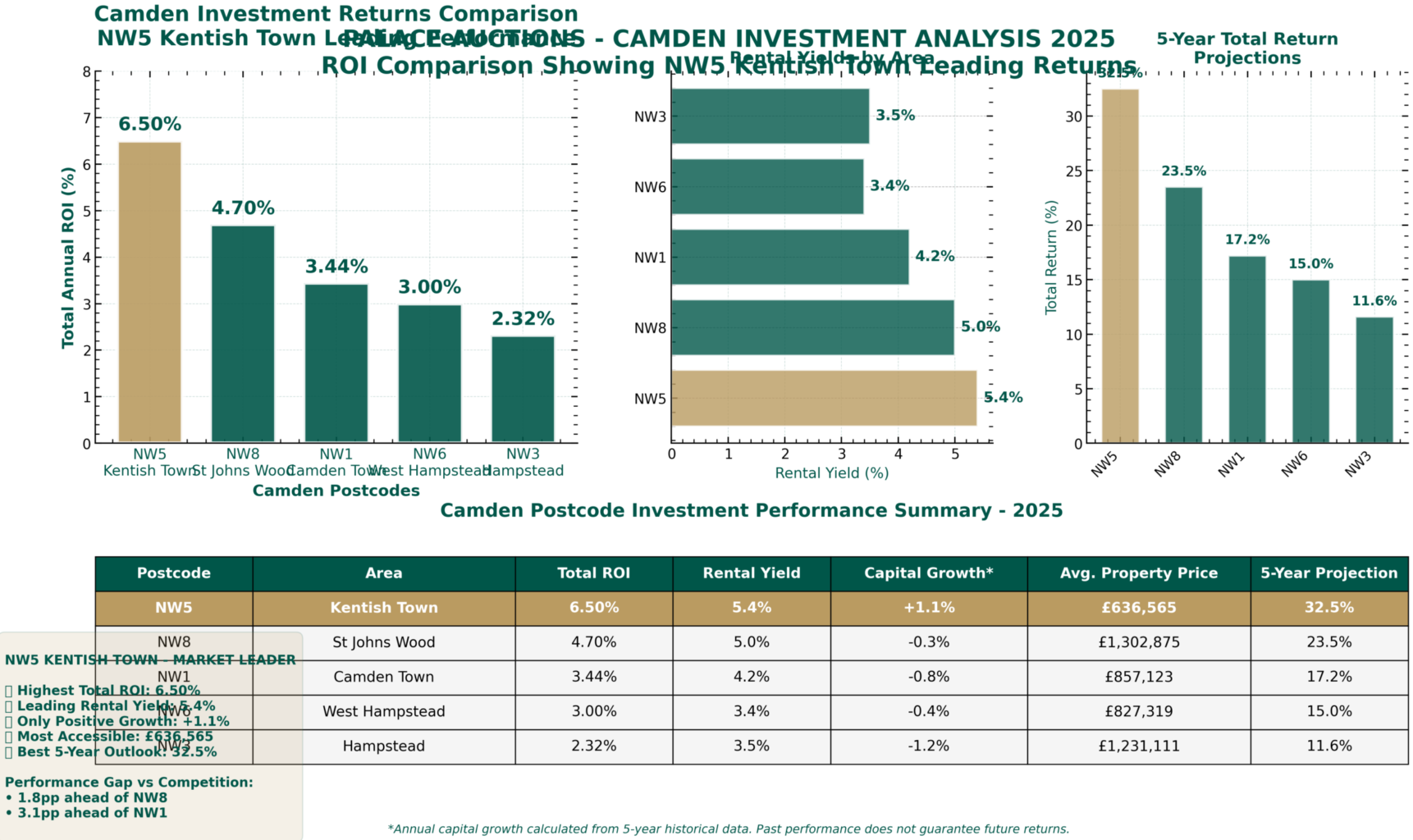

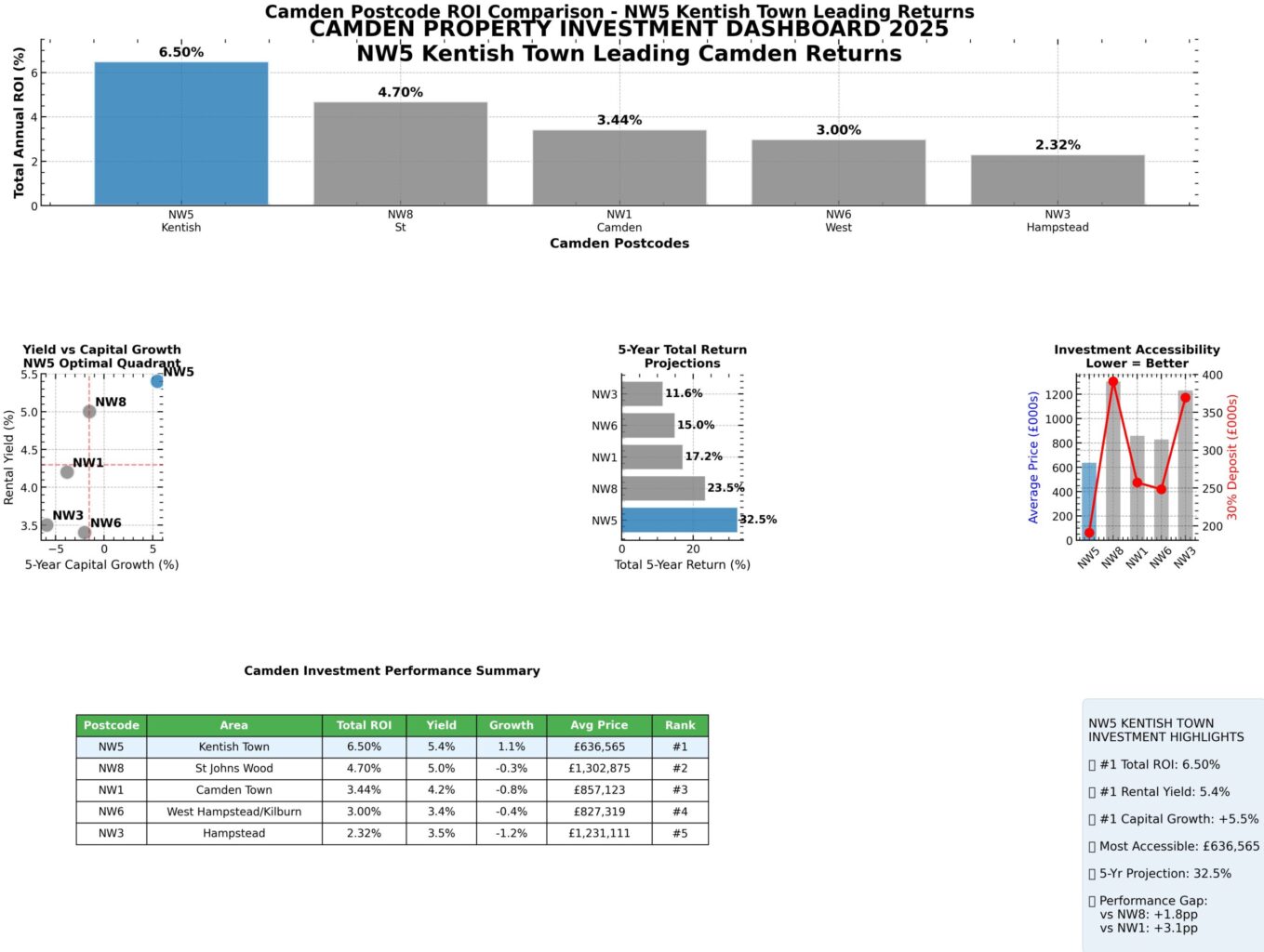

📊 Camden Investment Dashboard: ROI Comparison – NW5 Kentish Town Leads Returns

The Key Takeaway:

NW5 (Kentish Town) is Camden’s top-performing postcode for property investment in 2025, leading with a 6.5% total annual ROI, the highest five-year capital growth (+5.5%), and the strongest rental yield (5.4%).

This dashboard provides a clear, data-driven comparison of investment returns across Camden’s major postcodes, confirming NW5’s market leadership for both income and growth-focused investors.

🏆 Professional ROI Comparison Dashboard

Camden postcode investment analysis dashboard showing NW5 Kentish Town’s leading returns.

