Unlocking Investment Opportunities: Your Guide to Repossessed Property Auctions

Why Smart Investors Are Turning to Property Auctions

If you’ve been looking for ways to accelerate your property investment portfolio, repossessed property auctions might be exactly what you need. These specialized markets offer something that’s become increasingly rare in today’s competitive property landscape: genuine value combined with speed and certainty. Let’s explore why savvy investors are making auctions a cornerstone of their investment strategy—and how you can join them.

The Financial Advantage: Real Numbers, Real Opportunities

Substantial Savings from Day One

The numbers speak for themselves. On average, properties at repossessed auctions sell for 18.1% below market value. But here’s where it gets interesting: premium properties can deliver discounts of 30-40%, and if you’re targeting London properties, you could save an average of £161,464 compared to traditional market purchases. These aren’t just statistics—they’re your head start toward building wealth through property.

Returns That Actually Move the Needle

When it comes to generating returns, auction properties consistently outperform:

- Fix and flip strategies achieve an average 27.5% ROI

- Buy-to-let investments deliver solid 9-12% annual returns

- Value-add strategies can reach 15-30%+ returns

But perhaps the most compelling advantage is speed. With 28-day completions, you’ll bypass the endless chains, gazumping, and last-minute collapses that plague traditional property transactions. When you win a bid, you exchange immediately—no uncertainty, no delays.

Building Your Portfolio Faster

Auctions also open doors to portfolio-building opportunities that simply aren’t available in the conventional market:

