🏙️ Unlock City of London Property Insights & Tools

Key Takeaway:

Maximize your investment potential in the City of London with exclusive interactive tools, expert resources, and timely updates—empowering you to make informed decisions in the heart of the capital.

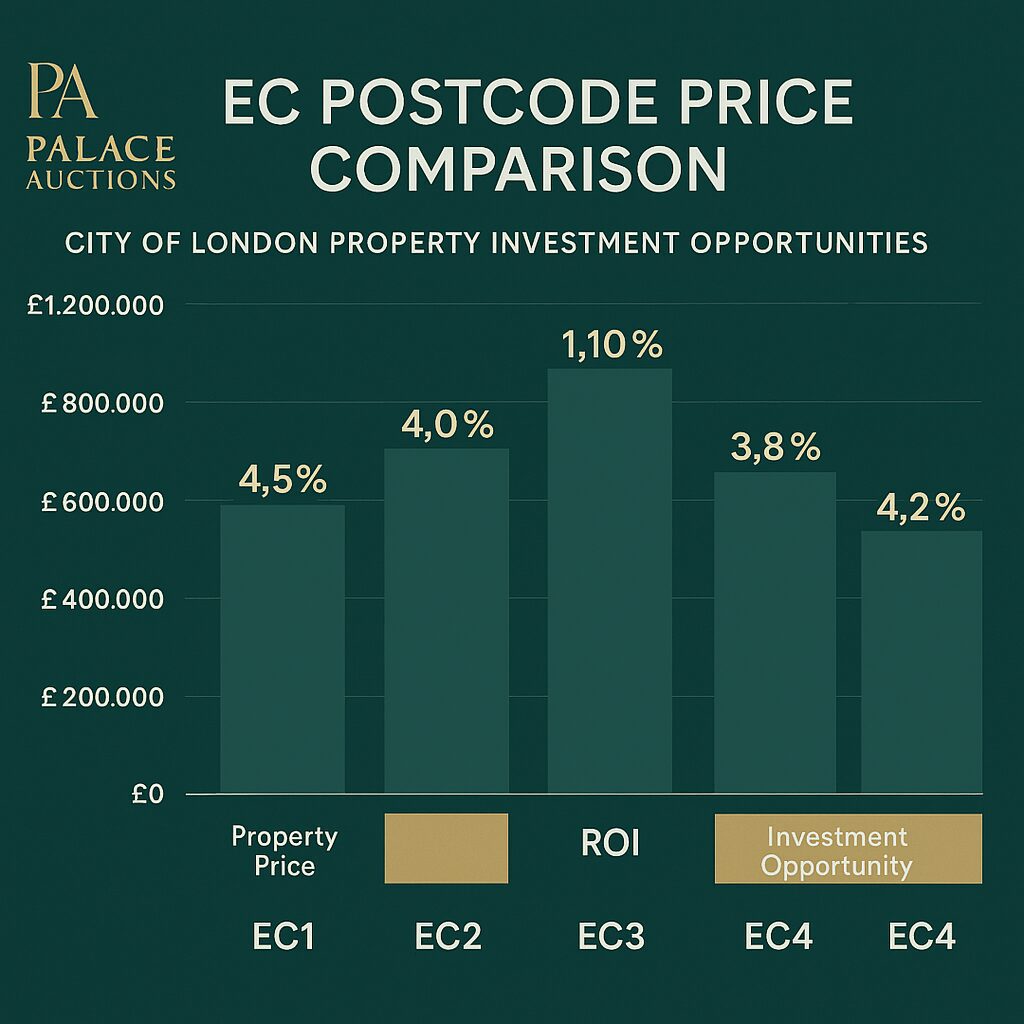

Discover the unique character of every corner of the Square Mile with our EC Postcode Comparison Tool—an interactive calculator that lets you compare all 26 City postcodes side by side. Instantly analyze property values, rental yields, and local amenities to pinpoint the best opportunities for your portfolio. Whether you’re seeking prime office space, luxury apartments, or hidden investment gems, this tool provides the clarity you need to make confident, data-driven choices.

Stay ahead of the curve with our Regeneration Timeline, a dynamic visual tracker highlighting the latest Barbican and social housing projects transforming the City’s landscape. Explore how ongoing regeneration is shaping future growth, enhancing community spaces, and unlocking new value across key districts. Plus, plan your next move with our Transport Journey Planner—quickly calculate travel times from any City postcode to major business districts, ensuring your investments are as connected as they are lucrative.

For international buyers, our International Buyer Guide offers essential resources including a currency converter and up-to-date tax information, simplifying your entry into London’s prestigious property market. Don’t miss a beat—sign up for our “Square Mile Property Intelligence” newsletter to receive weekly updates on market trends, new listings, and exclusive insights direct to your inbox. Join our community of informed investors and make Palace Auctions.

Area Guides – London

-

Upcoming Auctions

EC Post codes – City post code guide

Barbican Development – barbican-regeneration

Transport Guide – /city-transport-map

Lease extension guide

Market Reports – /square-mile-data

Hackney: A Vibrant East London Borough with Rich Investment Potential

Camden

Islington

Lambeth

Southwark

Tower Hamlets

Westminster