Palace Auctions London Market Update: Interest Rate Shifts Signal New Opportunities in Property Auctions

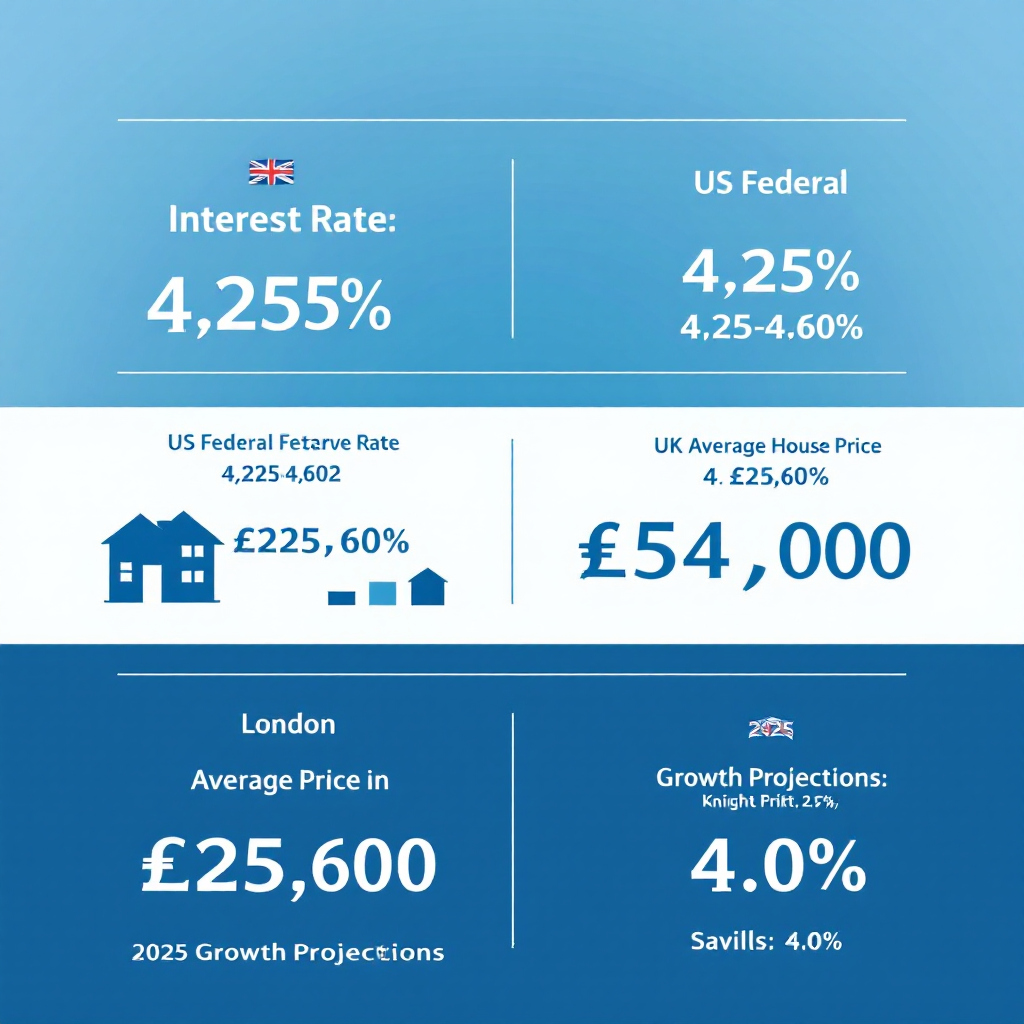

May 9, 2025 – London, UK In a significant development for property investors and market watchers, the Bank of England has recently cut its main interest rate to 4.25%, marking its fourth reduction in seven meetings. This move, coupled with the Federal Reserve’s steady stance at 4.25%-4.50%, is reshaping the landscape for property auctions and sales as we approach the summer months of 2025.

