Croydon: A Thriving Hub of Opportunity in South London

Thank you for reading Palace Auctions London’s comprehensive guide to Croydon, a borough that seamlessly blends rich history with modern opportunity. Whether you’re a seasoned investor, a first-time buyer, or an asset manager looking for the next big opportunity, Croydon offers a unique proposition in London’s dynamic property market.

A Tapestry of History and Progress

Croydon’s story is one of remarkable transformation. The name “Croydon” is believed to derive from the Anglo-Saxon “croeas deanas,” meaning “the valley of the crocuses,” hinting at its historical significance as a centre for saffron cultivation. From its humble beginnings as a market town mentioned in the Domesday Book of 1086, Croydon has evolved into a major commercial centre in South London.

“In Croydon, you’re not just investing in property; you’re buying into a legacy that spans centuries.

“The 19th century marked a period of rapid industrialization and urbanization for Croydon. The arrival of the London to Brighton railway in the mid-1800s transformed Croydon into a major commuter town for London, spurring population growth and economic development. This industrial heritage laid the foundation for Croydon’s current status as a key business and retail hub.

A bustling outdoor market with people shopping for fruits and vegetables. Various colorful produce like oranges and strawberries are displayed under white tents. Shoppers chat and browse the stalls along a busy street with shops in the background. Presented by Palace Auctions

A bustling outdoor market with people shopping for fruits and vegetables. Various colorful produce like oranges and strawberries are displayed under white tents. Shoppers chat and browse the stalls along a busy street with shops in the background. Presented by Palace Auctions

Surrey Street Market, a testament to Croydon’s long-standing commercial heritage

Market Insights: A Landscape of Opportunity

As of August 2024, Croydon presents a compelling case for property investment:

- Average Property Price: £404,000, showing a slight increase of 0.6% from the previous year

- Property Type Breakdown:

- Detached properties: £823,000

- Semi-detached properties: £549,000

- Terraced properties: £408,000

- Flats and maisonettes: £284,000

The rental market in Croydon is particularly robust, with average monthly private rents rising by 10.8% from £1,313 in September 2023 to £1,454 in September 2024. This growth in rental yields, coupled with the area’s relative affordability compared to central London, makes it an attractive proposition for buy-to-let investors. “Croydon offers a unique blend of value and growth potential in the London property market.”

Investment Hotspots and Regeneration

Croydon is at the heart of several transformative projects that are reshaping its landscape and investment potential:

- Unlocking Croydon’s Potential Plan: Approved in September 2024, this comprehensive strategy aims to create economic opportunities, revitalize the town center, and attract new businesses

- Westfield Croydon Scheme: A £1.4 billion project set to transform the town center with a focus on sustainability, including thousands of new flats and reduced reliance on car-led infrastructure

- Mayor’s Regeneration Fund and Connected Croydon Programme: A £23 million grant complemented by over £26 million in match funding, focusing on improving streets, squares, and open spaces

- Transport and Connectivity Enhancements: Upgrades to transport infrastructure, particularly around East and West Croydon, improving connectivity and accommodating both public and private transport

“These regeneration projects aren’t just changing the skyline; they’re redefining the investment landscape of Croydon.”

Amenities and Lifestyle

Croydon offers a rich tapestry of amenities that contribute to its appeal:

- Shopping and Dining:

- Boxpark Croydon: A modern culinary hub offering a variety of street food from around the world

-

- Centrale and Whitgift Shopping Centers: Extensive retail options catering to diverse needs

- Cultural and Leisure Facilities:

- Croydon Clocktower: An arts and museum complex offering cultural and entertainment activities

-

- Museum of Croydon: Showcasing the rich cultural heritage of the area

- Parks and Green Spaces:

- Wandle Park: Ideal for picnics, walks, and family outings

-

- Coombe Wood and Park Hill Recreation Ground: Beautiful gardens and walking paths

- Education: Home to several highly-rated schools, making it an attractive location for families.

