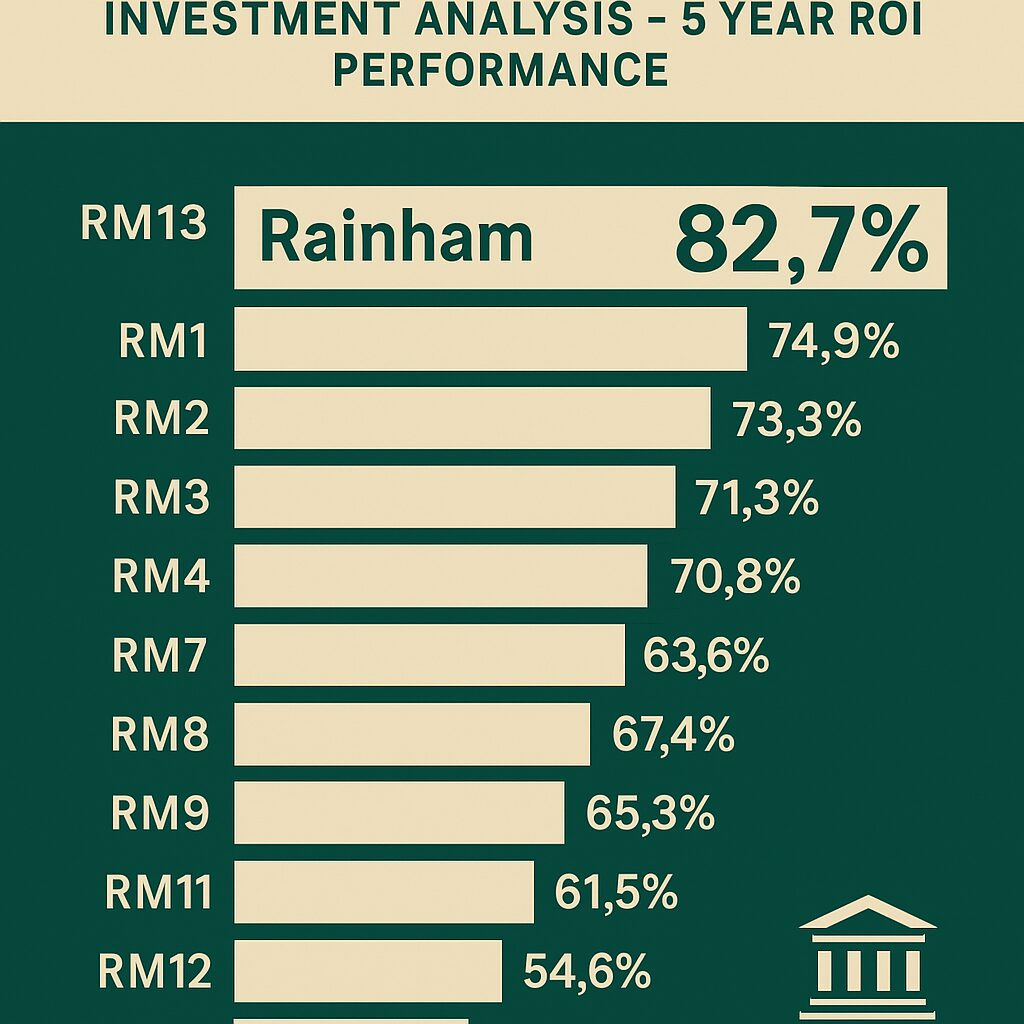

🏡 Top Real Estate Investment Area Performers in Havering (Based on 5-Year ROI Projections)

Romford leads Havering’s property investment landscape with the highest projected 5-year ROI, closely followed by Rainham and Gidea Park. Areas with Elizabeth Line connectivity and major regeneration projects offer the strongest growth prospects, while family-oriented suburbs provide stable, moderate returns.

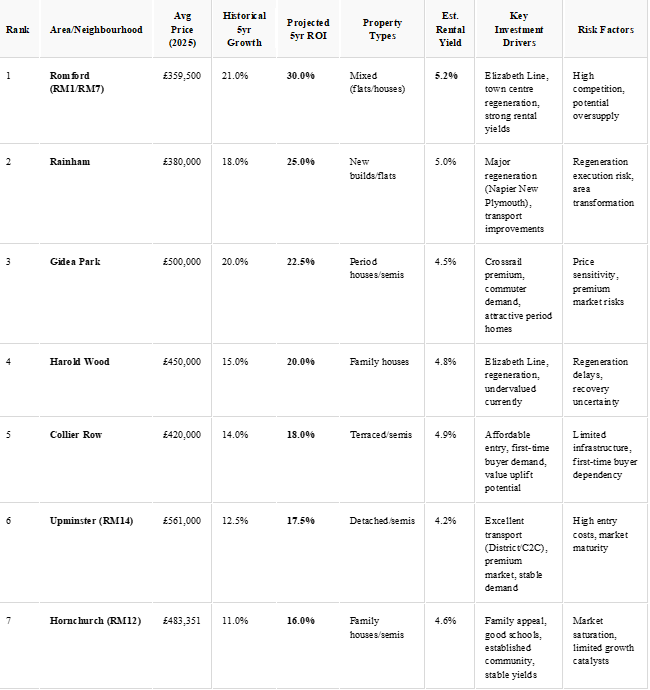

📊 Investment Performance Table

A table listing Romford and nearby London areas ranked by average 2023 house price, historical 5-year growth, RM13 property yields, projected ROI, property types, key investment drivers, and risk factors for Havering investment properties. Presented by Palace Auctions

A table listing Romford and nearby London areas ranked by average 2023 house price, historical 5-year growth, RM13 property yields, projected ROI, property types, key investment drivers, and risk factors for Havering investment properties. Presented by Palace Auctions

📈 Market Summary & Insights

| Statistic | Value/Insight |

| Total Areas Analysed | 8 |

| Average Projected 5-Year ROI | 20.1% |

| Median Projected 5-Year ROI | 19.0% |

| Average Property Price | £501,419 |

| Median Property Price | £466,676 |

| Average Rental Yield | 4.6% |

| Top ROI Performer | Romford (30%) |

| Lowest Entry Price | Romford (£359,500) |

📌 Key Investment Insights

- Elizabeth Line (Crossrail) areas—Romford, Gidea Park, Harold Wood—dominate the top ROI rankings due to superior connectivity and regeneration.

