Birmingham property investment opportunities in October 2025 present exceptional value for sophisticated investors. Our analysis shows that Selly Oak offers five-year returns of 60.8%. Small Heath has entry points starting at £180,000, with a projected ROI of 59.7%. Palace Auctions has unmatched expertise in Birmingham’s real estate market. As of July 2025, average house prices hit £230,000.

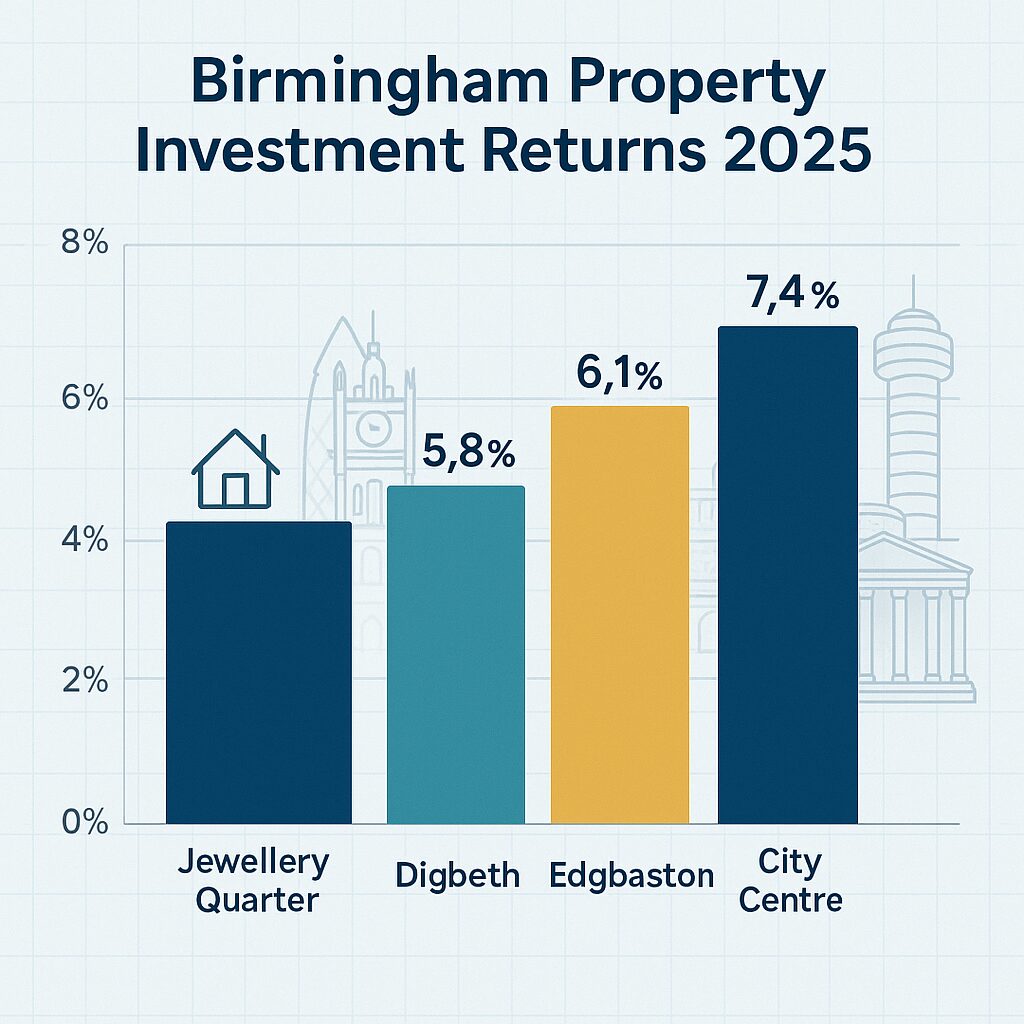

Rental yields in prime postcodes like B18 reach 6.7%. Major regeneration projects worth £5.9 billion are changing entire districts. If you want high-yield student properties in B29, growth in Digbeth’s creative area, or steady income from Edgbaston investments, this guide gives you key insights for Birmingham property deals. By October 2025, Birmingham’s property market will offer unique benefits for buyers, sellers, and investors. JLL forecasts predict Birmingham will see the UK’s highest city growth at 19.9% through 2028. The rental market is strong too, with average monthly rents reaching £1,068—an increase of 5.5% year on year.

