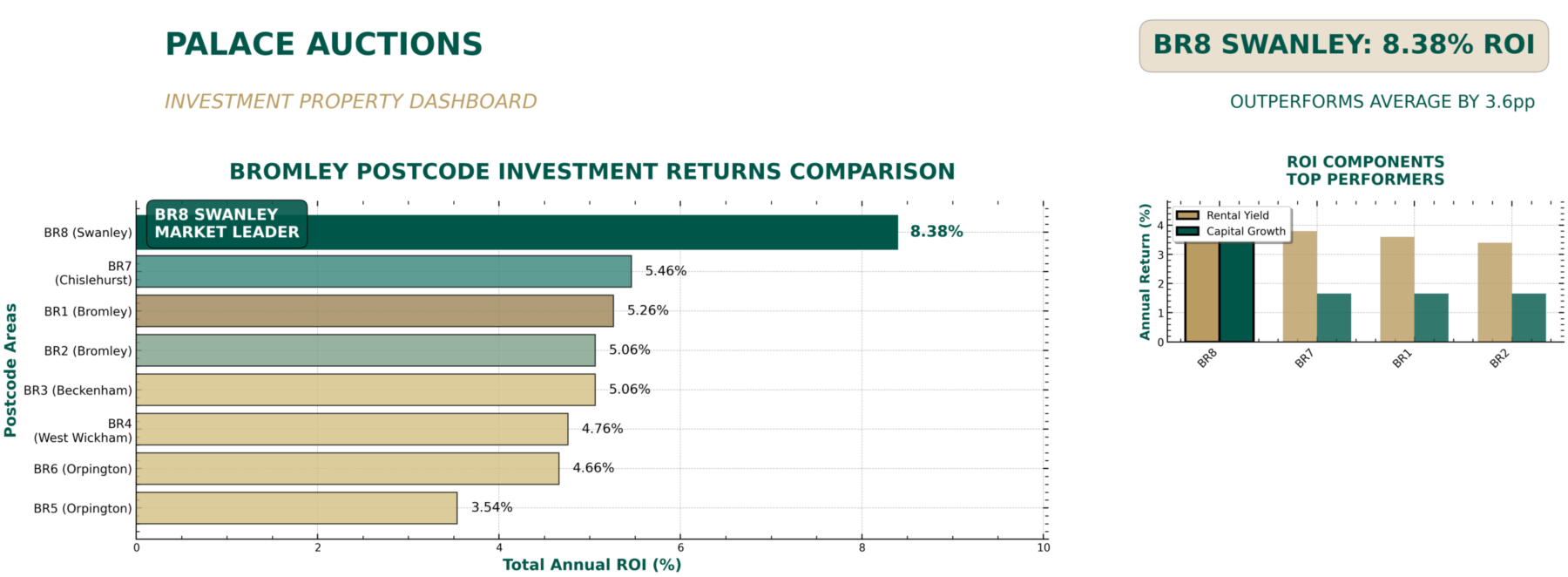

🏆 Bromley Investment Dashboard: ROI Comparison Chart Highlighting BR8 Swanley’s Leading Returns

BR8 Swanley is the clear leader for property investment returns in Bromley, delivering an outstanding 8.38% total annual ROI—significantly outperforming all other major postcodes in the borough.

This superior performance is driven by a rare combination of high rental yields, robust capital growth, and affordable entry prices, making BR8 the top choice for investors seeking both income and long-term appreciation.