- Bulk purchases from institutional sellers

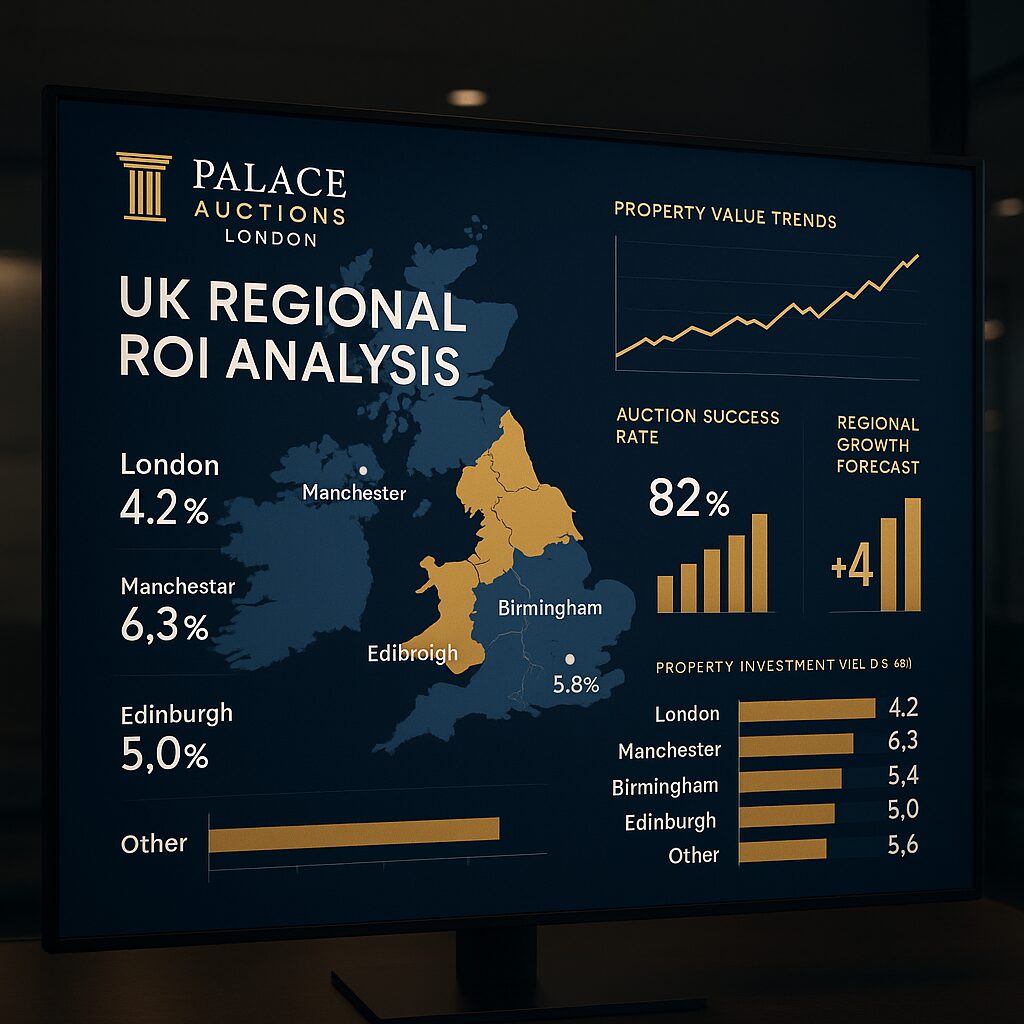

- Geographic diversification across regions

- Mixed residential and commercial acquisitions

Strategic Approaches That Work

The Fix and Flip Advantage

If you’re targeting properties for renovation and resale, focus on unmodernized properties in Scotland and Northern regions where margins are strongest. Apply the industry-standard “70% rule”: purchase at 70% of the after-repair value, minus your renovation costs. This approach gives you built-in profit protection while maximizing your upside potential.

Buy-to-Let Excellence

For rental income, Northern regions offer the sweet spot of 7-8% net yields. Yorkshire and North East markets are particularly attractive, offering optimal cash flow with moderate risk profiles—perfect for building a sustainable rental portfolio.

Commercial Conversion Opportunities

Here’s where the real innovation happens: acquiring distressed retail or office properties for residential conversion. You’re capitalizing on permitted development rights while meeting the strong demand for housing. It’s a strategy that benefits from current market trends while delivering substantial returns.

Understanding the Risks (And How to Manage Them)

Let’s be honest—every opportunity comes with risks, and auction properties are no exception. But with the right preparation, these risks become manageable challenges rather than deal-breakers.

Property Condition Challenges

The Reality: Limited inspection opportunities mean you might encounter hidden defects or damage from previous occupants.

Your Strategy: Budget 15-20% above your initial renovation estimates and prioritize external inspections wherever possible. This buffer gives you financial breathing room while protecting your profit margins.

Legal and Title Complications

The Reality: Outstanding liens, incomplete documentation, or successor liability concerns can complicate transactions.

Your Strategy: Engage specialist conveyancers who understand auction properties, purchase title insurance, and focus on bankruptcy sales that offer “free and clear” transfers. Professional guidance here isn’t optional—it’s essential.

Financing Pressures

The Reality: Immediate deposit requirements, limited mortgage availability, and 28-day completion pressure create financing challenges.

Your Strategy: Arrange pre-approved bridging finance, maintain liquid capital reserves, and develop relationships with specialist lenders before you need them. Being financially ready isn’t just about having money—it’s about having the right money at the right time.

Our Comprehensive Support System

Due Diligence That Protects Your Investment

We don’t just facilitate auctions—we help you invest wisely:

- Legal Pack Preparation: Complete documentation review that leaves no stone unturned.

- Property Reports: Structural surveys where accessible, giving you clarity before bidding.

- Market Analysis: Comparable sales and rental data to inform your decisions.

- Risk Assessment: Detailed condition and compliance evaluation.

- Financial Modelling: ROI projections and sensitivity analysis tailored to your goals.

Financing Solutions That Work

Through our preferred partnerships, we facilitate:

- Bridging Loans: Starting from 0.49% monthly—competitive rates for quick completions.

- Auction Mortgages: Specialists who understand the 28-day completion timeline.

- Portfolio Finance: Structured funding for bulk purchase opportunities.

