Description

Airbnb conversion properties wanted and are in high demand by our retained, well-funded clients at Palace Auctions. We have an urgent requirement for below-market-value properties suitable for renovation and conversion into high-yield short-term lets. Our investors seek to secure prime assets before auction to avoid bidding wars and ensure cost efficiency.Our potential buyers

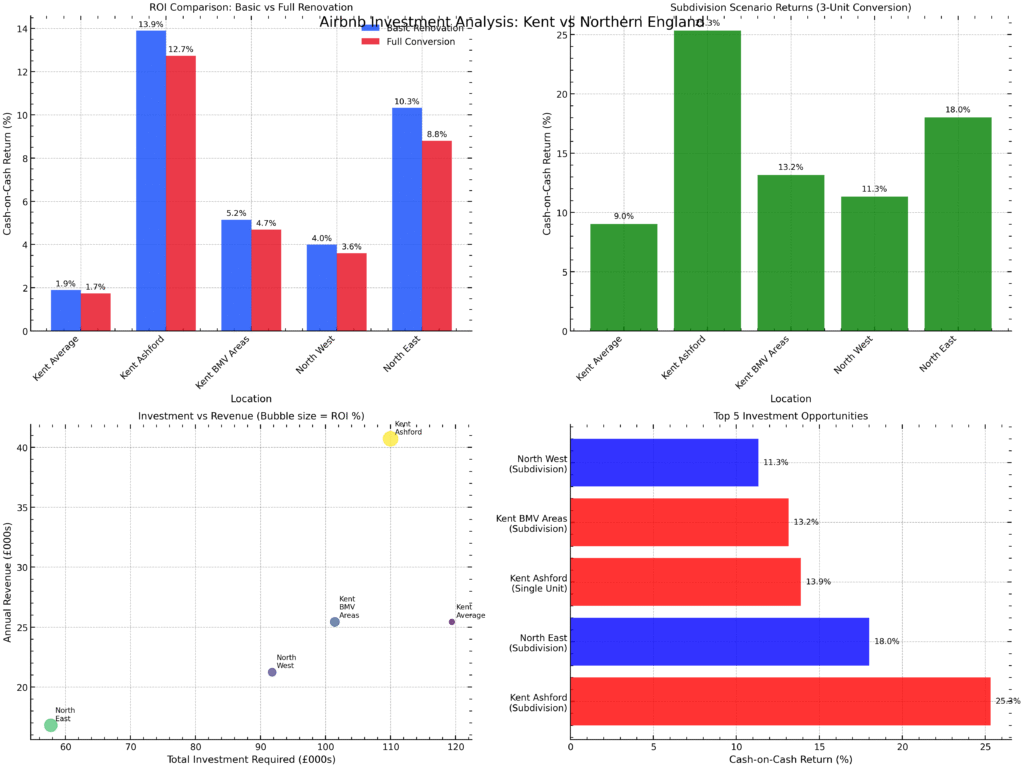

The buyers are Kent-based and prioritize opportunities within the county, though they remain keen to explore attractive deals further north. Ideal acquisitions include detached or semi-detached houses, former guesthouses, and larger period homes. Properties must be vacant or offered with vacant possession, enabling immediate project starts. We prefer off-market or pre-auction transactions, ensuring swift negotiations and certainty of sale. Larger properties that can be subdivided into two or more self-contained units are particularly appealing. Subdivision strategies can significantly enhance rental yield and overall returns. To support your decision, consider recent market performance: the average Airbnb in Kent generates approximately £2,119 per month at a 57% occupancy rate and an ADR of £123. In Manchester, properties achieve around £1,769 per month at 60% occupancy and an ADR of £95. [caption id="attachment_15360" align="alignright" width="1024"] airbnb-investments-kent-v-north-of-england-presented-by-palace-auctions-london[/caption]

airbnb-investments-kent-v-north-of-england-presented-by-palace-auctions-london[/caption]