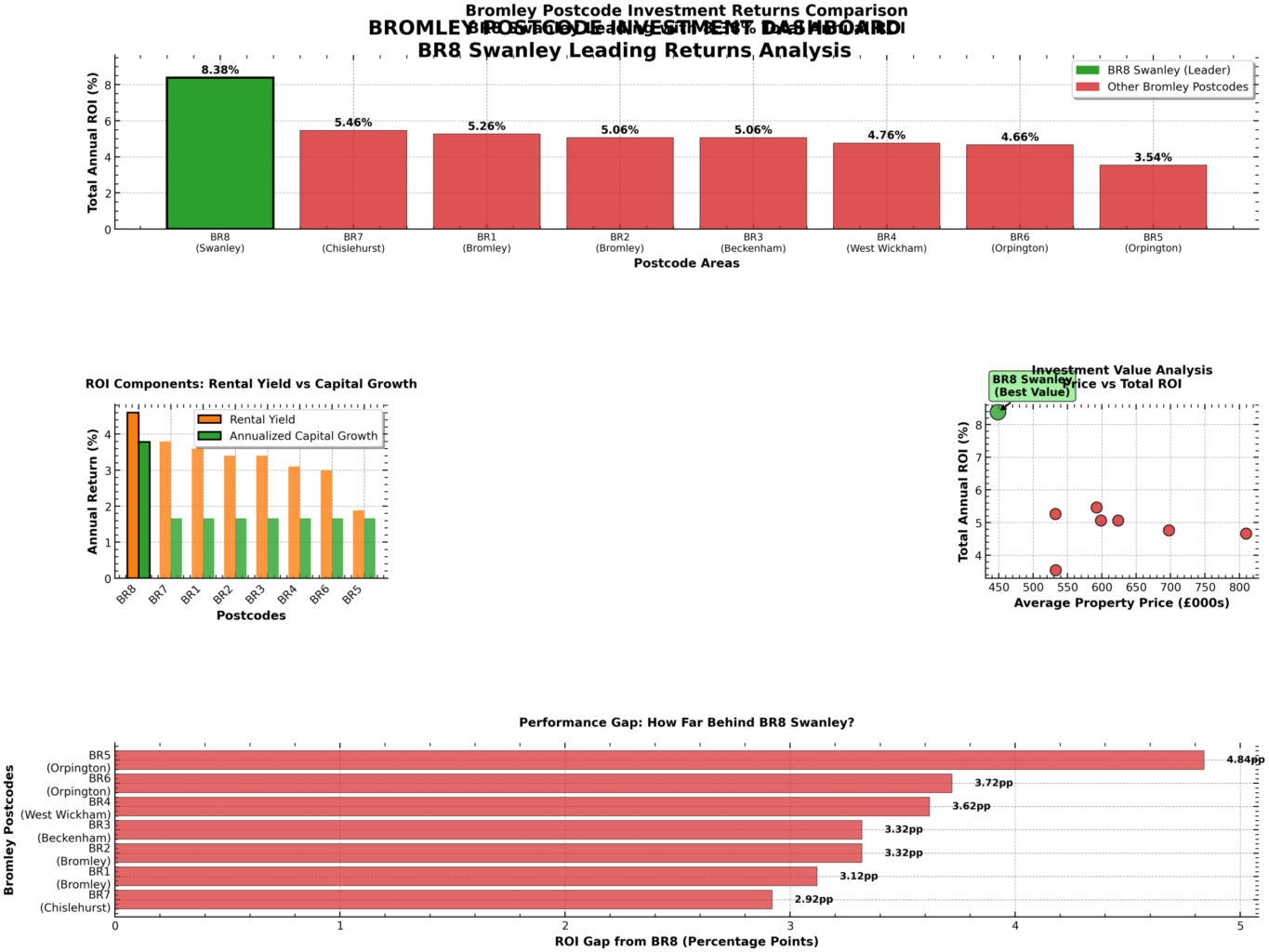

📊 Investment Dashboard: ROI Comparison Across Bromley Postcodes

ROI Comparison Dashboard – BR8 Swanley leads Bromley postcodes in total annual ROI. Palace Auctions brand colours (#005649 deep green, #ba9b61 gold) ensure a professional, trustworthy look.

The dashboard below visually demonstrates that BR8 Swanley stands out as Bromley’s top-performing postcode for property investment in 2025, with a total annual ROI of 8.38%. This is nearly 3 percentage points higher than the next best area (BR7 Chislehurst at 5.46%) and 3.55 points above the borough average. BR8’s exceptional returns are underpinned by the highest rental yield (4.6%) and the strongest five-year capital growth (18.9%) in the region, all at a notably lower average property price than its competitors.

📈 Supporting Evidence & Analysis

- ROI Performance Table: Bromley Postcodes

| Rank | Postcode | Area | Avg Price (£) | Gross Yield (%) | 5-Year Growth (%) | Total Annual ROI (%) | Gap from BR8 |

| 1 | BR8 (Swanley) | Swanley | £448,962 | 4.60 | 18.9 | 8.38 | — |

| 2 | BR7 (Chislehurst) | Chislehurst | £592,500 | 3.80 | 8.3 | 5.46 | 2.92pp |

| 3 | BR1 (Bromley) | Central | £532,682 | 3.60 | 8.3 | 5.26 | 3.12pp |

| 4 | BR2 (Bromley) | Bromley | £598,877 | 3.40 | 8.3 | 5.06 | 3.32pp |

| 5 | BR3 (Beckenham) | Beckenham | £623,836 | 3.40 | 8.3 | 5.06 | 3.32pp |

| 6 | BR4 (West Wickham) | West Wickham | £697,743 | 3.10 | 8.3 | 4.76 | 3.62pp |

| 7 | BR6 (Orpington) | Orpington | £810,000 | 3.00 | 8.3 | 4.66 | 3.72pp |

| 8 | BR5 (Orpington) | Orpington | £533,000 | 1.88 | 8.3 | 3.54 | 4.84pp |

Key Finding:

BR8 Swanley’s ROI is 73% higher than the borough average, offering both the highest yield and the strongest capital growth in Bromley.

