The West Midlands is one of the UK’s most dynamic regions for student property auctions, offering high yields, robust demand, and a transparent, fast-paced auction process. This guide covers everything you need to know—from market trends and legal essentials to area hotspots and real-world investment outcomes.

The West Midlands is a powerhouse for student property investment, anchored by major cities like Birmingham, Coventry, and Wolverhampton. With a regional population of 2.92 million and over 183,000 students, the area boasts a young, diverse demographic and a thriving higher education sector. Top universities include the University of Birmingham, Coventry University, and the University of Warwick (ranked 9th in the UK), all attracting significant international student populations

.

| City | Main Universities | Student Population | International % | Notable Rankings |

|---|---|---|---|---|

| Birmingham | University of Birmingham, Birmingham City, Aston | 183,720 | Significant | Aston: Top 25 UK |

| Coventry | Coventry University, University of Warwick | 67,000+ | 42% at Coventry | Warwick: 9th UK |

| Wolverhampton | University of Wolverhampton | N/A | Growing | Top 13% worldwide |

| Metric | PBSA (West Midlands) | HMO (West Midlands) |

|---|---|---|

| Avg. weekly rent | £110–£250 | £98–£150 |

| Occupancy rate | 97.5–99.8% | High, but more variable |

| Gross rental yield | 6–9% | 7.5–8.5% (Birmingham) |

| Rental growth (annual) | 4–6% forecast | 3–5% |

| Void periods | Minimal | 3–4 weeks typical |

| Supply-demand ratio | 2.7:1 | Tight, but less acute |

Key Finding:

Persistent undersupply, high occupancy, and strong rental growth make the West Midlands a top choice for student property investors.

High completion rates (often 90%+) are a hallmark of student property auctions in the West Midlands.

