🗺️ Property Investment Gateway

Discover Your Perfect Investment Location Across the UK

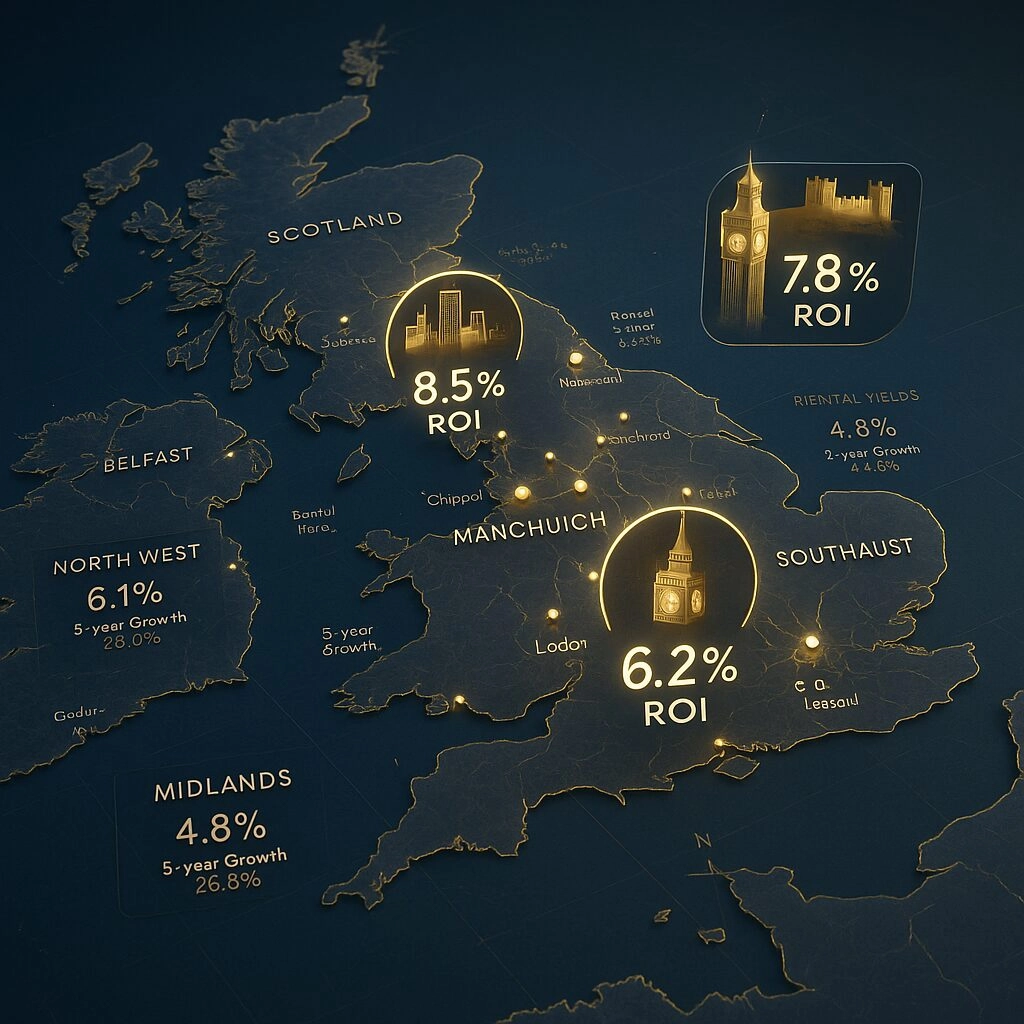

Investment Insight: With rental yields ranging from 5.0% in London to 10.2% in Sunderland, choosing the right city can triple your returns.

