Modular & Futuristic Homes: Investment Tools, Sustainability, and FAQs

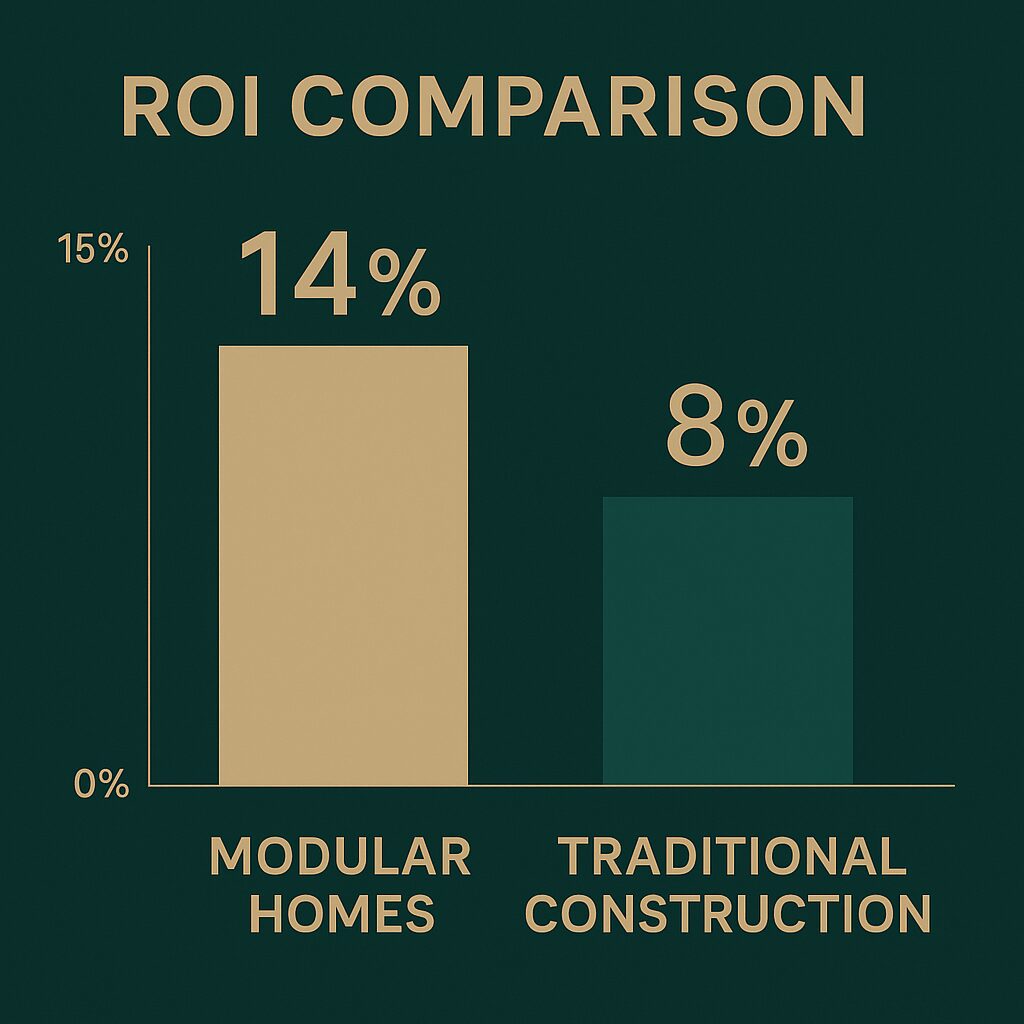

Key Takeaway: Modular homes investment delivers superior 53% average ROI compared to 47.4% for traditional properties, with construction 5.5 months faster and rental yields reaching 5.5%. The UK market’s growth from £15.73 billion to projected £25.10 billion by 2030 creates exceptional opportunities for forward-thinking investors ready to embrace the future of sustainable, technology-enhanced property development.

Unlock the full potential of your property investment strategy with our exclusive ROI Comparison Tool—designed to help you evaluate the financial performance of modular homes versus traditional builds. By entering your purchase price, build timeline, and projected rental income, you’ll see how modular homes consistently outperform, boasting a 53% average ROI and delivering robust rental yields of up to 5.5%. With construction times averaging 5.5 months faster, investors benefit from quicker returns and reduced holding costs, all while capitalizing on a market set to surge from £15.73 billion in 2025 to £25.10 billion by 2030.Sustainability is at the heart of the modular revolution.

Our Sustainability Calculator empowers you to measure the environmental impact and energy savings of your next project. Discover how modular construction can cut embodied carbon by up to 45%, reduce energy use by 30%, and slash construction waste by as much as 90% compared to conventional methods. Modern modular homes routinely achieve 20–30% lower carbon footprints and up to 40% greater energy efficiency, translating into annual utility bill savings of £800–£1,200 for a typical three-bedroom property. These advantages not only benefit the planet but also enhance long-term asset value and eligibility for green mortgage incentives.

Quick FAQ:

- Mortgage Availability: Most major UK lenders—including Halifax, NatWest, Santander, and Nationwide—now offer mortgages for modular homes, with loan-to-value ratios typically between 60–80%. Specialist lenders may go up to 85% for BOPAS-certified builds, and green mortgage products are available for energy-efficient properties.

- Planning Permission: Modular homes require full planning permission, just like traditional builds. Lenders will require evidence of planning approval and compliance with UK Building Regulations before releasing funds.

- Warranty Terms: To secure a mortgage, your modular home must carry a recognized 10- or 12-year structural warranty from providers such as NHBC, BLP, or BOPAS, ensuring durability and lender confidence. For self-build projects, staged payment mortgages are available.