This strong performance pairs with game-changing infrastructure. HS2’s Curzon Street station cuts London journey times to under 50 minutes. The £1.9 billion Smithfield regeneration will create 3,000 new homes. The BBC’s move to Digbeth is forming a new media hub. This positions Birmingham as Britain’s most appealing property investment opportunity outside London.

Our unique analysis of Birmingham’s investment zones reveals extraordinary opportunities across diverse communities, with top performers delivering five-year returns ranging from 42.4% to 60.8% through combined capital appreciation and rental income.

Price Dynamics and Growth Trajectory

Birmingham’s typical property value of £230,000 in July 2025 indicates a consistent 1.2% yearly increase, but this citywide statistic conceals notable discrepancies, generating tactical possibilities. Detached properties command £435,000.

Flats start at £146,000, allowing for diverse investment across price and property types. The market’s strength shows in the price per square foot. At £307, Birmingham exceeds the West Midlands average of £249 and the UK average of £290. This highlights the city’s premium position in regional markets.

First-time buyers pay an average of £208,000, while home movers spend £272,000. This reflects a healthy market segmentation that supports ongoing demand.

Looking ahead, Birmingham tops UK cities with projected growth of 16-19.9% over five years. This means an annual appreciation of 3.7%, the highest forecast among major British cities. Together with rental hikes of 15.5-22.2%, this presents appealing return opportunities for tactical investors.

Top Investment Performers by ROI Selly Oak (B29) leads our rankings with 60.8% returns over five years. Strong 7.5% rental yields in the student market drive this. Even with higher entry costs at £357,000, the area’s closeness to the University of Birmingham and its established HMO infrastructure provide £26,775 in annual rental income, with low vacancy risk.

Small Heath (B9) stands out as the value champion, showing projected returns of 59.7% with entry prices at just £180,000. The 7.0% rental yield, paired with affordable housing initiatives and strong demand from young professionals, offers great risk-adjusted returns for budget-conscious investors.

Digbeth (B5) presents a transformation opportunity with 59.0% returns. It benefits from significant regeneration, including HS2 proximity, the BBC studios development, and its creative quarter status. Current prices of £224,000 allow investors to seize potential appreciation as the area develops into Birmingham’s top creative hub.

Recognizing Birmingham’s particular investment territories is significant for improving returns, with each zone affording unique benefits that align with different investment strategies.

Jewellery Quarter (B18) blends heritage charm with modern flair. It offers 6.7% yields—the highest in the city—while ensuring strong capital growth. The average entry price of £200,000 makes luxury accessible. Converted industrial buildings attract young professionals and creative businesses. The area’s 55.2% five-year return projection benefits from its Historic Quarter status, protecting its character while allowing thoughtful development.

Edgbaston (B15) is Birmingham’s traditional prestige address, with average prices at £246,000. It provides 6.4% yields, primarily through HMOs for university students and medical professionals. Its established reputation, closeness to Queen Elizabeth Hospital, and green suburban setting create steady demand. But projected returns are more modest at 51.1%.

City Centre (B1/B2) properties average £225,000 and offer the greatest convenience, especially with the Paradise Birmingham development set to finish in late 2025. They yield 6.0% and have a five-year return of 55.7%. Central locations provide liquidity benefits and attract both owner-occupiers and investors looking for easy management near transport hubs.

Emerging Growth Zones Perry Barr (B44) at £217,000 captures regeneration momentum with improved transport links and 6.4% yields. The area’s 56.6% projected returns enjoy a 2.0% regeneration bonus as infrastructure improvements enhance accessibility and desirability for both renters and future buyers.