📍 Interactive UK Investment Map & City Comparison Tool

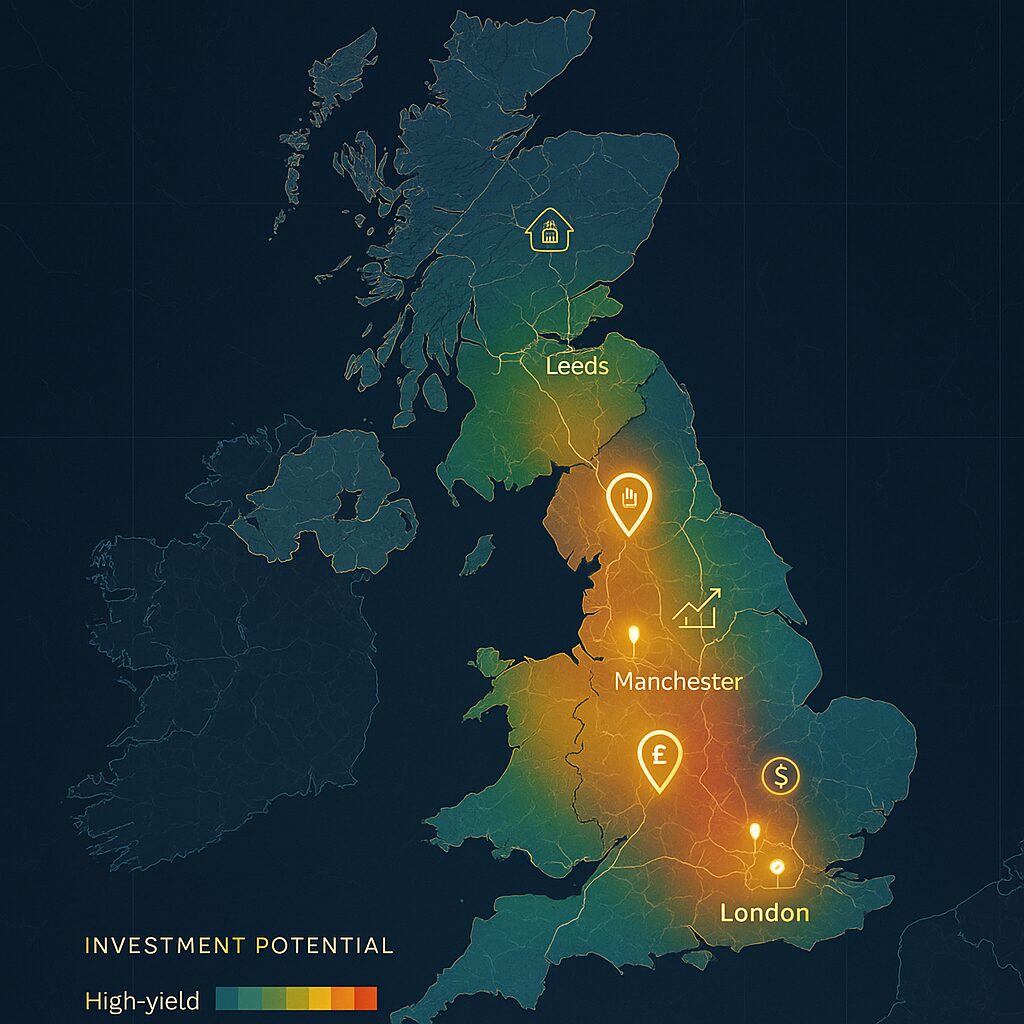

Navigate your property investment journey with our interactive UK map featuring clickable hotspots for London, Sunderland, Manchester, and Leeds – each linking to comprehensive city-specific investment guides tailored to your portfolio goals. Our dynamic map interface showcases real-time market data including average property prices ranging from £85,000 in Sunderland to £650,000 in London, gross rental yields spanning 4.95% to 10.25%, and population demographics that drive rental demand. Simply click any city marker to access detailed neighbourhood analyses, upcoming auction opportunities, local market trends, and downloadable investment reports. The integrated four-city comparison tool allows side-by-side analysis of crucial metrics including gross rental yields, net operating income, cash-on-cash returns (ranging from 3.2% in London to 25.5% in Sunderland), price-to-rent ratios, and capital growth projections – empowering you to make data-driven decisions aligned with your investment strategy.

💰 Smart ROI Calculator & Investment Analytics

Transform property possibilities into precise profit projections with our advanced ROI calculator, pre-loaded with city-specific market data to deliver instant, accurate investment analysis for your chosen location. Input your target property price or let the calculator use local averages – from Manchester’s £180,000 typical investment yielding 7.35% gross returns to Leeds’ £150,000 properties generating 8.45% yields – then watch as it calculates your expected monthly cash flow, annual returns, cap rates, and 10-year wealth accumulation scenarios. The calculator incorporates real-world variables including local council tax rates, property management fees averaging 8-10%, typical void periods, and current mortgage rates at 4.5% for buy-to-let investors. With Sunderland properties delivering exceptional 25.5% cash-on-cash returns versus London’s steady 3.2% capital appreciation play, our calculator helps you balance yield versus growth to match your investment timeline and risk tolerance.

🎯 Speak to Your Regional Expert Today

Connect instantly with your dedicated regional specialist through our “Speak to a Regional Expert” portal – matching you with city-specific property professionals who bring deep local knowledge and proven investment success to your portfolio strategy.

London investors work with Edward Swindells , our Prime Central London specialist (07971 033276), who navigates high-value markets and identifies hidden gems in zones 2-3 with appreciation potential.

Sunderland opportunities are managed by Thomas Barrett (0207 101 3647), the North East’s high-yield expert who’s helped investors secure properties with 10%+ returns in SR1 postcodes.

Manchester’s booming market is covered by our friend and joint agent Tina Barker (07858 111108), specializing in city centre regeneration zones and student HMOs yielding up to 9.7%.

Leeds investors can benefit from Remi Notman expertise (07884 559097) in Yorkshire’s student housing and commercial conversion opportunities delivering 6.3%-10.6% yields. Click the prominent

“Speak to Regional Expert” button to schedule your free 30-minute consultation, receive a personalized market report, and access exclusive off-market opportunities in your chosen city.

CITY COMPARISON DASHBOARD

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

London Sunderland Manchester Leeds

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Yield: 4.95% 10.25% 7.35% 8.45%

Price: £650k £85k £180k £150k

CoC: 3.2% 25.5% 13.2% 17.9%

P/R: 20.1 9.8 13.6 11.8

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Property for sale A dashboard with four bar charts comparing UK cities on key metrics, ideal for UK property investment city guides. Sunderland and Leeds consistently show higher returns, while London has the lowest. Presented by Palace Auctions

Property for sale A dashboard with four bar charts comparing UK cities on key metrics, ideal for UK property investment city guides. Sunderland and Leeds consistently show higher returns, while London has the lowest. Presented by Palace Auctions