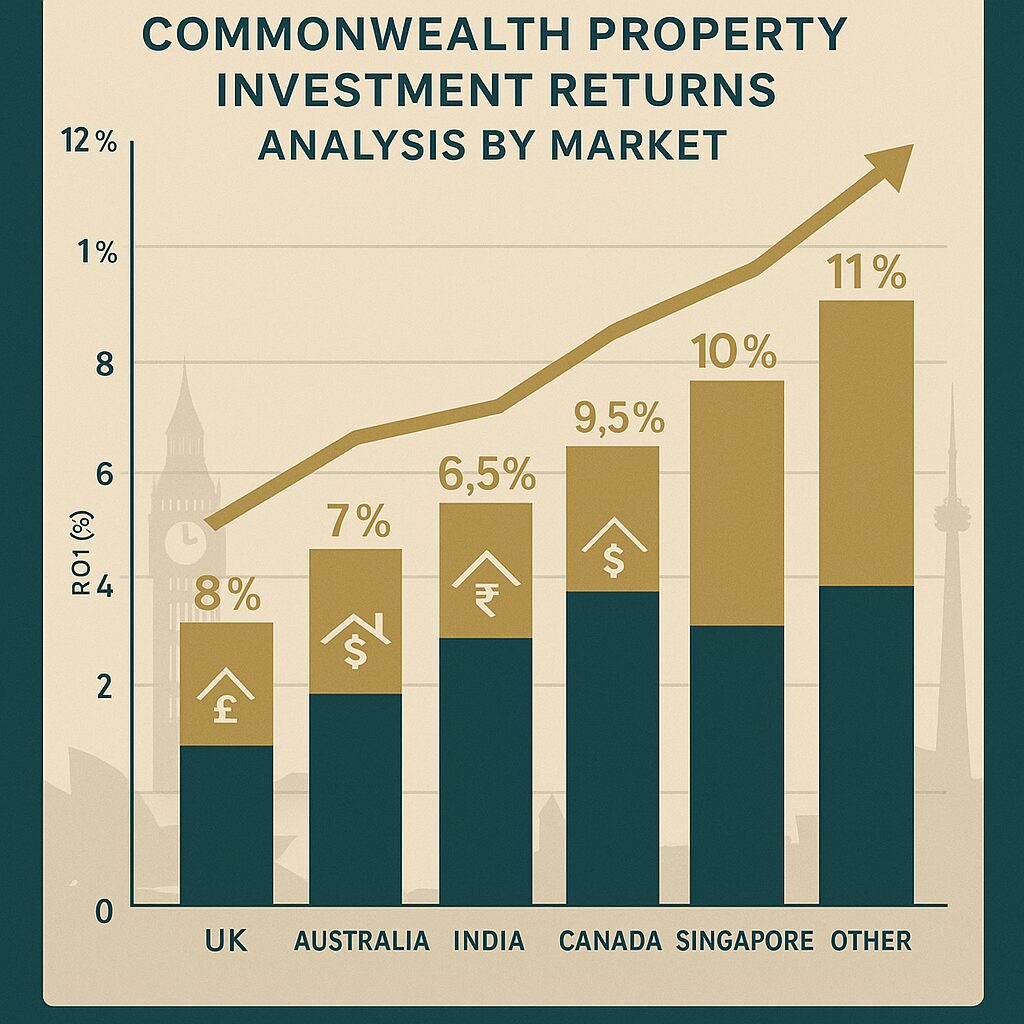

As global real estate investment is set to exceed US$1 trillion in 2026, the Commonwealth stands out as a landscape of both stability and dynamic growth for investors, buyers, and dealers. Mature markets like the UK and Australia are forecast to deliver steady returns—UK house prices are projected to rise by 2–3.5%, while Australia anticipates a 4.5% increase in residential values—supported by transparent regulations and resilient economies. Meanwhile, emerging destinations such as Kenya are capturing attention, with the nation’s real estate sector expected to reach US$7.7 billion by 2029, offering a diverse array of opportunities across more than 50 Commonwealth countries.

At the forefront of this evolution is Rendeavour’s Tatu City, East Africa’s largest private urban development and a flagship for next-generation Commonwealth investment. Just 30 minutes from Nairobi’s CBD, Tatu City spans 5,000 acres and has already attracted over US$3.5 billion in investment. Home to more than 100 companies—including global leaders like Heineken and Naivas—and serving 25,000 daily users, Tatu City’s Special Economic Zone status delivers unmatched tax incentives, such as a 10% corporate tax rate and VAT exemptions. This master-planned city exemplifies how strategic investment in Commonwealth markets can yield both immediate returns and long-term capital appreciation.

Ready to seize the next wave of real estate opportunity? Palace Auctions’ exclusive “Real Estate in The Commonwealth and Rendeavour’s Tatu City: A 2026 Outlook” delivers the expert insights and strategic guidance you need. Whether you’re seeking stable yields in established markets or high-growth prospects in emerging economies, our comprehensive analysis covers forecasts, regulatory frameworks, and tailored investment strategies. Connect with our international property specialists today to access premium listings, exclusive market intelligence, and personalized support—your gateway to success in the 2026 Commonwealth real estate landscape.