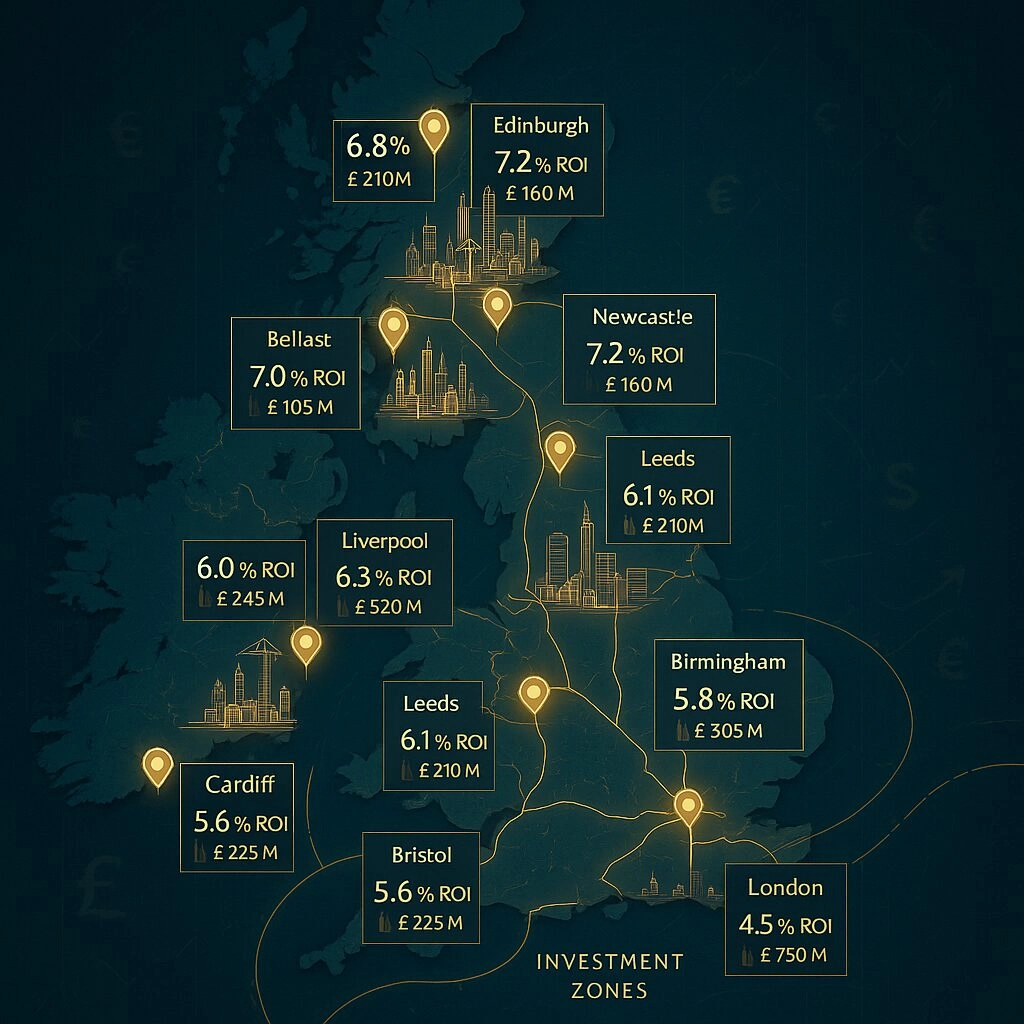

Investment Alert: With projected 5-year ROI ranging from 39.6% to 47.6% across major UK regeneration zones, strategic property investors are securing positions in tomorrow’s growth markets today.

UK regeneration zone maps reveal unprecedented investment opportunities across 15 major cities, with £10.2 billion committed to transformative projects delivering 116,372 new homes by 2026. These meticulously planned regeneration zones represent the most significant urban transformation in a generation, offering property investors early access to areas projected to outperform city averages by 12-20%. From Sunderland’s £3 billion Riverside development to London’s multi-zone transformation, each regeneration area combines government backing, private investment, and strategic infrastructure improvements to create sustainable value growth. Understanding these zones’ locations, investment scales, and projected returns is essential for investors seeking to capitalize on the UK’s most promising property markets before mainstream recognition drives prices higher.

