China’s Real Estate Market: An Auctioneer’s Perspective for 2026

Key Takeaway: China’s real estate market in 2026 is defined by new opportunities in auctions and distressed assets, but foreign investors must navigate a complex landscape of ownership rules, tax obligations, and capital controls.

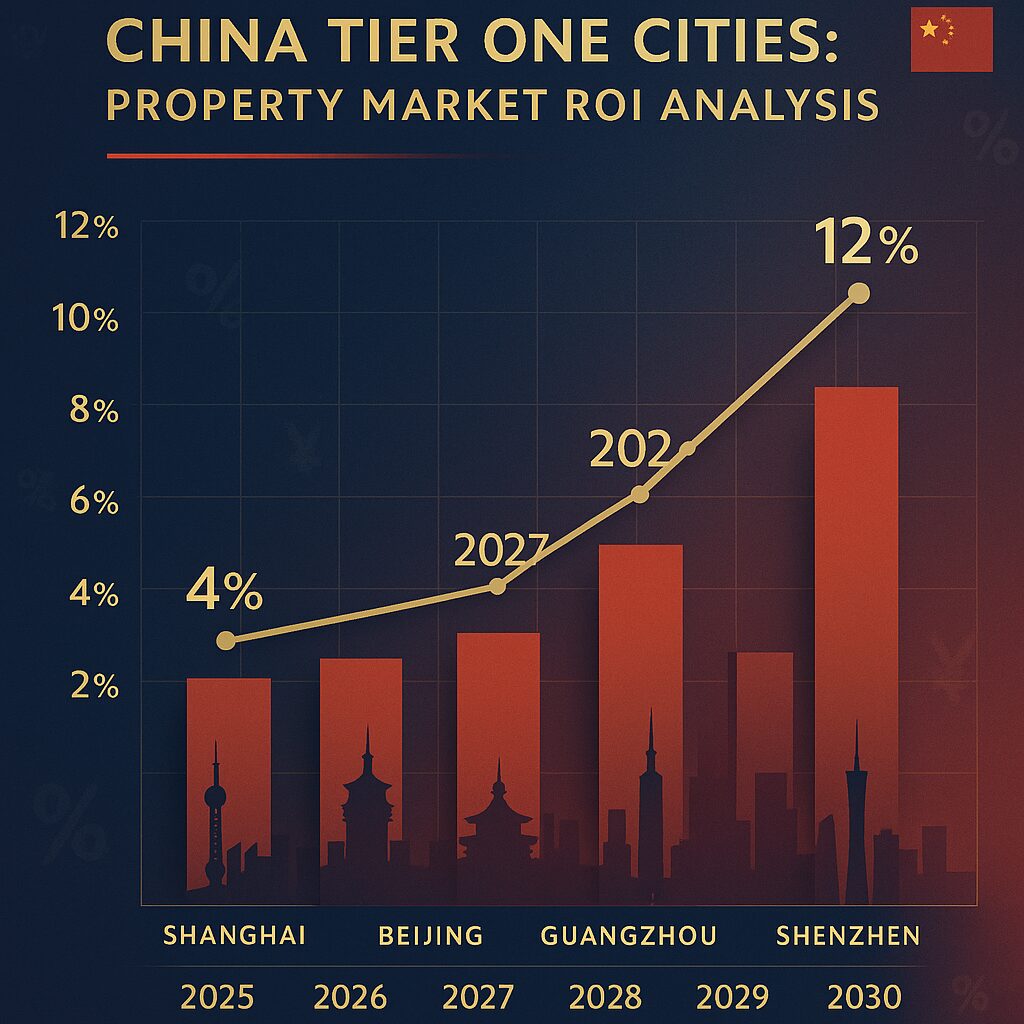

As China’s property sector stabilizes after a prolonged correction, auctioneers are seeing a surge in distressed and judicial property sales—offering unique value opportunities for both domestic and international investors. While primary market sales are projected to decline further in 2025–2026, the auction market is thriving, with record volumes of foreclosed and non-performing assets coming to market, often at significant discounts. For foreign buyers, this environment presents a rare chance to acquire high-quality assets in major cities, but success depends on understanding the regulatory framework and conducting thorough due diligence on property rights and transaction processes.

Foreign investment in Chinese real estate is possible but subject to strict eligibility criteria. Individual foreign buyers must have resided in China for at least one year on a valid work or study visa and are generally limited to purchasing a single residential property for self-use. Commercial property investment is more flexible but typically requires establishing a local entity or joint venture. All land in China is state-owned, so buyers acquire long-term land-use rights—70 years for residential and 40–50 years for commercial properties. Taxes for foreign investors include deed tax (3–5%), stamp duty (0.05%), and, upon sale, capital gains tax and VAT. Recent reforms have introduced tax incentives for reinvesting profits domestically, but rental income and capital gains remain taxable, and local variations may apply.

Repatriating funds from property sales or rental income is tightly regulated. After settling all taxes and obtaining the necessary documentation, foreign investors must secure approval from the State Administration of Foreign Exchange (SAFE) to transfer proceeds abroad. The process requires meticulous record-keeping and compliance with both tax and foreign exchange regulations, and remittances are typically allowed only once per year following annual audit and tax clearance. Double taxation agreements may reduce withholding tax rates for eligible investors, but capital controls remain robust. For tailored guidance on navigating China’s evolving real estate market, auction opportunities, and compliance requirements, contact Palace Auctions’ China desk or sign up for our China Property Insights newsletter for the latest updates.

China Property Investment FAQ

Can foreigners buy property in China?

Yes, but with restrictions. Foreign individuals must have lived in China for at least one year on a valid work or study visa and are generally limited to one residential property for self-use. Commercial property investment is possible, usually requiring a local company or joint venture. All land is state-owned; buyers acquire land-use rights for a fixed term.

What are the tax implications for foreign property owners?

Foreign buyers pay deed tax (3–5%), stamp duty (0.05%), and, upon sale, capital gains tax and VAT. Rental income and capital gains are taxable, with rates and exemptions varying by region. New incentives allow deferral or reduction of withholding tax on reinvested profits under certain conditions.

How can foreign investors repatriate funds from China?

Repatriation is subject to strict foreign exchange controls. After paying all taxes and securing documentation, investors must obtain SAFE approval to remit proceeds abroad. The process is detailed and may require additional approvals for large sums. Double taxation agreements may reduce withholding tax in 2025 / 26.

Key Real Estate Locations Across The World

-

USA The Real Estate Market 2025

Hong Kong

Japan – The Real Estate Market in 2025

Monaco Real Estate Market: A Comprehensive Overview for Investors, Buyers, and Dealers

Real Estate in the Commonwealth

Global Property Auction Network | Palace Auctions International

World of Auctions – UK Regions & Auctions Auctioneers