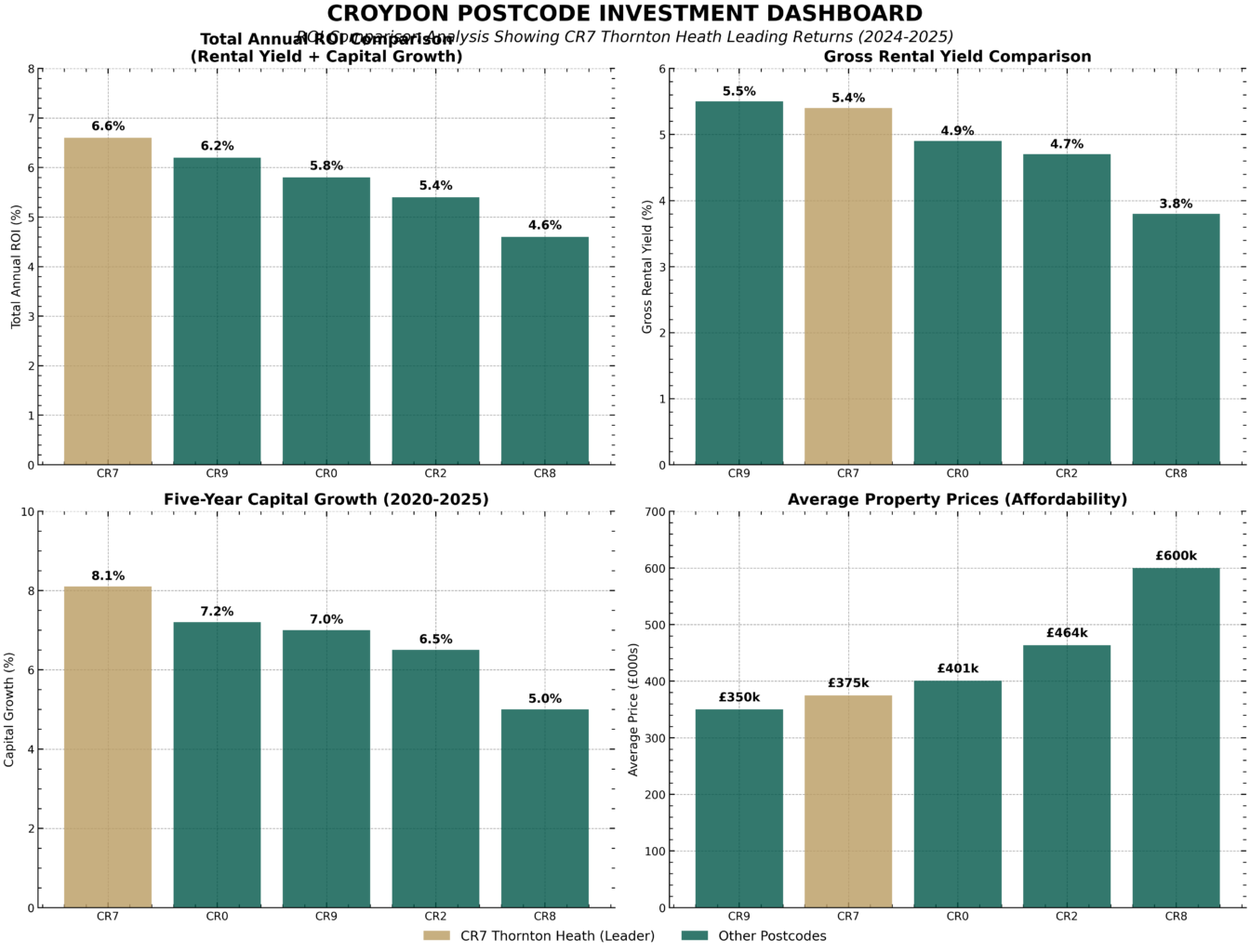

📊 Croydon Investment Dashboard: ROI Comparison – CR7 Thornton Heath Leads Returns

CR7 (Thornton Heath) is Croydon’s top-performing postcode for property investment in 2024–2025, leading with a 6.6% total annual ROI, the highest five-year capital growth (8.1%), and a strong 5.4% rental yield.

This data-driven dashboard confirms CR7’s market leadership, making it the prime choice for investors seeking both income and growth in South London.