Longbridge presents intriguing opportunities at £263,000, where £700 million regeneration transforms the former Rover plant into a thriving mixed-use community. While current yields of 4.8% appear modest, the 44.9% five-year return projection reflects significant appreciation potential as regeneration completes.

Purchasing Birmingham property in 2025 requires a thorough understanding of new regulations, local market practices, and strategic timing to maximise investment value.

New Transparency Requirements

As of April 2025, the Alabama Act 2025-59 requires clear disclosure of brokerage services and fees at the first meeting. You don’t need a binding contract to view properties, but written agreements are necessary before making offers. Buyers must now negotiate agent fees directly, since sellers will not pay the commissions for buyers’ agents by default. These changes aim to improve transparency, but buyers should also budget for agent fees along with regular costs. Include 2-3% for the buyers’ agent commission in your calculations. This fee is negotiable and may sometimes be part of offer discussions.

Due Diligence Essentials

Birmingham’s stricter code enforcement creates both opportunities and risks for buyers. The city can now foreclose on non-owner-occupied properties with unpaid liens exceeding £1,500 after six months.

Creating distressed opportunities may need thorough title searches. Critical due diligence steps include:

Birmingham provides several buyer aid avenues that boost affordability: the Ready to Own Project offers up to £10,000 in non-repayable loans for down payment and closing expenses.

. Eligibility requires:

This may provide over £15,000 in total support for qualified buyers. For investors, buy-to-let mortgages often need a 25% deposit. Interest rates are usually around 5–6%. Portfolio landlords can find specialist lenders who provide competitive terms for purchasing some properties.

Strategic Timing and Negotiation

October 2025 offers great buying conditions as the market stabilises before expected growth in 2026. Properties usually remain on the market for 36 days.

Providing negotiation leverage compared to the previous year’s 31-day average. In competitive areas like Digbeth and the Jewellery Quarter, successful strategies include:

Marketing Birmingham real estate in 2025 necessitates tactical placement to take advantage of robust demand while managing changing market conditions and regulatory obligations.

Optimal Timing for Largest Returns

The current market landscape favors sellers. Analysts expect Birmingham’s figures to rise by 3.7% each year until 2028. But timing can differ by area and property type. **Immediate Sale Advantages** (October 2025-March 2026):

Strategic Hold Opportunities (12-18 months): Areas near major regeneration projects warrant patience. Digbeth properties could see a 5% extra appreciation from the completion of BBC studios. While Smithfield-adjacent holdings enjoy Phase 1 construction visibility.

Sellers must follow updated rules for smooth transactions:

Energy Performance Requirements: Landlords must ensure rental properties have at least an EPC rating of E. By 2028, they may need to achieve a C rating. You should include upgrade costs of £5,000-£8,000 in the pricing.

Capital Gains Considerations: Non-resident sellers pay 28% CGT on gains over £3,000. UK residents enjoy a £12,300 annual exemption, making timing important for portfolio disposals.

New Build Warranties: Developers must offer 10-year structural warranties from approved providers. Existing warranty documents boost buyer confidence and value.

Disclosure Obligations: Sellers must declare:

Strategic improvements can yield 10-20% value increases in Birmingham’s competitive market:

High-ROI Improvements:

Presentation Essentials: Good photography that showcases unique features is key. Virtual tours are now expected for properties over £300,000. Stage properties to highlight space and light. Buyers in Birmingham especially value storage and outdoor access.

Marketing Channels: Combine traditional estate agents with online platforms. Rightmove and Zoopla produce 90% of purchaser queries, but niche investors frequently uncover chances via private-market connections that Palace Auctions can tap into.

Birmingham’s rental market in 2025 demonstrates exceptional strength, with strategic positioning enabling investors to capture premium yields exceeding 7% in select areas.

Tenant demographics and demand drivers

Understanding Birmingham’s tenant base proves crucial for investment success. Young professionals aged 20–35 comprise 60% of renters.

