27 and beyond, Lewisham is poised for continued growth and transformation. The ongoing regeneration projects, improving transport links, and focus on sustainable development are set to enhance the borough’s appeal further.

While the property market has seen fluctuations, the robust growth in the rental market and the area’s ongoing regeneration indicate a positive outlook for property investors in the coming years. Lewisham’s diverse community, cultural richness, and strategic location position it well for future growth and development. “Investing in Lewisham today is about seeing the potential of tomorrow. It’s about being part of a community on the rise.”

Conclusion

Lewisham represents a unique opportunity in the London property market. Its combination of historical charm, ongoing regeneration, excellent connectivity, and strong community appeal make it an attractive proposition for a wide range of investors. As the borough continues its transformation, those who invest wisely today stand to reap substantial rewards in the future.

At Palace Auctions London, we’re excited to guide you through the opportunities that Lewisham presents. Whether you’re looking for your first investment property, expanding your portfolio, or seeking to capitalize on the area’s regeneration, we have the expertise and local knowledge to help you make informed decisions.

Ready to explore the potential of Lewisham? Contact our expert team at Palace Auctions London today, and let’s embark on your next investment journey together.

Palace Auctions London: Your Gateway to Prime Property Investments in Lewisham

For more information about local services and regulations, please visit the official website of the London Borough of Lewisham: www.lewisham.gov.uk