Market Opportunity & Urgency

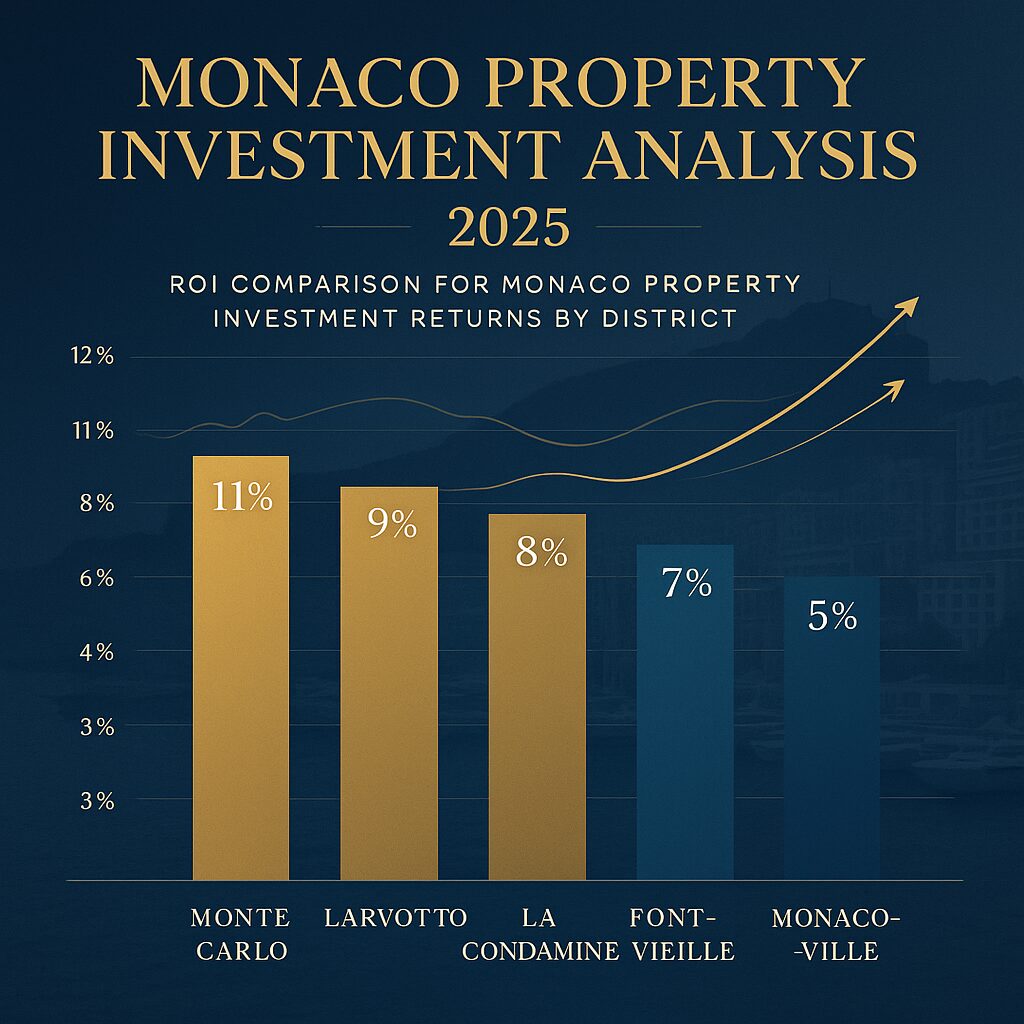

Monaco’s property market has reached unprecedented heights in 2024, with average prices hitting €51,967 per square meter and prime locations like Larvotto commanding €97,563 per m²—a staggering 48% year-on-year increase.

With transaction volumes up 21% and new-build sales reaching their highest levels since 2006, savvy investors are capitalizing on this exclusive market before supply constraints drive prices even higher. Our comprehensive Monaco Property Investment Guide reveals the insider strategies and market intelligence you need to secure your position in the world’s most prestigious real estate market.

Tax Benefits & Investment Advantages

Discover why Monaco remains the ultimate tax-efficient investment destination, offering zero personal income tax, no capital gains tax, no wealth tax, and complete exemption from rental income tax for residents. With absolutely no restrictions on foreign ownership

and inheritance tax at 0% for direct descendants, Monaco provides unparalleled wealth preservation opportunities that our expert team can help you navigate. From understanding the streamlined notary-based transaction process to maximizing your investment’s potential, our guide provides the clarity and confidence you need to make informed decisions.

Call to Action & Expert Support

Don’t let this exclusive opportunity pass you by. Our Monaco investment specialists are standing by to provide confidential consultations tailored to your specific requirements, whether you’re seeking a luxury residence, investment portfolio expansion, or tax-optimized wealth planning. Complete our secure contact form below for immediate access to off-market opportunities, personalized investment strategies, and expert guidance through every step of your Monaco property journey. Your gateway to Monaco’s elite real estate market starts here.

❓ Monaco Investment FAQ Section

Essential information for international investors considering Monaco property

Q: Can foreigners buy property in Monaco?

A: Yes, absolutely. Monaco has no restrictions on foreign ownership regardless of nationality, residency status, or investment size. No government approvals or local partners are required.

Q: What are the main tax benefits for Monaco property investors?

A: Monaco offers exceptional tax advantages:

- ✅ Zero annual property taxes

- ✅ No wealth tax

- ✅ No capital gains tax for individuals

- ✅ Tax-free rental income

- ✅ 0% inheritance tax for direct descendants and spouses.

Q: How does the Monaco property transaction process work?

A: All transactions must go through a Monégasque notary who ensures legal security. The process involves:

- Written offer submission

- 10% deposit payment

- Preliminary agreement signing

- Due diligence completion

- Final deed preparation

- Registered transfer

Most purchases are cash transactions with financing options available.

Q: What are current transaction costs?

A: Buyer costs typically range from 6-12.5% of purchase price for existing properties (covering notary and registration fees). New properties incur 20% VAT instead of transfer tax.

🔧 Interactive Elements

💱 Currency Converter

Convert your investment amounts instantly between EUR, GBP, and USD to understand your purchasing power in Monaco’s exclusive market.

📧 Confidential Inquiry Form

Submit your details for a private consultation with our Monaco specialists. All inquiries are handled with complete discretion and professionalism.

🎯 Ready to explore Monaco’s exclusive opportunities? Use our currency converter to your right (EUR/GBP/USD) to calculate investment amounts, and submit our confidential inquiry form to connect with our Monaco specialists today.

Page last updated: October 24, 2025, 06:15 GMT