- Regeneration zones (Romford, Rainham, Harold Hill) offer the highest growth potential but carry execution and transformation risks.

- Family-oriented suburbs (Hornchurch, Upminster) provide stable, moderate returns and strong community appeal.

- Rental yields are highest in Romford (5.2%) and lowest in luxury Emerson Park (3.5%).

- Entry prices range widely, from £359k (Romford) to £857k (Emerson Park).

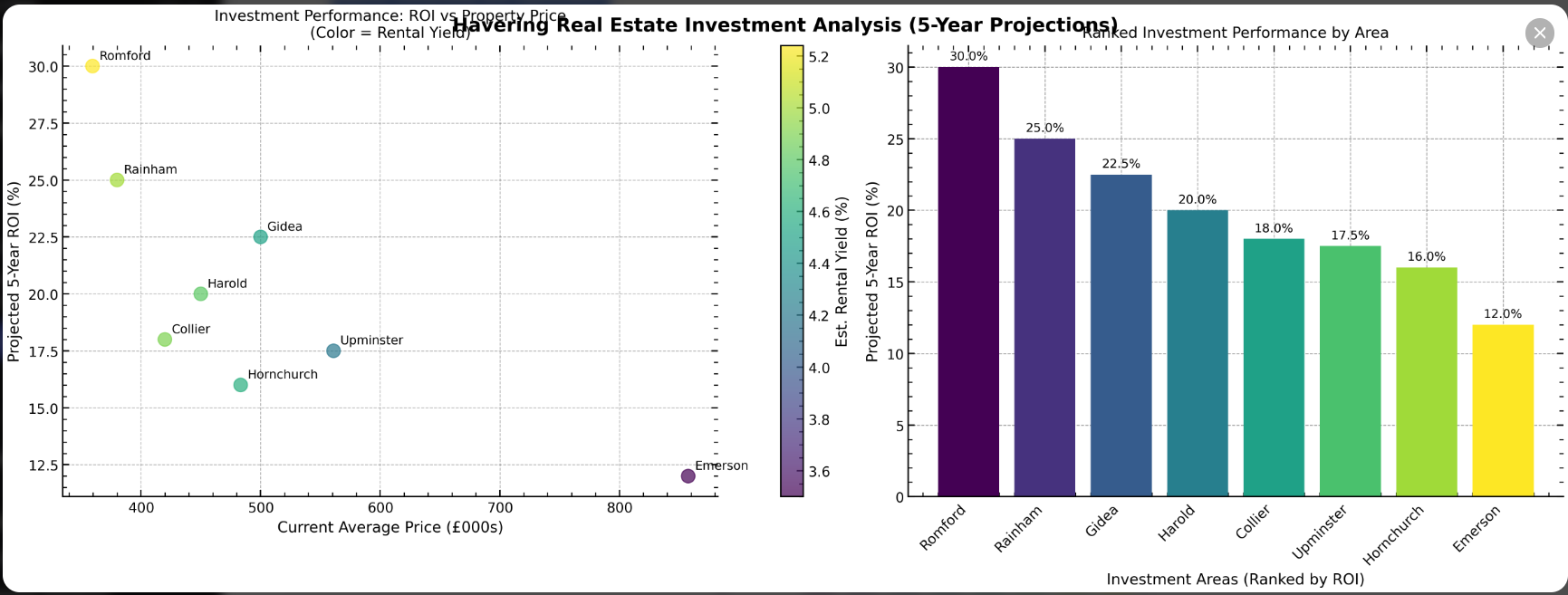

📊 Visual: Projected 5-Year ROI by Area

Property for sale Side-by-side charts: Left, scatterplot showing ROI (%) vs. average property price for seven areas; right, bar graph ranking the same areas by projected 5-year ROI—Rothfield and Rahman lead, while Emerson trails—highlighting East London property auctions. Presented by Palace Auctions

Property for sale Side-by-side charts: Left, scatterplot showing ROI (%) vs. average property price for seven areas; right, bar graph ranking the same areas by projected 5-year ROI—Rothfield and Rahman lead, while Emerson trails—highlighting East London property auctions. Presented by Palace Auctions

Projected 5-Year ROI (%) for Top Havering Investment Areas

📝 Conclusion

Romford is Havering’s top investment hotspot for the next five years, thanks to Crossrail, regeneration, and strong rental demand. Rainham and Gidea Park also offer compelling growth, while established suburbs like Hornchurch and Upminster provide stability. Investors should weigh future returns.

London Area Investment Guides

-

City of London

Barking and Dagenham

Barnet: A Prime Investment Destination in North London

Bexley

Brent

Bromley

Camden

Croydon

Ealing

Enfield

Greenwich

Hackney: A Vibrant East London Borough with Rich Investment Potential

Hammersmith and Fulham

Haringey

Harrow

Hillingdon

Hounslow

Islington

Kensington and Chelsea

Kingston upon Thames

Lambeth

Lewisham

Merton

Newham

Redbridge

Richmond upon Thames

Southwark

Sutton

Tower Hamlets

Waltham Forest

Wandsworth

Westminster