Unlock Westminster’s Finest Property Investments with Palace Auctions

Key Takeaway: Experience seamless property investment in London’s most prestigious postcodes—SW1, W1, and NW8—through Palace Auctions’ expert-led platform, tailored for both local and international buyers.

Palace Auctions invites you to explore exclusive property opportunities in the heart of Westminster, covering the iconic neighborhoods of Belgravia, Mayfair, St John’s Wood, and beyond. With a proven 74% completion rate and a diverse portfolio ranging from luxury apartments to high-yield commercial assets, our Mayfair-based team delivers market-leading results for investors seeking both capital preservation and attractive rental yields. Whether you’re a seasoned investor or a first-time buyer, our transparent auction process and personalized advisory services ensure you access the best of London’s prime real estate.

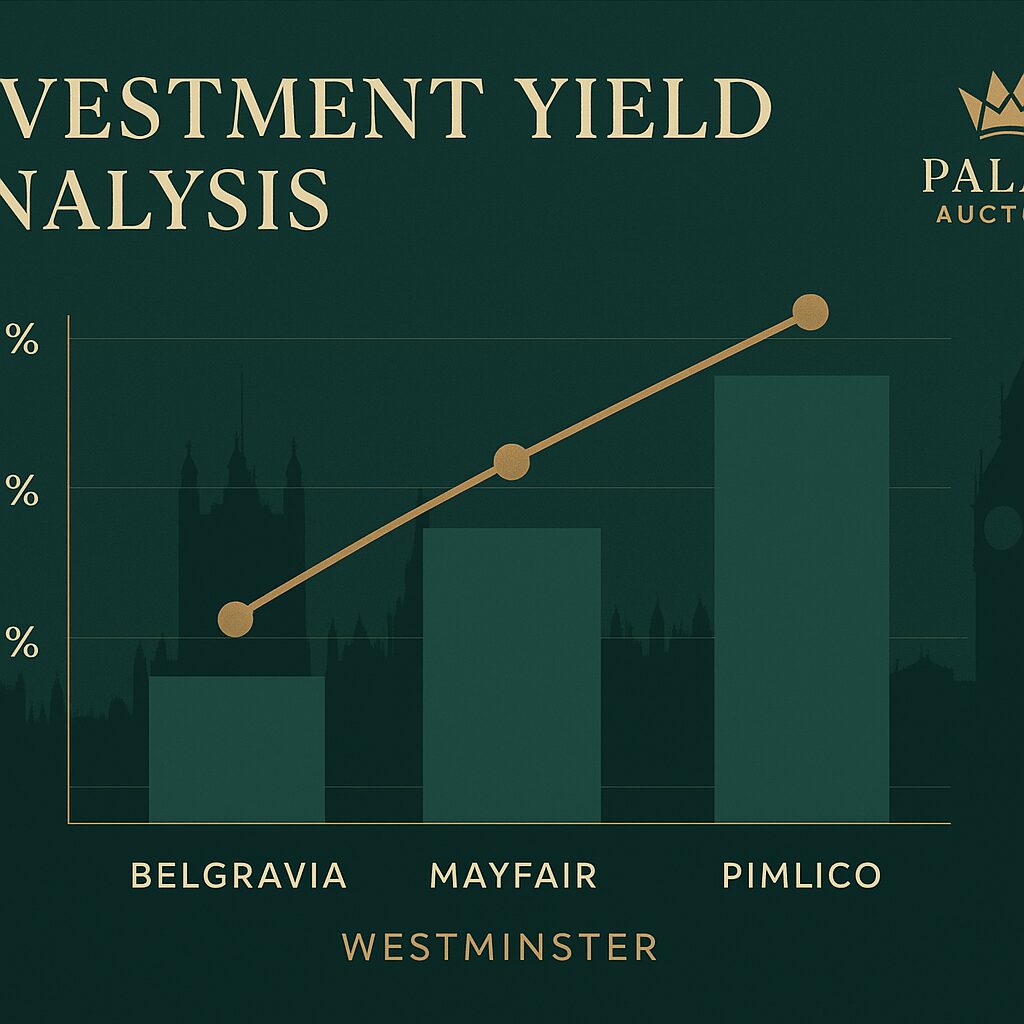

Empower your investment decisions with our suite of essential tools. The Currency Converter Widget offers real-time exchange rates, making it easy for international investors to manage GBP transactions and minimize currency risk—crucial when dealing with Westminster’s premium property prices (averaging £2.1M in W1, £1.6M in SW1, and £1.3M in NW8). Our Yield Calculator Tool lets you instantly compare residential and commercial returns based on your purchase price, reflecting Westminster’s unique market dynamics: residential yields range from 2.5% in W1 to 5.0% in NW8, while commercial properties typically deliver 3–5% returns. These tools provide clarity and confidence, helping you maximize both immediate rental income and long-term growth.

Discover the perfect location for your next investment with our Westminster Neighbourhood Selector, featuring an interactive map of SW1, W1, and NW8. Dive into detailed area profiles—compare weekly rents (£985 in SW1, £1,021 in W1, £1,256 in NW8), explore local amenities, and identify development hotspots. Our mapping technology highlights transport links, market trends, and investment opportunities, ensuring you make informed choices in London’s most sought-after districts. Combined with our live and timed auctions, bespoke private sales, and comprehensive support, Palace property market.

Palace Auctions London: Your Gateway to Prime Property Investments in Westminster

For more information about local services and regulations, please visit the official website of the City of Westminster: www.

London Locations

-

City of London

Camden

Brent

Lambeth

Wandsworth

Kensington and Chelsea

Upcoming Auctions

🏘️Property Valuations & Market Appraisals | Palace Auctions

International Property Auction Services: Cross-Border Investment Opportunities

Mayfair and Belgravia Property Guide

Commercial Property opportunities

Auction Finance Solutions