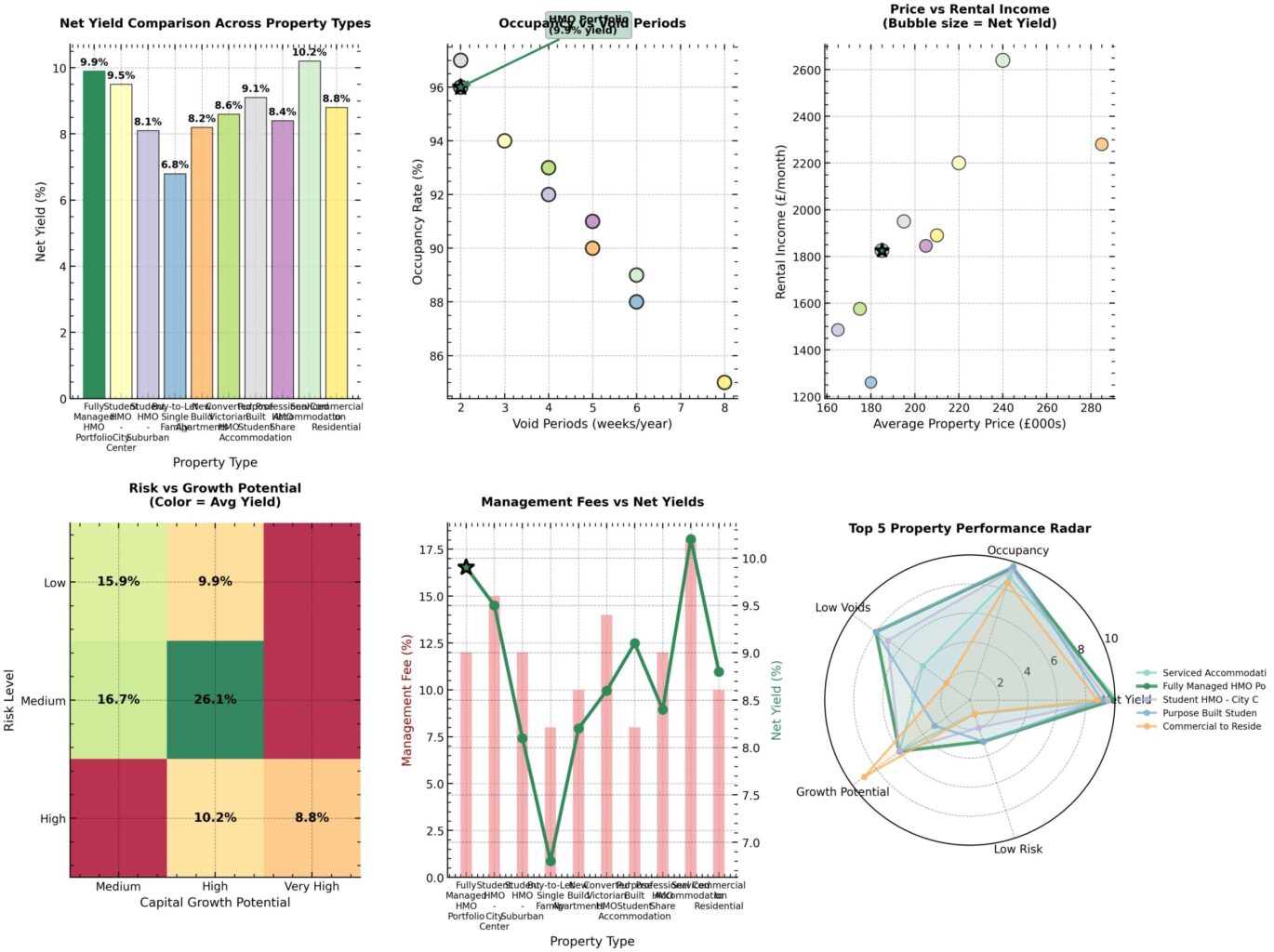

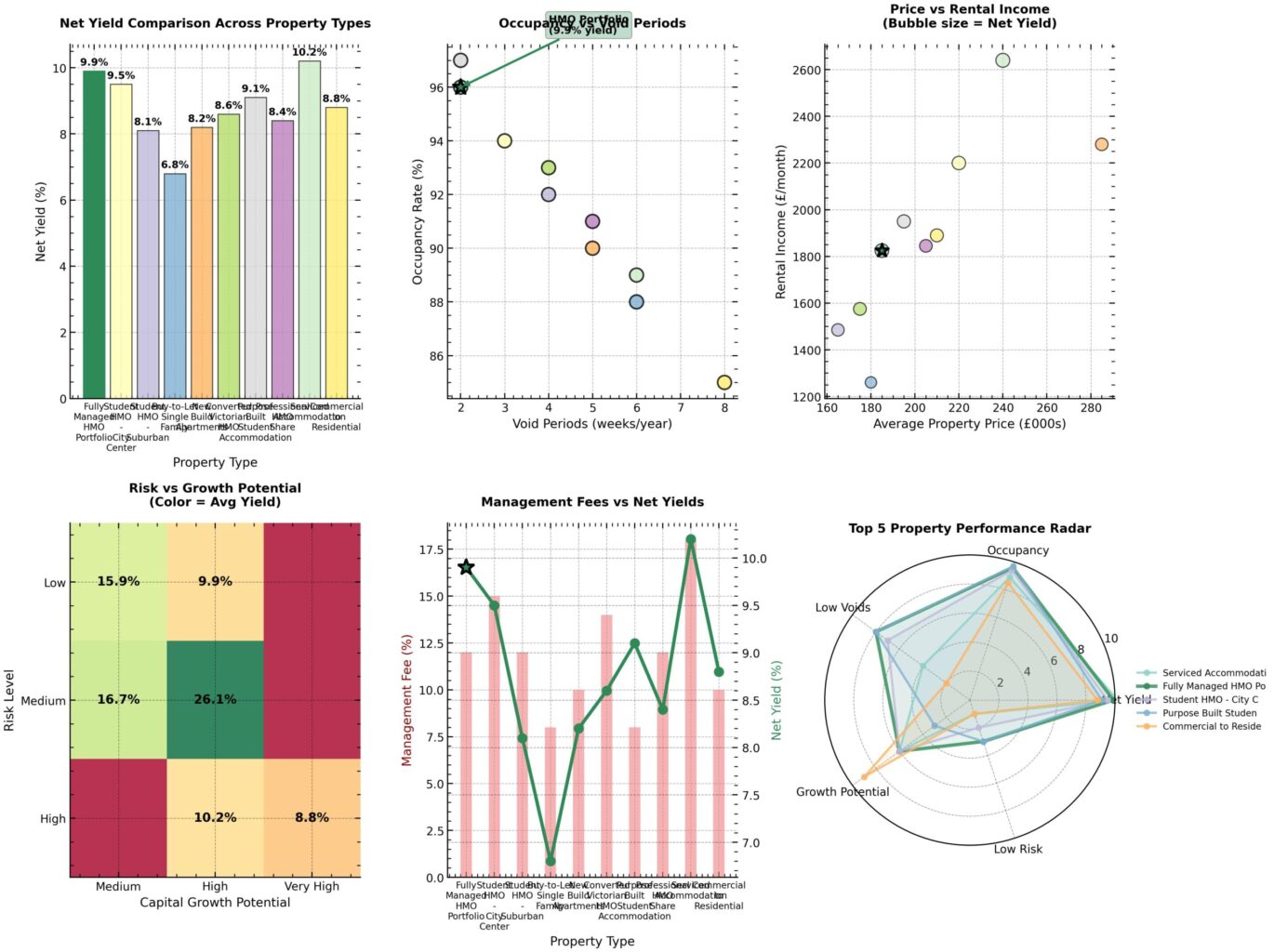

Fully managed HMO portfolios in the West Midlands achieve a market-leading 9.9% net yield with exceptionally low voids—just 2 weeks per year—offering investors high returns and stability.

| Property Strategy | Location | Investment | Monthly Income | Net Yield | Occupancy | Void Period | Performance | Risk Profile |

|---|---|---|---|---|---|---|---|---|

| 🟢 Fully Managed HMO Portfolio | West Midlands | £185,000 | £1,825 | 9.9% | 96% | 2 weeks | 🟢 EXCELLENT | Low Risk, High Growth |

| 🟢 Student HMO – City Center | Birmingham City Centre | £220,000 | £2,200 | 9.5% | 94% | 3 weeks | 🟢 EXCELLENT | Medium Risk, High Growth |

| 🟡 Student HMO – Suburban | Coventry/Warwick | £165,000 | £1,485 | 8.1% | 92% | 4 weeks | 🟡 GOOD | Medium Risk, Medium Growth |

| 🔴 Buy-to-Let Single Family | Birmingham Suburbs | £180,000 | £1,260 | 6.8% | 88% | 6 weeks | 🔴 AVERAGE | Low Risk, Medium Growth |

