Discover Smarter Real Estate Investing with Palace Auctions

Key Takeaway: Unlock the full potential of the U.S. real estate market in 2025 and into 2026 with our all-in-one resource hub—designed for both domestic and international investors seeking data-driven insights, regulatory clarity, and actionable opportunities.

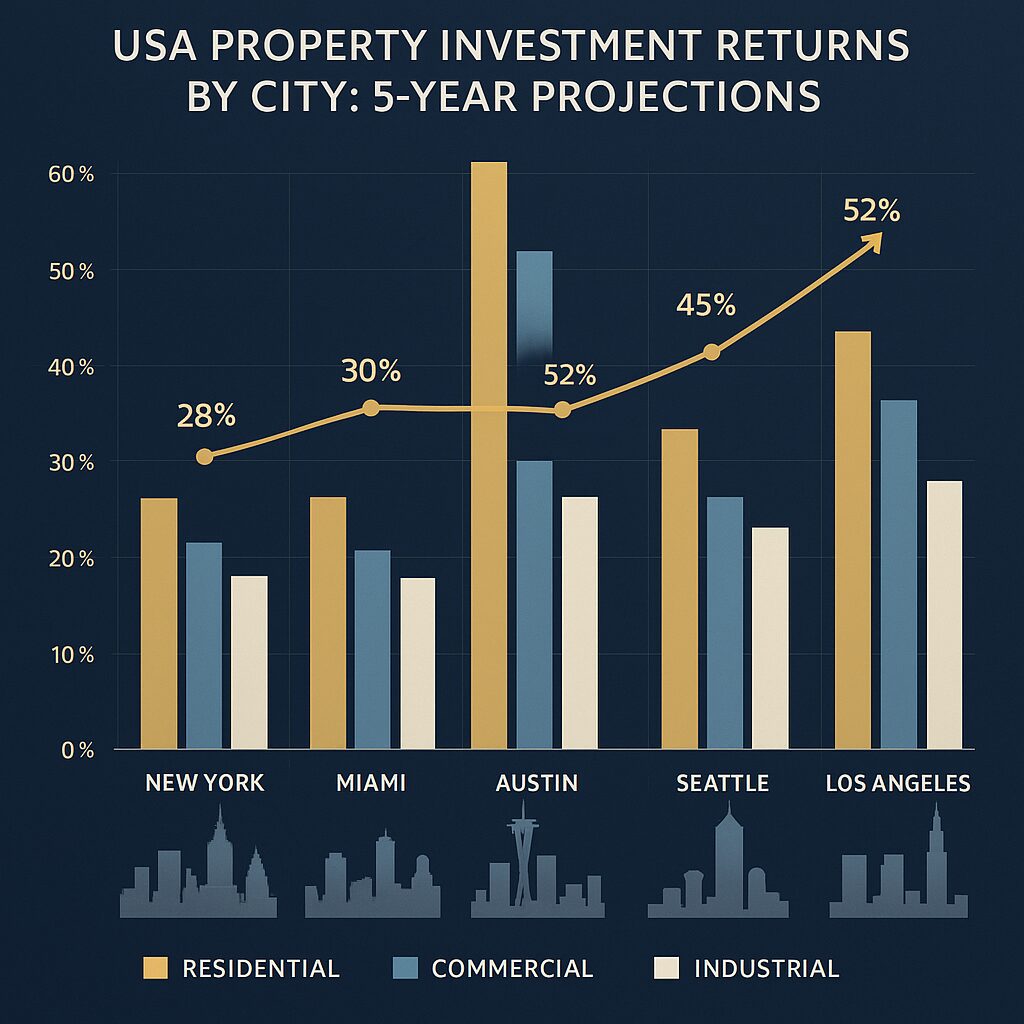

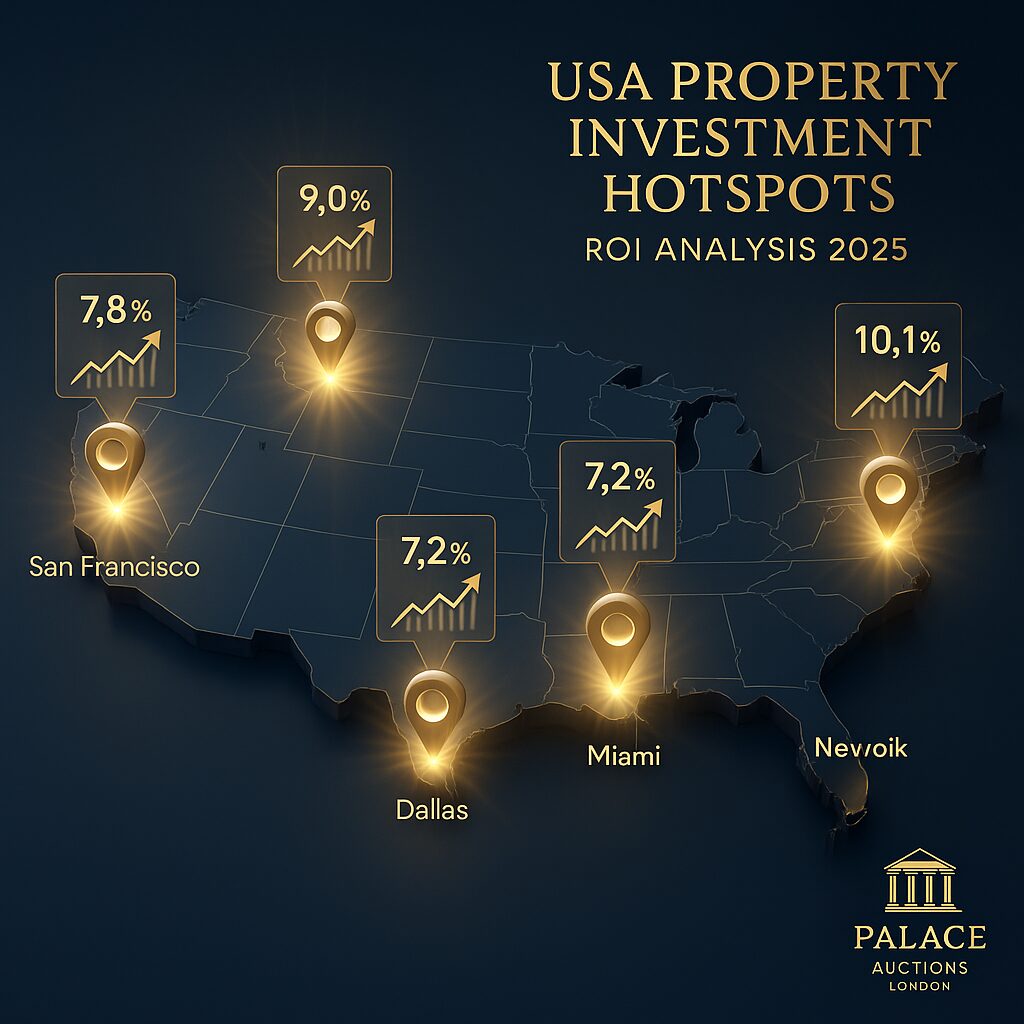

Explore the U.S. like never before with our interactive map, spotlighting the nation’s top investment markets and providing real-time ROI projections. Whether you’re eyeing high-growth cities like Dallas, Miami, or Nashville, or searching for emerging opportunities in affordable, high-yield regions, our map empowers you to compare markets, analyze trends, and make informed decisions based on the latest data and expert forecasts. Stay ahead of the curve and identify where your next investment could deliver the strongest returns.

Navigating U.S. real estate as a foreign investor? Our FIRPTA calculator takes the guesswork out of tax withholding, offering instant, accurate estimates tailored to your transaction. Plus, our comprehensive state-by-state foreign ownership regulations guide demystifies the complex and ever-changing legal landscape—helping you avoid costly compliance pitfalls and seize opportunities with confidence. With new laws and restrictions emerging across more than half the states, this guide is an essential tool for cross-border buyers and advisors.

Don’t miss a beat in the fast-moving U.S. market—sign up for our weekly newsletter and receive exclusive updates on market trends, investment hotspots, regulatory changes, and expert analysis delivered straight to your inbox. Join a community of savvy investors leveraging the latest tools and insights from Palace Auctions to maximize returns and minimize risk. Start your journey/usa-the-real-estate-market-2026/)!