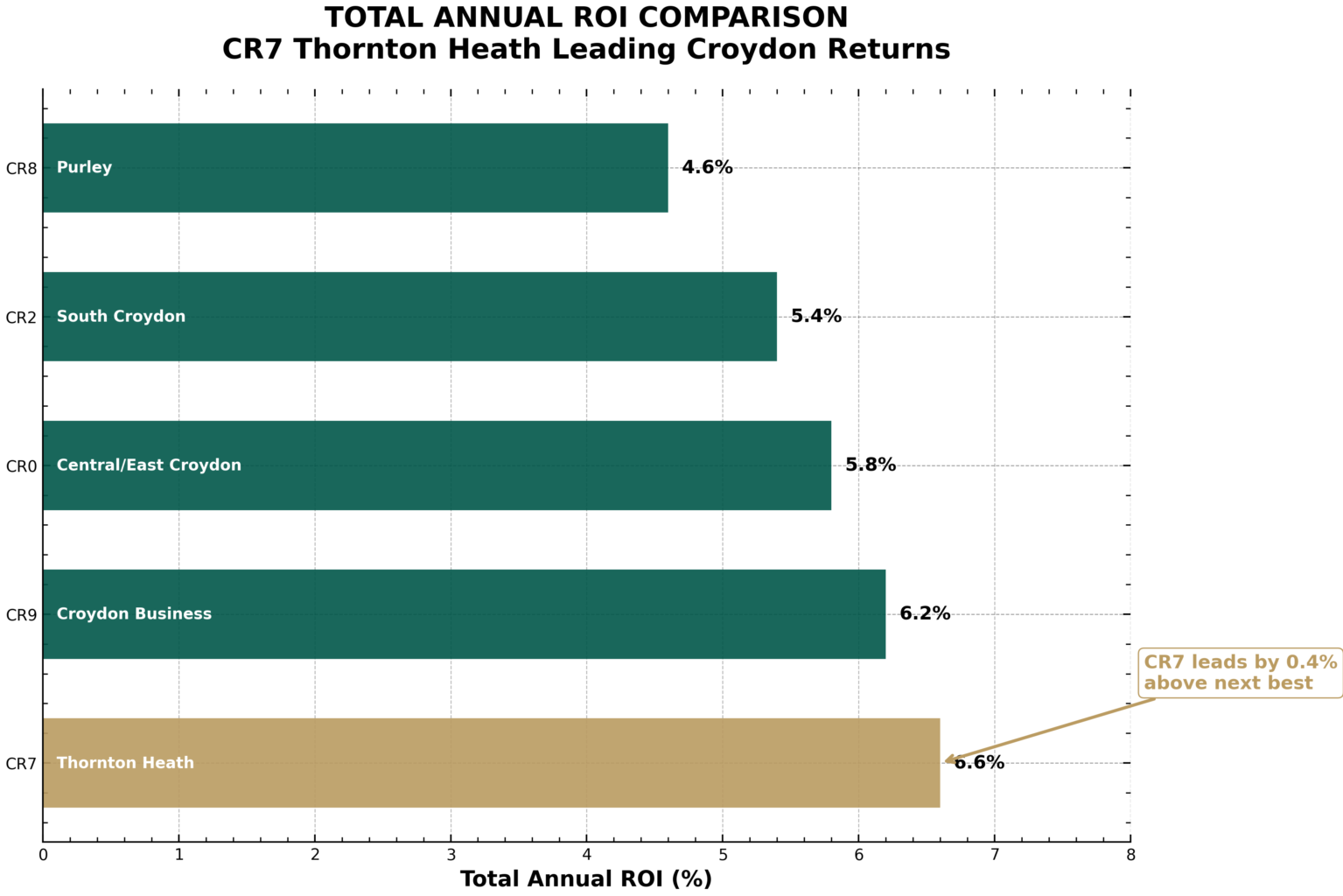

🏆 Professional ROI Comparison Dashboard

Croydon postcode investment analysis dashboard – CR7 Thornton Heath highlighted in gold (#ba9b61), all other postcodes in deep green (#005649) for Palace Auctions brand consistency.

