Key Takeaway: Japan’s real estate market in 2026 offers unmatched accessibility, robust legal protections, and new financing pathways for global investors—making it a prime destination for those seeking both stability and growth.

Japan’s property market continues to shine as one of the world’s most open and resilient, attracting a growing wave of international buyers and investors. With no restrictions on foreign ownership of land or buildings, overseas investors enjoy the same rights as Japanese nationals, fueling record transaction volumes and double-digit price growth in prime districts like Tokyo, Osaka, and Fukuoka.

The market’s transparency, strong legal framework, and government-backed infrastructure projects have created a landscape where both capital appreciation and rental yields are within reach. As auctioneers, we see firsthand the quality and diversity of assets coming to market, and the increasing sophistication of international buyers who recognize Japan’s long-term value proposition.

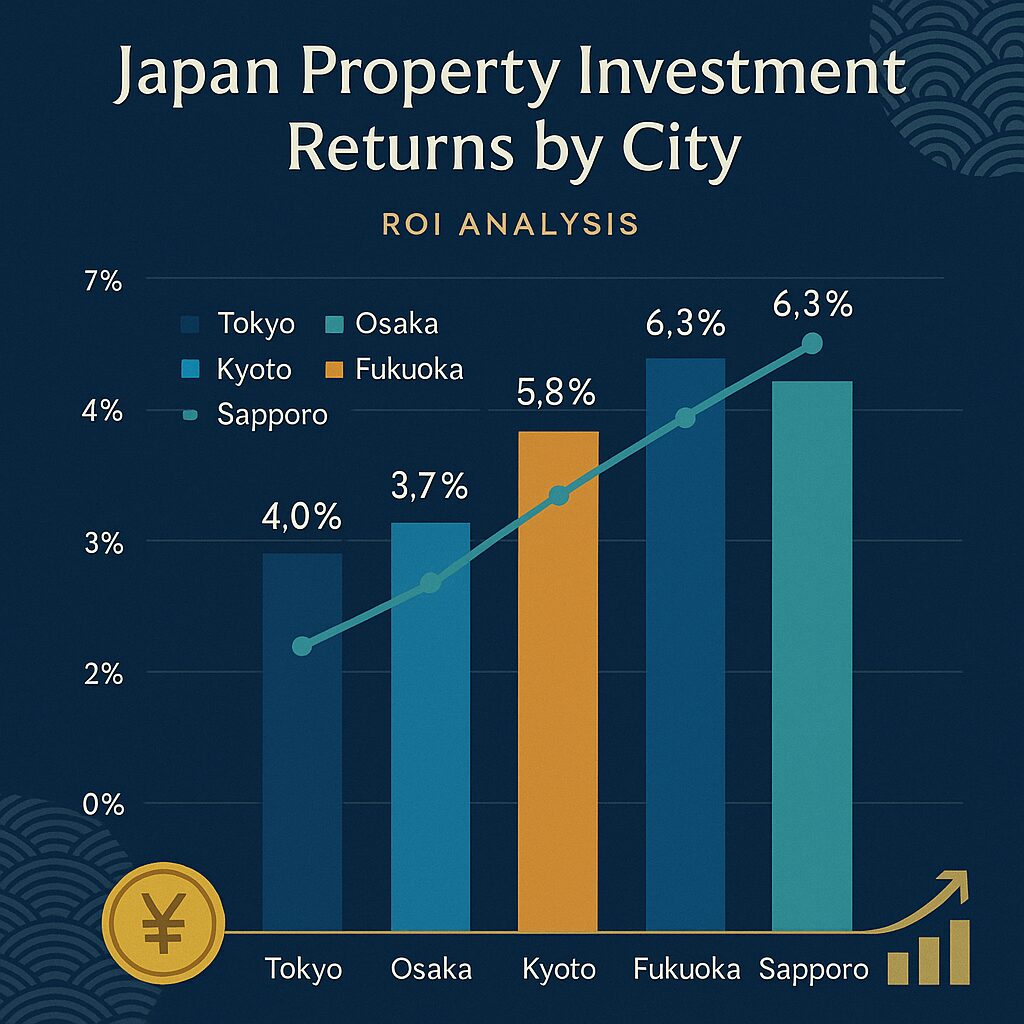

Navigating Japan’s mortgage landscape has become more accessible, with specialized lenders such as SMBC Trust Bank (Prestia), Tokyo Star Bank, Suruga Bank, and new entrants like Yen Loans K.K. now offering tailored financing solutions for non-residents and foreign nationals. Permanent residents can access the most competitive rates (0.3–0.8%) and high loan-to-value ratios (up to 90%), while non-residents should expect higher down payments (20–50%) and interest rates between 1.0–2.9%. English-language support is widely available, and engaging a bilingual legal advisor is highly recommended to ensure smooth transactions and full regulatory compliance. Regional cities beyond Tokyo are also gaining traction, offering higher yields and strong population inflows for those seeking portfolio diversification.

Japan Investment FAQ

Can foreigners buy property in Japan?

Yes—Japan imposes no legal restrictions on foreign ownership of real estate. Non-residents and overseas buyers can freely purchase, own, lease, and sell property, with full freehold rights. The only exceptions are certain agricultural lands and properties near sensitive sites, which may require special approval.

What mortgage options are available for foreign investors?

Permanent residents enjoy the best terms from major banks, with up to 90% loan-to-value and low rates. Non-permanent residents and non-residents can access mortgages from foreign-friendly lenders like SMBC Trust Bank (Prestia), Tokyo Star Bank, Suruga Bank, and SBI Shinseki Bank, typically requiring 20–50% down payments and offering English-language support. New options for non-residents include Yen Loans K.K. and select international banks.

Where can I find English-speaking Japanese law firms for real estate transactions?

Top firms include Anderson Mori & Tomotsune, Nishimura & Asahi, White & Case LLP Tokyo, Nagashima Ohno & Tsunematsu, and Greenberg Traurig Tokyo.

These firms offer comprehensive bilingual support for property transactions, due diligence, and tax compliance.

Stay Informed: Weekly Japan Market Updates

Stay ahead in Japan’s fast-evolving real estate landscape—sign up for our exclusive newsletter to receive weekly updates on market trends, auction highlights, legal developments, and expert insights tailored for international investors.

Subscribe to Japan Market Intelligence → For personalized guidance or to connect with a bilingual legal or mortgage advisor, contact our Japan specialists at japan@palaceauctions.com or call our Tokyo office at +81-3-6447-2180.