| 🟡 New Build Apartments | Birmingham New Quarter | £285,000 | £2,280 | 8.2% | 90% | 5 weeks | 🟡 GOOD | Medium Risk, High Growth |

| 🟡 Converted Victorian HMO | Moseley/Kings Heath | £175,000 | £1,575 | 8.6% | 93% | 4 weeks | 🟡 GOOD | Medium Risk, Medium Growth |

| 🟢 Purpose Built Student Accom. | University Campus | £195,000 | £1,950 | 9.1% | 97% | 2 weeks | 🟢 EXCELLENT | Low Risk, Medium Growth |

| 🟡 Professional HMO Share | Jewellery Quarter | £205,000 | £1,845 | 8.4% | 91% | 5 weeks | 🟡 GOOD | Medium Risk, High Growth |

| 🔴 Serviced Accommodation | City Centre | £240,000 | £2,640 | 10.2% | 89% | 6 weeks | 🔴 AVERAGE | High Risk, High Growth |

| 🔴 Commercial to Residential | Digbeth/Eastside | £210,000 | £1,890 | 8.8% | 85% | 8 weeks | 🔴 AVERAGE | High Risk, Very High Growth |

Fully managed HMO portfolios in the West Midlands achieve a market-leading 9.9% net yield with exceptionally low voids—just 2 weeks per year—offering investors high returns and stability.

Key Takeaway:

Proximity to high-frequency transport links is a major driver of rental demand and property values.