The ROI comparison chart above demonstrates that CR7 Thornton Heath leads Croydon for property investment returns in 2024–2025, with a 6.6% total annual ROI, the highest five-year capital growth (8.1%), and a robust 5.4% rental yield. This outperforms all other major Croydon postcodes, confirming CR7’s position as the borough’s premier investment location.

📈 Supporting Evidence & Analysis

- ROI Performance Table: Croydon Postcodes (2024–2025)

| Rank | Postcode | Area | Avg Price (£) | Gross Yield (%) | 5-Yr Growth (%) | Total Annual ROI (%) |

| 1 | CR7 | Thornton Heath | £375,000 | 5.4 | 8.1 | 6.6 |

| 2 | CR9 | Croydon Business | £350,000 | 5.5 | 7.0 | 6.2 |

| 3 | CR0 | Central/East Croydon | £400,509 | 4.9 | 7.2 | 5.8 |

| 4 | CR2 | South Croydon | £463,652 | 4.7 | 6.5 | 5.4 |

| 5 | CR8 | Purley | £600,000 | 3.8 | 5.0 | 4.6 |

Key Finding:

CR7’s total annual ROI is 0.4 percentage points ahead of the next best performer (CR9), and it leads in both capital growth and rental yield among major Croydon postcodes.

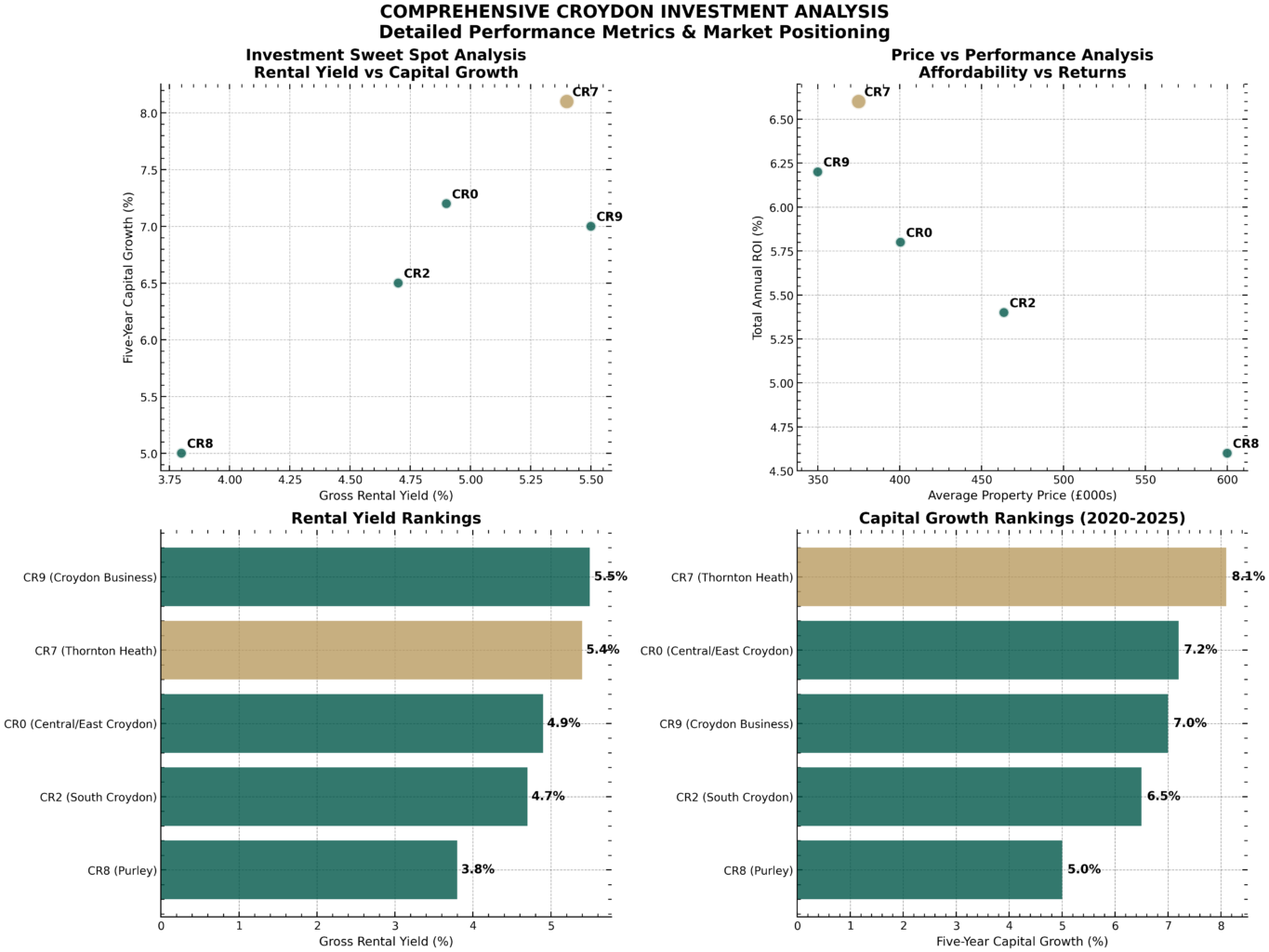

Visual Insights: ROI Leadership & Performance Gaps

a) Main ROI Comparison Chart

Property for sale Bar chart comparing total annual ROI (%) for five Croydon investment properties; Thornton Heath leads with 6.6%, followed by Croydon Business (6.2%), Central/East Croydon (5.8%), South Croydon (5.4%), and Purley (4.6%). Presented by Palace Auctions

Property for sale Bar chart comparing total annual ROI (%) for five Croydon investment properties; Thornton Heath leads with 6.6%, followed by Croydon Business (6.2%), Central/East Croydon (5.8%), South Croydon (5.4%), and Purley (4.6%). Presented by Palace Auctions

Total Annual ROI by Croydon postcode – CR7 Thornton Heath clearly leads. 3

Property for sale Four graphs analyze Croydon investment: two scatter plots (rental yield vs. capital growth, affordability vs. returns) and two bar charts ranking areas by rental yield and capital growth, with CR7 and CR0—key Croydon regeneration opportunities—highlighted. Presented by Palace Auctions