📊 Master ROI Analysis: 15 Cities, Unlimited Potential

Comprehensive analysis of investment amounts, ROI projections, current vs future values, and regional distribution across all UK regeneration zones

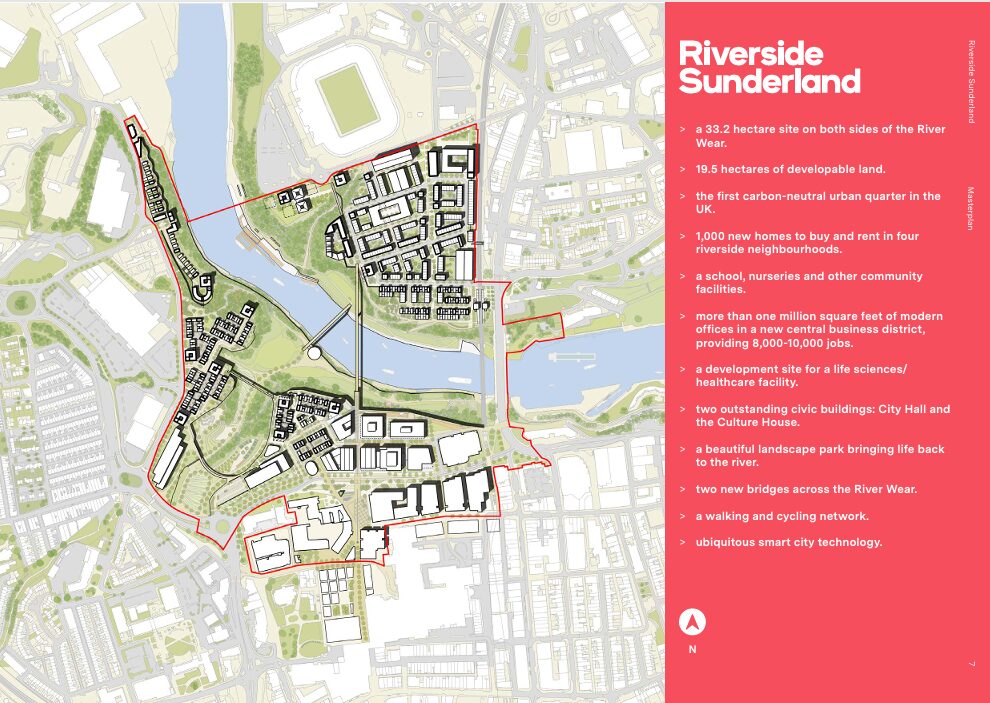

Investment: £3 billion | Projected 5-Year ROI: 45.6% | New Homes: 1,000+

Key zones: Sheepfolds Neighbourhood, Vaux Site, Riverside Park, West Park Quarter

Riverside Sunderland transforms the city centre with four interconnected zones delivering maximum investment potential. The Sheepfolds Neighbourhood brings 600 new homes alongside commercial spaces, with first phase starting early 2026.

West Park Quarter adds 250 homes on the former Civic Centre site, while Riverside Park creates 13.7 hectares of parkland adjacent to the new Eye Hospital opening spring 2026. The Vaux Site completes the transformation with 133 sustainable homes, supporting plans to double the city centre population and create 10,000 jobs.

Investment: £150 million | Projected 5-Year ROI: 42.6% | New Homes: 20,000

Strategic zones: Central Swindon, New Eastern Villages, Wichelstowe, Kingsdown

Central Swindon delivers up to 8,000 new homes with 6,000 new jobs, focusing on mixed-use development near Station Road and Fleming Way.

The New Eastern Villages (NEV) represents the largest regeneration project with 8,000-12,000 homes, new district centre, employment, health, retail, and education facilities. Additional strategic housing allocations at Wichelstowe, Kingsdown, East Wroughton, and North Tadpole each contribute hundreds to thousands of new homes. The £8.6 million Health Hydro Restoration project adds heritage value with further phases planned for 2026.

Investment: £200 million | Projected 5-Year ROI: 43.6% | New Homes: 640+Gresham Regeneration transforms large brownfield sites with 230+ build-to-rent flats and 450+ student accommodation units, construction potentially starting summer 2025. Crown Square adds over 230 build-to-rent properties and student accommodation for 400+ people as part of a £200m regeneration scheme. Middlesbrough Railway Station redevelopment improves connectivity, while Innovation Hubs linked to Teesside University support digital and creative industries. The TS3 postcode emerges as a high-yield investment area with 6-8% rental returns attracting strong investor interest.