Situated in the city centre and adjacent to suburbs with good transport links, this group values modern amenities. They prefer proximity to jobs and lifestyle choices over traditional features. The student population exceeds 80,000, creating steady demand in Selly Oak, Edgbaston, and more recently, Perry Barr. Purpose-built student housing saw a 6.7% increase in rental rates. However, traditional HMOs can yield higher returns with good management. Corporate moves from London, driven by HS2 links and savings, boost demand for premium rentals.

HSBC, Goldman Sachs, and PwC’s expansions create opportunities for elite properties earning £1,500 or more in monthly rent.

Maximising rental returns requires strategic property selection and management.

Property Type Performance:

Geographic Yield Leaders: Postcodes B18 (6.7%), B2 (6.5%), and B44 (6.4%)

Student areas like B29 achieve impressive 7.5% yields, while others perform consistently well.

HMO Strategies:

Birmingham’s unparalleled infrastructure development fundamentally alters investment trends, as strategic placement near significant projects leads to improved returns.

Game-Changing Projects

HS2 Curzon Street Station

Birmingham is changing fast. The £816 million boost from construction will lead to long-term growth. With connections to London in under 50 minutes, properties within 1 km are outperforming by 3% each year. Over the next thirty years, we expect 4,000 new homes and 36,000 jobs.

Smithfield Regeneration

Smithfield is set to become Birmingham’s new civic heart with a £1.9 billion investment. This 17-hectare site will include 3,000 homes, a market district, and cultural facilities. This shift will draw people southeast from the traditional centre, allowing early investors to benefit the most.

Ladywood Estate

Ladywood is Britain’s largest estate regeneration project, costing £2.2 billion over 20 years. The masterplan includes 70% redevelopment, creating opportunities for generational wealth. With 20% of homes being affordable, this ensures stability for mixed-tenure living.

Digbeth Creative Quarter

The BBC’s move and the rise of creative industries are transforming Digbeth. It’s becoming Birmingham’s version of Shoreditch. With 10 development sites, there’s potential for over 6,000 homes. This suggests steady growth as creative workers look for nearby housing.

Looking towards 2026 and beyond, Birmingham property investment faces favourable dynamics supporting continued outperformance. Accelerating catalysts:

Market Projections:

Investment Implications: The supply-demand imbalance creates sustained appreciation pressure while rental growth outpaces inflation. Early 2026 presents an optimal entry before HS2 publicity drives national attention. Focusing on regeneration-adjacent areas offers the greatest upside while established neighbourhoods provide stability.

Understanding and mitigating risks ensure successful Birmingham property investment despite favourable fundamentals.

Market Risks:

Mitigation Strategies: Diversify across neighbourhoods and property types while maintaining conservative leverage. Highlight sectors with many demand motivators—eschewing single-employer or mono-demographic dependence. Regulatory Elements:

Protection Measures: Budget for compliance upgrades, keep the right insurance (including rent guarantees), and hire qualified professionals for tax and legal advice.

Navigating Birmingham’s property market requires local know-how, strong connections, and thorough market insights. Palace Auctions offers full support for successful investments in Birmingham, whether you’re buying, selling, or building portfolios.

Market Intelligence: Get real-time analysis of pricing trends, off-market opportunities, and regeneration effects. Our unique analytics spot undervalued properties before they gain wider attention.

Transaction Excellence: We manage everything from the initial search to completion. This includes due diligence, negotiation, and compliance. Our Birmingham experts ensure smooth execution, even with complexities.

Auction Expertise: Access distressed and probate properties often 15-20% below market value through our auction network. We guide you on bidding strategies that maximise value while reducing risk.

Portfolio Services: Receive strategic advice on portfolio construction, including area diversification, tenant mix, and exit planning. Our experience helps investors build sustainable long-term wealth.

Contact Palace Auctions today to explore Birmingham’s outstanding property investment opportunities. With 60.8% returns possible in prime areas and transformative infrastructure changes ahead, October 2025 is the perfect time for strategic investment in Britain’s second city.

Outbound Links:

Internal Link:

“Explore upcoming Birmingham property auctions for below-market opportunities.”

Page Last Updated: Tuesday, 14 October 2025, 13:29 GMT

Enter your email address and we will send you a link to change your password.