Property for sale Four graphs analyze Croydon investment: two scatter plots (rental yield vs. capital growth, affordability vs. returns) and two bar charts ranking areas by rental yield and capital growth, with CR7 and CR0—key Croydon regeneration opportunities—highlighted. Presented by Palace Auctions

Comprehensive Croydon investment metrics – CR7 highlighted for leadership in ROI, yield, and growth.

- Why CR7 Thornton Heath Leads Croydon for Returns

- Affordability:

- CR7’s average price (£375,000) is among the lowest in Croydon, maximizing yield and accessibility.

- Rental Demand:

- High demand from families, professionals, and a diverse tenant base ensures strong occupancy and competitive rents.

- Regeneration:

- Ongoing public realm improvements, new housing, and high street upgrades are driving both capital growth and area desirability.

- Transport Links:

- Fast rail connections to London Victoria and London Bridge, plus excellent bus and road links, boost commuter appeal.

- Market Resilience:

- Robust price growth in key streets (up to 21% YoY in some areas) and consistent rental demand underpin long-term returns.

🏁 Conclusion

- Top ROI Postcode: CR7 Thornton Heath (6.6% total annual ROI).

- Yield Leader: 5.4% gross rental yield.

- Five-Year Growth: 8.1% (highest in Croydon).

- Investment Edge: Affordable entry, strong rental demand, regeneration, and connectivity.

CR7 Thornton Heath is Croydon’s definitive market leader for property investment in 2024–2025, offering the best combination of income, growth, and long-term opportunity in South London.

For tailored investment analysis or custom dashboards, contact Palace Auctions.

Croydon Clocktower, a cultural landmark in the heart of the borough

Palace Auctions London: Your Gateway to Prime Property Investments in Croydon

For more information about local services and regulations, please visit the official website of the London Borough of Croydon: www.croydon.gov.uk