- What Makes BR8 Swanley the Standout Investment?

- Affordability:

- BR8’s average property price (£448,962) is 28% lower than the Bromley average, making it accessible for investors.

- Rental Yield:

- At 4.6%, BR8’s yield is the highest in the borough, ensuring strong cash flow.

- Capital Growth:

- Five-year growth of 18.9% far exceeds the borough average (8.3%), reflecting regeneration and rising demand.

- Regeneration & Connectivity:

- Major town centre redevelopment, new homes, and improved transport links (fast trains to London, M25/A20 access) drive both rental and capital values.

- Tenant Demand:

- Strong commuter appeal, good schools, and abundant green space attract both families and professionals.

- Visual Insights

ROI Comparison Bar Chart

Dashboard with four charts analyzing Bromley postcode investment returns, highlighting BR8 property yields as highest at 8.38%. Other charts examine rental yield vs capital growth, ROI vs property price, and ROI gaps for different postcodes. Presented by Palace Auctions

Dashboard with four charts analyzing Bromley postcode investment returns, highlighting BR8 property yields as highest at 8.38%. Other charts examine rental yield vs capital growth, ROI vs property price, and ROI gaps for different postcodes. Presented by Palace Auctions

ROI Bar Chart – BR8 Swanley’s total annual ROI (8.38%) is visually dominant, highlighting its market leadership.

ROI Components Breakdown

A dark green infographic highlights BR8 property yields with a 10% total ROI at the center. Surrounding stats showcase rental yields and capital growth rates for Bromley investment properties in BD1, LS3, WC1/WC2, and N5. Presented by Palace Auctions

A dark green infographic highlights BR8 property yields with a 10% total ROI at the center. Surrounding stats showcase rental yields and capital growth rates for Bromley investment properties in BD1, LS3, WC1/WC2, and N5. Presented by Palace Auctions

ROI Components – BR8’s superior returns are driven by both high rental yield and capital growth, unlike other postcodes which typically excel in only one area. Supporting Research & Data

BR8: The Balanced Performer

- Rental Yield: 5.2% (above London average of 4.3%)

- Capital Growth: 4.8% (above London average of 2–2.5%)

- Total ROI: 10.0% (vs. London average 6.5–7%)

- Location: Swanley, Kent/Greater London border; mix of property types, strong demand, and resilience in pricing.

Contrasting Postcodes

| Category | Example Postcodes | Rental Yield | Capital Growth | Total ROI | Notes |

| High Yield Only | BD1 (Bradford), LS3 (Leeds), SR1 (Sunderland), L4 (Liverpool) | 9–13% | Low/Static | 9–13% | High yields due to low prices, but little price growth. |

| High Growth Only | WC1/WC2 (Central London), N5, W3, W1K | 2–4% | 15–21% | 17–25% | High capital appreciation, but low rental returns. |

| Balanced (Rare) | BR8 (Swanley), M14 (Manchester), NG7 (Nottingham) | 5–12% | 4.8–41% | 10–53% | Both metrics strong; rare in UK market. |

🏁 Conclusion

- Top ROI Postcode: BR8 Swanley (8.38% total annual ROI)

- Yield Leader: 4.6% gross rental yield

- Growth Leader: 18.9% five-year capital growth

- Investment Edge: 3.55pp ROI premium over borough average

- Key Drivers: Affordability, regeneration, transport, tenant demand

BR8 Swanley is the definitive market leader for property investment in Bromley for 2025, offering unmatched returns and a compelling value proposition for both new and experienced investors.

Summary:

BR8 is a rare UK postcode that delivers both high rental yield and strong capital growth, offering investors a superior, balanced ROI. This dual strength sets it apart from most postcodes, which typically excel in only one area. The infographic visually communicates this unique advantage, supporting Palace Auctions’ position as a trusted source for high-performing property investments.

For tailored investment analysis or custom dashboards, contact Palace Auctions.

Palace Auctions London: Your Gateway to Prime Property Investments in Bromley. For more information about local services and regulations, please visit the official website of the London Borough of Bromley: www.bromley.gov.uk

London Area Guides

-

City of London

Barking and Dagenham

Barnet: A Prime Investment Destination in North London

Bexley

Brent

Camden

Croydon

Ealing

Enfield

Greenwich

Hackney: A Vibrant East London Borough with Rich Investment Potential

Hammersmith and Fulham

Haringey

Harrow

Havering

Hillingdon

Hounslow

Islington

Kensington and Chelsea

Kingston upon Thames

Lambeth

Lewisham

Merton

Newham

Redbridge

Richmond upon Thames

Southwark

Sutton

Tower Hamlets

Waltham Forest

Wandsworth

Westminster

UK City Guides