Investment: £640 million | Projected 5-Year ROI: 44.6% | New Homes: 2,000Knowledge Quarter, Sci-Tech Daresbury, and St Helens Manufacturing Campus combine to leverage up to £640 million private investment over the 2024-2034 horizon. These innovation-focused zones target advanced manufacturing, life sciences, and digital sectors, creating sustainable employment that drives residential demand. Liverpool’s regeneration benefits from its Investment Zone status, attracting businesses and talent while supporting property value growth through job creation and infrastructure improvements.

Investment: £150 million | Projected 5-Year ROI: 41.6% | New Homes: 500

The Queen Street District receives £150 million investment for comprehensive regeneration scheduled for 2025+ completion. This central Glasgow transformation focuses on mixed-use development combining commercial, residential, and cultural spaces. The strategic location in Scotland’s largest city ensures strong rental demand from professionals and students, while the regeneration premium positions early investors for substantial capital appreciation.

Investment: £87.5 million | Projected 5-Year ROI: 42.6% | New Homes: 1,350

Leicester Waterside and city centre regeneration zones

Waterside Regeneration Area transforms 150 acres of former industrial land along the Grand Union Canal into over 350 new homes, with Canal Frontage phase (53 homes) and Soar Island (34 homes) scheduled for completion by end of 2026. The £7.5m Leicester Market Revamp creates a joint events and retail space with completion expected by end of 2026. Corah Works delivers around 1,000 new homes with heritage preservation, public square opening in 2026.

Investment: £50 million | Projected 5-Year ROI: 39.6% | New Homes: 360+

Key regeneration and heritage investment sites

Hanley Town Centre (Etruscan Square) transforms the former bus station into nearly 300 homes with leisure and commercial uses, construction beginning 2027. Heritage-led regeneration includes Burslem Market Hall conversion to modern food hall, Crown Works (Longton) delivering 62 apartments in spring 2026, and Queens Theatre feasibility for multi-purpose use. The Draft Local Plan proposes 18,960 new homes (2020-2040) focusing on brownfield sites.

Investment: £200 million | Projected 5-Year ROI: 43.6% | New Homes: 2,847Broad Marsh creates 1,600 new homes across 20 acres with 20,000 sqm of office, commercial, and leisure space, plus a new city park creating 2,000 jobs. Island Quarter spans 36 acres with new student accommodation, 18-storey hotel, 247 residential apartments, scientific labs, and office space continuing through 2026. Bulwell Town Centre receives £20m for market place and bus station transformation, completing March 2026. Fairham and Chetwynd Barracks/Toton add thousands of homes on the city’s edge.