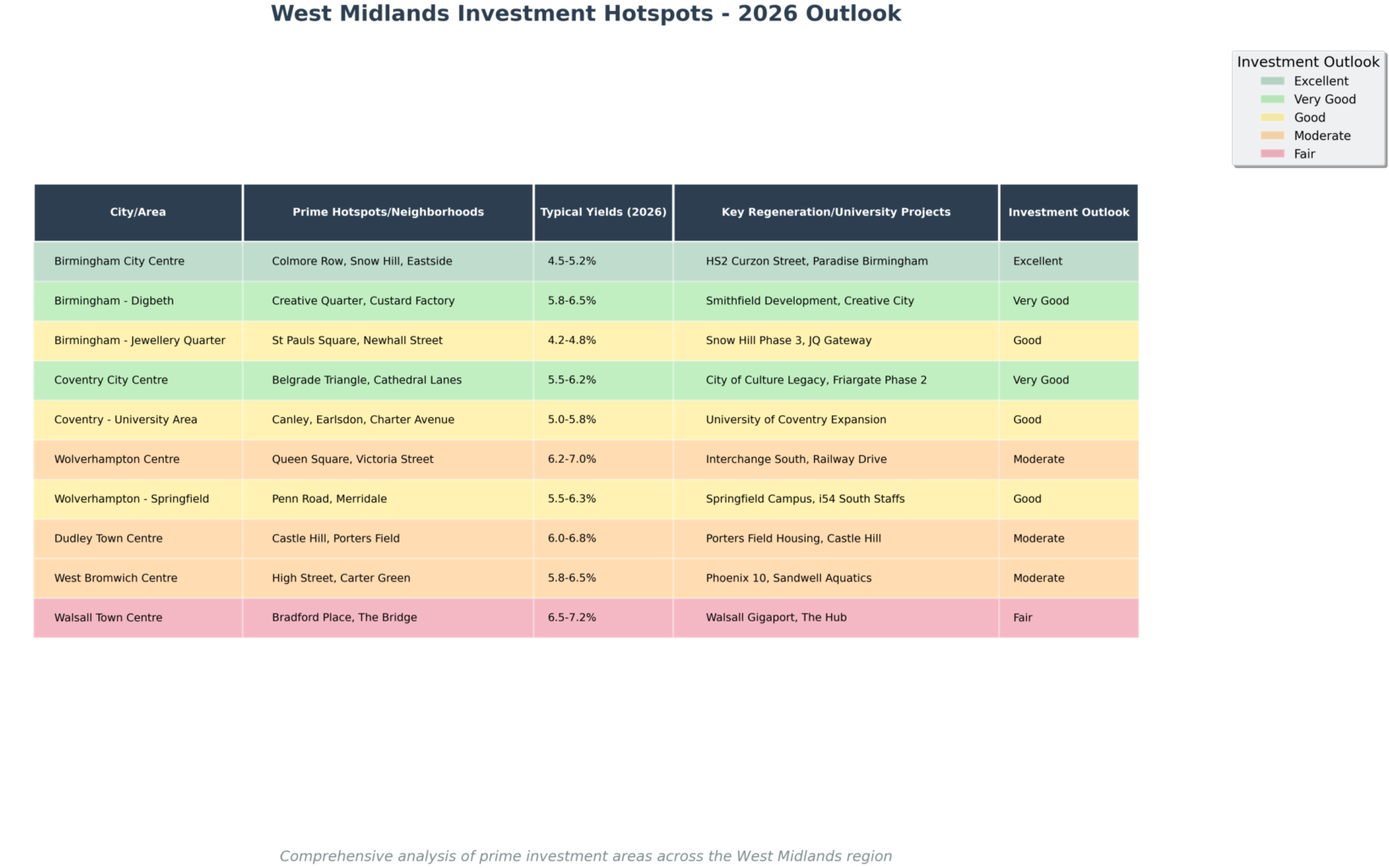

The West Midlands offers a compelling mix of high-yield student property opportunities, robust demand, and a transparent auction process. With strong transport links, ongoing regeneration, and a large student population, the region is primed for both new and experienced investors.

Ready to explore student property auctions in the West Midlands? Start your due diligence, connect with local student markets!

Enter your email address and we will send you a link to change your password.