Description

Freehold SPV sale of a six-floor mixed-use building at 365 Edgware Road with a basement & ground-floor restaurant plus five flats, offering £184,200 pa income and a 6.02% adjusted yield on £3.06 M total investment.

Description

Edgware Road property investment at 365 Edgware Road is a turnkey freehold opportunity structured as an SPV sale. The asset comprises:- Basement & ground floor: fully let restaurant on a 20-year lease (5-year rent reviews) at £5,000 pcm

- First floor: one 2-bed flat and one studio

- Second & third floors: one 2-bed flat each

- Fourth floor: one studio

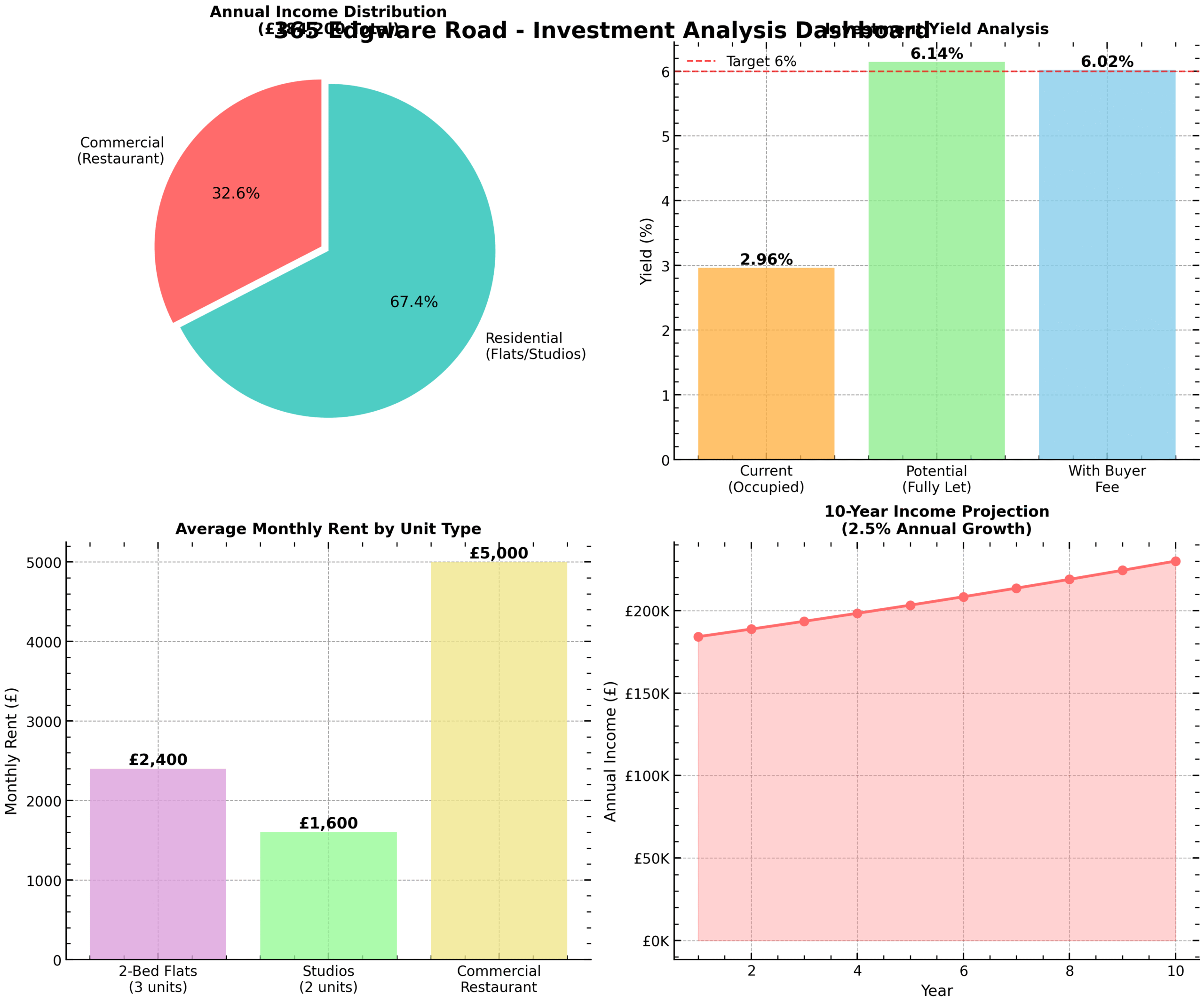

Income & Yield Analysis

| Metric | Value |

|---|---|

| Asking Price | £3,000,000 |

| Buyer’s Fee (2%) | £60,000 |

| Total Investment | £3,060,000 |

| Current Active Annual Income | £88,800 |

| Potential Fully Let Annual Income | £184,200 |

| Gross Yield (Fully Let) | 6.14% |

| Adjusted Yield (Including Fee) | 6.02% |

| Commercial Income (Restaurant) | £60,000 pa |

| Residential Income (Flats/Studios) | £124,200 pa |

| Current Vacancy Rate | 51.8% |

Income Distribution & Yield Dashboard

[caption id="attachment_15684" align="aligncenter" width="750"] 365-edgeware-road-investment-analysis-presented-by-Palace-Auctions[/caption]

Figure 1: Income split, yield comparison, rent by unit type & 10-year income growth projection.

365-edgeware-road-investment-analysis-presented-by-Palace-Auctions[/caption]

Figure 1: Income split, yield comparison, rent by unit type & 10-year income growth projection.

Location

365 Edgware Road sits in the City of Westminster, W2, with:- Edgware Road Station: Bakerloo, Circle, District & Hammersmith & City lines (TFL)

- Multiple bus routes along Edgware Road (routes 6, 18, 27, 43, 98, N18)

- Nearby amenities: Hyde Park, Paddington Basin, Marylebone High Street

- Westminster planning portal: https://www.westminster.gov.uk/planning-building

Media Links

Internal & External Links

Internal Link Suggestion: – Auction Calendar for upcoming viewing slots- Restaurant guide & reviews: maps.app.goo.gl/dcPNa7NoDuBRYesv8

- London buy-to-let guidance: gov.uk/guidance/residential-property-development-finance

- Edgware Road transport: tfl.gov.uk/modes/tube/stations/edgware-road-bakerloo