Current Interest Rate Environment

The Bank of England’s latest decision reflects a careful response to global economic pressures, particularly concerning potential disinflationary effects from U.S.-China trade tensions. This “careful and gradual” approach to monetary policy, while conservative, signals a positive shift for property investors. Meanwhile, across the Atlantic, the Federal Reserve’s holding pattern has not dampened expectations of future cuts, with markets anticipating three to four rate reductions throughout 2025.

Impact on UK Property Market

The UK housing market has demonstrated remarkable resilience in the face of changing economic conditions. Recent data shows the average house price holding at £298,602, following a minimal 0.1% month-on-month decrease in February 2025. The market continues to show regional variations, with London properties averaging £549,000, while the North East maintains more modest prices at £161,000.

Auction Market Dynamics

Our analysis at Palace Auctions London indicates that the auction market is uniquely positioned to capitalize on these changing conditions. As a real-time indicator of market conditions, auctions continue to move even when traditional markets may stall, creating distinctive opportunities for astute investors.

Upcoming Auction Schedule

Palace Auctions London is pleased to announce our summer auction calendar:

- May 29, 2025

- July 3, 2025

- August 13, 2025

These dates have been strategically selected to maximize opportunity windows in the evolving market conditions.

Market Outlook and Opportunities

Property Price Projections

Leading property consultancies maintain optimistic forecasts for 2025, with Knight Frank projecting a 2.5% rise and Savills anticipating a 4.0% increase in property values. These predictions are supported by strong buyer confidence and earnings growth outpacing inflation.

Investment Considerations

The auction market is presenting several key opportunities:

- Distressed Properties: In the current market, there’s an increase in stock levels due to repossessions and offloads, creating opportunities for value-driven investors. Weather it is those who wish to invest or divest certain real estate assets. There are indeed opportunities for all.

- Technology Integration: Our auction platform continues to evolve with technological advancements, offering global investors easier access to London properties.

- Sustainable Properties: Properties with strong environmental credentials are commanding premium prices, reflecting growing investor awareness of sustainability factors.

U.S. Market Influence

The U.S. housing market’s performance continues to influence global property trends. Current data shows the median resale home price at $398,400, representing a 3.8% year-over-year increase. Mortgage rates have stabilized around 6.82% for 30-year fixed mortgages, affecting market dynamics and international investor behavior.

Economic Context

The broader economic picture remains supportive of property investment. London’s economy is forecast to grow by 1.9% in 2025, with a 1.5% rise in jobs and 2.0% increase in household spending. This economic resilience, combined with the recent interest rate cut, creates a favorable environment for property auction participants.

Strategic Recommendations for Investors

- Timing Considerations: With interest rates showing a downward trend in the UK, investors should consider accelerating their acquisition plans to benefit from potentially lower financing costs.

- Market Segments: Focus on properties near transport links and those suitable for supported living schemes, which continue to show strong demand.

- Post-Auction Opportunities: Engage with auction houses post-sale to negotiate on unsold lots, particularly in cases where initial bidding may have been affected by interest rate uncertainties.

Looking Ahead

As we move toward summer 2025, the property auction market presents a complex but opportunity-rich environment. The combination of moderating interest rates, strong economic fundamentals, and evolving market dynamics suggests a positive outlook for well-informed investors. The global real estate market is experiencing a pivotal year, with supply shortages becoming more acute for in-demand assets. This trend, coupled with declining new supply due to high construction and financing costs, is likely to maintain upward pressure on prices for quality properties.

Conclusion

The recent interest rate decisions by both the Bank of England and Federal Reserve mark a significant moment for property investors. While challenges remain, particularly around affordability and market access, the auction market continues to provide efficient price discovery and opportunity identification mechanisms for investors.

Palace Auctions London remains committed to providing comprehensive market intelligence and facilitating successful transactions in this dynamic environment. We encourage investors to maintain close contact with our advisory team as we navigate these evolving market conditions together.

For more information about upcoming auctions and market opportunities, please contact Palace Auctions London’s investor relations team.