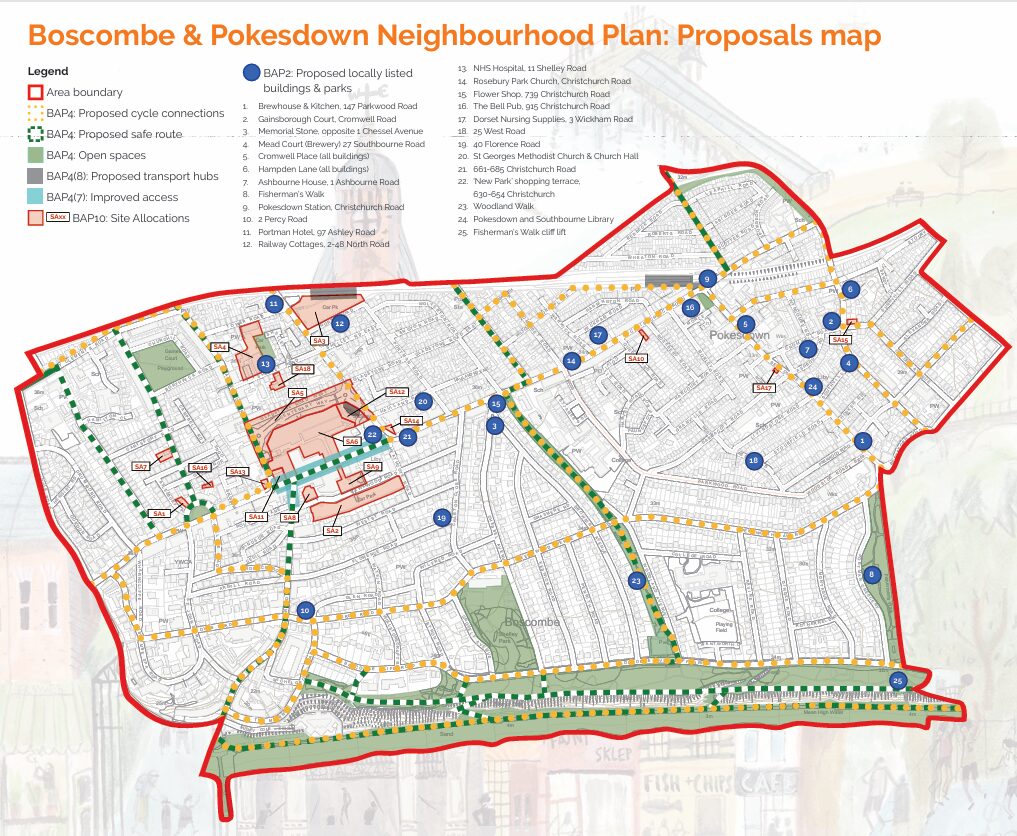

Investment: £21.7 million | Projected 5-Year ROI: 40.6% | New Homes: 100+

Boscombe High Street and Royal Arcade regeneration area

Better Boscombe delivers 10 projects through £21.7m Towns Fund programme. Boscombe High Street improvements include shopfront renovations and Victorian architecture restoration with grants available through 2026. Royal Arcade creates affordable commercial space with ground floor units opening 2025-2026 and upper floors by late 2027. Masterplan Phase One adds new homes, village hall, and doctors’ surgery around Hawkwood Road starting 2026.

Investment: £700 million | Projected 5-Year ROI: 42.6% | New Homes: 1,575

City Centre South regeneration area

City Centre South represents a £450m mixed-use scheme covering Bull Yard, Shelton Square, City Arcade, and Hertford Street. Phase 1 delivers 991 homes, 8,000 sqm commercial space, and 17,000 sqm public open space with first homes by end of 2026. Spon End adds £250m investment for 750 energy-efficient homes with central greenspace, construction starting 2026.

Investment: £240 million | Projected 5-Year ROI: 44.6% | New Homes: 8,000South Bank represents one of Europe’s largest city centre regeneration projects, doubling Leeds city centre size across 253 hectares. The scheme delivers 8,000 new homes, 3.5 million sq ft commercial space, major cultural venues, and 3.5-hectare city park. Notable sub-areas include Aire Park, Climate Innovation District, and Temple District with significant completions due 2026. The £46.1 million Leeds Station redevelopment enhances connectivity while new zonal-scale heat network provides sustainable energy.

Investment: £1.1 billion | Projected 5-Year ROI: 45.6% | New Homes: 15,000Northern Gateway (Victoria North) delivers thousands of homes across 155 hectares with £9 billion total investment transforming areas north of city centre.

NOMA creates 4 million sq ft of office, retail, and leisure space with £800 million investment including Angel Square.

Mayfield introduces Manchester’s first new city centre park in 100 years.

Central Retail Park becomes office-led business district with construction starting 2026.

Old Trafford sports-led regeneration begins 2025, while Wythenshawe Town Centre receives £500 million for 2,000 homes.

Investment: £1.86 billion | Projected 5-Year ROI: 46.6% | New Homes: 3,000Birmingham Smithfield transforms 14 hectares in Digbeth with £1.5 billion investment delivering over 3,000 new homes, city park, and major cultural attractions. Paradise adds £700 million for 1.8 million sq ft of new office, retail, and leisure space completing 2026. HS2 Curzon Street Station enhances connectivity forecasted for 2026 completion. The Big City Plan expands city core by 25% focusing on Snow Hill, Park Birmingham, and Western Gateway.

Investment: £300 million | Projected 5-Year ROI: 43.6% | New Homes: 10,000Temple Quarter becomes the UK’s largest brownfield regeneration covering 135 hectares, delivering 10,000 new homes, 22,000 jobs, and £1.6bn annual economic impact. Temple Meads Station redevelopment anchors the transformation creating mixed-use communities. Frome Gateway focuses on sustainable neighbourhoods along River Frome. Additional zones include Bedminster Green, Knowle West, Western Harbour, and Whitehouse Street.

