Merton: A Vibrant South London Borough Ripe for Investment

Unlock Merton’s investment potential with our comprehensive Merton Regeneration Investment Guide 2025. This essential resource offers exclusive insights into upcoming infrastructure projects, regeneration zones, and emerging investment hotspots across the borough. Dive into detailed analysis of transport links, planning permissions, and projected capital growth areas that are driving Merton’s property renaissance. Download your free investment guide today and discover why Merton is a top choice for forward-thinking investors.

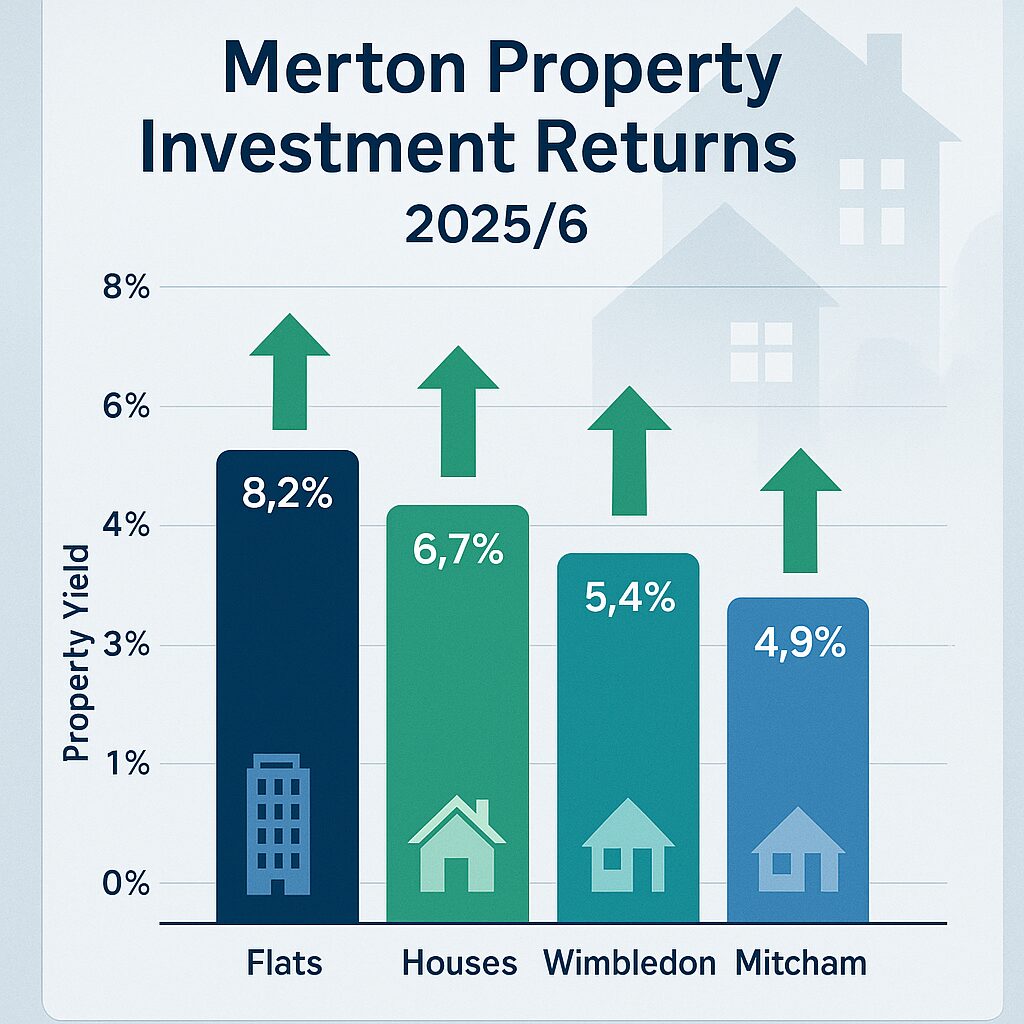

Make informed decisions with our interactive Merton Borough Statistics Dashboard. Access real-time market data including average property prices, auction success rates, rental yields, and demographic trends across all Merton postcodes. Our analytics platform features historical price movements, upcoming auction inventory, and comparative market analysis tools—giving you the competitive edge in today’s dynamic property market. Explore market data now and stay ahead of the curve.

Never miss a Merton investment opportunity—sign up for our exclusive market intelligence newsletter. Receive weekly updates on new auction listings, sold prices, regeneration announcements, and expert market analysis delivered directly to your inbox. Subscribers gain early access to off-market opportunities and priority notifications for high-potential Merton properties before they reach public auction. Join over 15,000 investors who rely on Palace Auctions for their London property market insights. Subscribe to market updates today and secure your Merton market advantage.

Palace Auctions London: Your Gateway to Prime Property Investments in Merton

For more information about local services and regulations, please visit the official website of the London Borough of Merton: www.merton.gov.uk.