🌟 Discover Redbridge: Your Gateway to Smart Property Investment

Key Takeaway:

Unlock the full potential of Redbridge with exclusive resources, real-time data, and the latest regeneration news—empowering you to make informed, confident investment decisions in one of London’s most dynamic boroughs.

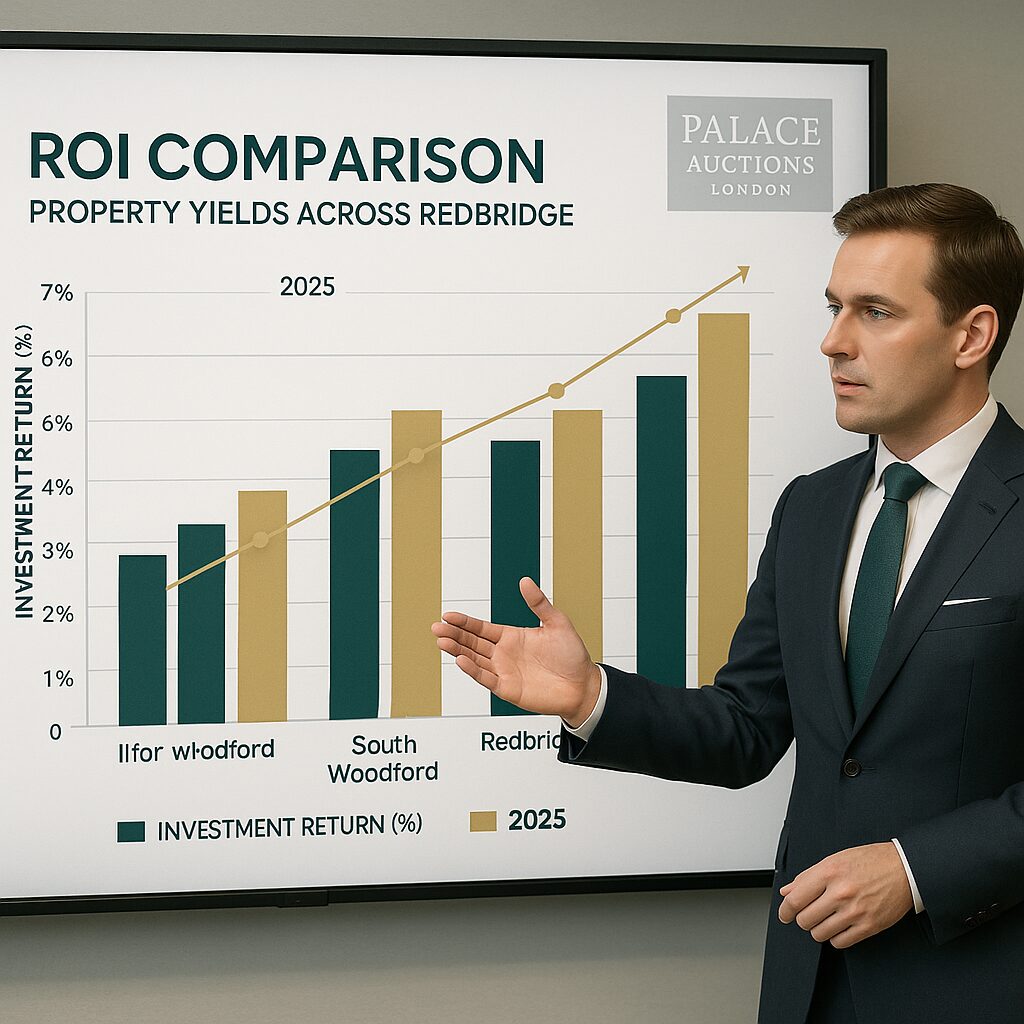

Looking to invest in one of London’s fastest-growing and best-connected boroughs? Download our comprehensive Redbridge Investment Guide 2025 PDF for in-depth analysis of local property trends, regeneration projects, and expert insights into the borough’s residential and commercial opportunities. This essential guide covers everything from average prices and rental yields to area hotspots like Ilford, Gants Hill, and Woodford—helping you identify the best strategies for capital growth and rental income.

Stay ahead of the market with our interactive Borough Statistics Dashboard, featuring up-to-date data on property prices, rental rates, transaction volumes, and demographic trends. Whether you’re a seasoned investor or a first-time buyer, our dashboard provides the clarity and context you need to compare Redbridge with other London boroughs and track the impact of major infrastructure upgrades like the Elizabeth Line and ongoing regeneration schemes.

Don’t miss out on the latest developments shaping Redbridge’s future!

Sign up for our newsletter to receive exclusive updates on regeneration projects, new investment opportunities, and borough-wide transformation initiatives. Be the first to know about upcoming auctions, planning news, and community enhancements—delivered straight to your inbox. Join our community of informed investors and make your next with confidence.

Palace Auctions London: Your Gateway to Prime Property Investments in Redbridge

For more information about local services and regulations, please visit the official website of the London Borough of Redbridge: www.redbridge.gov.uk.