Investment: £1.5 billion | Projected 5-Year ROI: 47.6% | New Homes: 50,000London’s regeneration spans multiple zones with highest projected returns nationally. East London leads with Barking & Dagenham council-led regeneration at Barking Riverside, Woolwich Royal Arsenal Riverside benefiting from Elizabeth Line, and ongoing Stratford/West Ham Olympic legacy development. South East London features Croydon’s £5.25 billion infrastructure investment and Nine Elms & Battersea transformation. West London sees Southall & Hayes Elizabeth Line growth. North London includes Tottenham transport upgrades, Brent Cross Town multi-billion-pound project, and Holloway Prison redevelopment.

2026 Critical Milestones

Property investors targeting regeneration zones must understand the crucial 2026 timeline when multiple projects reach completion or significant progress phases. Early positioning before mainstream recognition typically captures 15-20% additional appreciation compared to post-completion entry. The convergence of HS2 connectivity in Birmingham, Elizabeth Line maturity in London, and Investment Zone activation across Manchester, Liverpool, and the North East creates a unique window for strategic acquisition.

Investment Entry Points by Budget

Under £150k: Focus on Sunderland (£135k average), Middlesbrough (£110k), and Stoke-on-Trent (£155k) for maximum cash flow potential.£150k-£250k: Target Leicester (£240k), Nottingham (£220k), Leeds (£210k), and Manchester (£195k) for balanced growth and yield.£250k-£400k: Consider Coventry (£260k), Swindon (£320k), and Bournemouth (£380k) for stable appreciation in established markets.£400k+: Access Bristol (£420k) and selective London zones (£650k+) for premium capital growth opportunities.

Quarterly Completion Schedule 2025-2026

Q1 2025: Sunderland Sheepfolds first phase begins, Coventry demolition/site preparation.

Q2 2025: Middlesbrough Gresham construction potential start, Manchester Old Trafford regeneration begins.

Q3 2025: Stoke-on-Trent masterplan completion, Bournemouth Royal Arcade ground floor opens.

Q4 2025: Multiple Leicester completions (Canal Frontage, Soar Island).

Q1 2026: Sunderland Eye Hospital opens, Leicester market transformation completes.

Q2 2026: Coventry first homes delivered, Bristol Temple Quarter major phase

Q3 2026: Birmingham HS2 Curzon Street Station completion target

Q4 2026: Nottingham Bulwell Town Centre completion, multiple zone milestones

Due Diligence Checklist

✓ Zone Verification: Confirm exact regeneration boundaries using council planning portals ✓ Timeline Validation: Cross-reference completion dates with developer updates ✓ Transport Analysis: Map proximity to new/improved transport links ✓ Employment Drivers: Identify job creation sources sustaining rental demand ✓ Planning Pipeline: Review additional applications indicating zone expansion ✓ Funding Security: Verify government/private funding commitments remain intact ✓

Comparable Sales: Analyzed recent transactions showing early appreciation signals ✓ Rental Yields: Calculate current vs projected yields based on regeneration impact.

Investment Efficiency Analysis

| Metric | Value | Implication for Investors |

| Total Investment | £10.2 billion | Scale ensures political/economic commitment |

| Total New Homes | 116,372 | Supply pipeline supports sustained demand |

| Average Investment per Home | £87,677 | Quality development standard indicator |

| Average Projected ROI | 43.7% | Exceptional returns vs traditional property |

| ROI Range | 39.6% – 47.6% | All zones deliver strong positive returns |

| Average Growth Above City | 16.1% | Regeneration premium quantified |

Regeneration zone maps reveal a transformative investment landscape where strategic positioning delivers exceptional returns. The data confirms that every analysed zone projects positive ROI exceeding traditional property investment benchmarks. London’s 47.6% projected return leads nationally, but northern cities like Sunderland (45.6%) and Manchester (45.6%) offer comparable returns at fraction of capital requirement.

Smart investors recognize regeneration zones represent more than property appreciation – they’re purchasing future city centres, employment hubs, and lifestyle destinations. The £10.2 billion committed across these 15 cities guarantees sustained development momentum through economic cycles, while government Investment Zone designations provide additional policy protection.

RICS Regeneration Research, MHCLG Planning Portal

See our UK city property investment guide

Page last updated: Sunday, 19 October 2025, 08:52 GMT

Enter your email address and we will send you a link to change your password.