- International Buyer Support: Currency optimization and tax efficiency guidance.

Support Beyond the Auction

Your relationship with us doesn’t end when the gavel falls:

- Completion Management: We liaise with all parties to ensure smooth transactions.

- Renovation Partnerships: Access to our vetted contractor network saves time and money.

- Property Management: From rental setup to ongoing management, we’ve got you covered.

- Exit Strategy Planning: Whether you’re selling or refinancing, we help maximize returns.

Q4 2025: Where the Smart Money Is Going

Based on our latest market analysis, here’s where you should focus your attention:

- Scottish Buy-to-Let Properties

- 14.7% average ROI

- 27.3% typical discounts

- Low risk score (5.3/100)

- Average price: £124,383

- Northern Ireland Commercial Properties

- 11.6% ROI potential

- Lowest repossession rates (0.8/1000)

- Strong rental demand

- Average price: £231,458

- Yorkshire Commercial Assets

- 16.2% highest absolute ROI

- 30.4% substantial discounts

- Industrial/logistics focus

- Average price: £275,640

Your Auction Journey: From Preparation to Completion

Before the Auction

Financial Readiness

- Secure proof of funds documentation.

- Arrange pre-approved finance.

- Ensure deposit availability (10% minimum).

- Obtain insurance quotes.

Property Analysis

- Download and review legal packs thoroughly.

- Commission desktop surveys where possible.

- Calculate your maximum bid limits realistically.

- Assess renovation requirements honestly.

Registration Process

- Complete KYC verification early.

- Provide identification documents.

- Confirm payment methods.

- Accept auction terms.

Auction Day Strategy

Success on auction day comes down to preparation and discipline:

- Set firm maximum limits (and stick to them).

- Monitor competing interest without getting caught up.

- Bid decisively when appropriate.

- Pay your deposit immediately upon success.

- Instruct solicitors the same day.

Post-Auction Execution Timeline

- Days 1-7: Legal due diligence and survey completion.

- Days 8-14: Finalize funding and insurance arrangements.

- Days 15-21: Complete searches and enquiries.

- Days 22-28: Exchange and complete.

Market Outlook: What’s Coming in 2026

Industry analysis suggests continued opportunities ahead:

- Repossession rates stabilizing at current levels.

- Interest rate reductions improving affordability.

- Insolvency levels remaining elevated but manageable.

- Increased institutional participation in distressed sales.

- Technology enhancing auction efficiency and reach.

Emerging Investment Themes

Keep an eye on these developing opportunities:

ESG Non-Compliant Properties: EPC ratings below C creating motivated sellers

Retail-to-Residential Conversions: Continued high street transformation

Portfolio Disposals: Landlords exiting due to regulatory changes

International Investment: Weak pound attracting overseas buyers

Why Palace Auctions Is Your Ideal Partner

Proven Track Record

With over £5M in distressed property sales annually and a 76% sale completion rate, we’ve built our reputation on results. Our network includes relationships with major lenders and insolvency practitioners, while our AI-powered valuations and online bidding platform represent the cutting edge of auction technology.

Your Competitive Advantages

When you work with us, you gain:

- First Access: Preview properties before public marketing.

- Expert Guidance: Risk assessment and opportunity identification tailored to your goals.

- Financing Solutions: Pre-arranged funding partnerships that work.

- Complete Service: Support from acquisition through exit.

- Transparent Pricing: No hidden fees or charges—ever.

Ready to Transform Your Investment Strategy?

Repossessed property auctions aren’t just about finding deals. They’re about finding the right deals for your investment goals.

Whether you’re looking to flip properties for quick returns, build a buy-to-let portfolio, or explore commercial conversions, we’re here to guide you every step of the way.

The opportunities are real, the numbers are compelling, and the support is comprehensive. The question isn’t whether auction properties can accelerate your investment journey—it’s whether you’re ready to take advantage of what they offer.

Let’s start the conversation about your next investment opportunity.