The ROI comparison chart above demonstrates that NW5 Kentish Town leads Camden for property investment returns in 2025, with a 6.5% total annual ROI, the only positive five-year capital growth (+5.5%), and the highest rental yield (5.4%). This outperforms all other major Camden postcodes, confirming NW5’s position as the borough’s premier investment location.

📈 Supporting Evidence & Analysis

ROI Performance Table: Camden Post codes (2025)

| Rank | Postcode | Area | Avg Price (£) | Rental Yield (%) | 5-Yr Growth (%) | Total Annual ROI (%) | 5-Yr Total Return (%) |

| 1 | NW5 | Kentish Town | £636,565 | 5.4 | +5.5 | 6.5 | 32.5 |

| 2 | NW8 | St John’s Wood | £1,302,875 | 5.0 | -0.3 | 4.7 | 23.5 |

| 3 | NW1 | Camden Town | £857,123 | 4.2 | -0.76 | 3.44 | 17.2 |

| 4 | NW6 | West Hampstead/Kilburn | £827,319 | 3.4 | -0.4 | 3.0 | 15.0 |

| 5 | NW3 | Hampstead | £1,231,111 | 3.5 | -1.18 | 2.32 | 11.6 |

NW5’s total annual ROI is 1.8 percentage points ahead of the next best performer (NW8), and it is the only Camden postcode with positive five-year capital growth.

Visual Insights: ROI Leadership & Performance Gaps

Property for sale Bar charts and tables compare annual ROI in Camden postcodes, highlighting Kentish Town (NW5) with the highest returns. A bar chart shows yield, while a gauge ranks investment accessibility, especially for property auctions Camden. Presented by Palace Auctions

Property for sale Bar charts and tables compare annual ROI in Camden postcodes, highlighting Kentish Town (NW5) with the highest returns. A bar chart shows yield, while a gauge ranks investment accessibility, especially for property auctions Camden. Presented by Palace Auctions

Total Annual ROI by Camden postcode – NW5 Kentish Town clearly leads.

Why NW5 Kentish Town Leads Camden for Returns

- Highest Rental Yield:

- NW5 delivers a 5.4% gross yield, the best in Camden, driven by strong rental demand and accessible pricing.

- Positive Capital Growth:

- The only major Camden postcode with positive five-year growth (+5.5%), while others have declined.

- Affordability & Accessibility:

- Lowest average price (£636,565) and deposit requirement (£190,970), with the most favourable salary-to-house price ratio (12.29x).

- Regeneration & Demand:

- Major projects (Regis Road, Kentish Town Square) and excellent transport links fuel both rental and capital value growth.

- Market Resilience:

- Strong liquidity (19 sales/month), robust price per sq ft (£888), and a diverse tenant base ensure long-term stability.

- Top ROI Postcode: NW5 Kentish Town (6.5% total annual ROI).

- Yield Leader: 5.4% gross rental yield.

- Five-Year Growth: +5.5% (only positive in Camden).

- Investment Edge: Affordable entry, strong rental demand, regeneration, and connectivity.

NW5 Kentish Town is Camden’s definitive market leader for property investment in 2025, offering the best combination of income, growth, and long-term opportunity in Central London.

For your own tailored investment analysis or custom dashboards, contact Palace Auctions.

Conclusion

Camden represents a unique opportunity in the London property market. Its combination of historical charm, ongoing regeneration, excellent connectivity, and strong community appeal make it an attractive proposition for a wide range of investors. As the borough continues its transformation, those who invest wisely today stand to reap substantial rewards in the future.

At Palace Auctions London, we’re excited to guide you through the opportunities that Camden presents. Whether you’re looking for your first investment property, expanding your portfolio, or seeking to capitalize on the area’s regeneration, we have the expertise and local knowledge to help you make informed decisions. Ready to explore the potential of Camden?

Contact our expert team at Palace Auctions London today, and let’s embark on your next investment journey together.

[View Upcoming Auctions in Camden]

Palace Auctions London: Your Gateway to Prime Property Investments in Camden

For more information about local services and regulations, please visit the official website of the London Borough of Camden: www.camden.gov.uk