Description

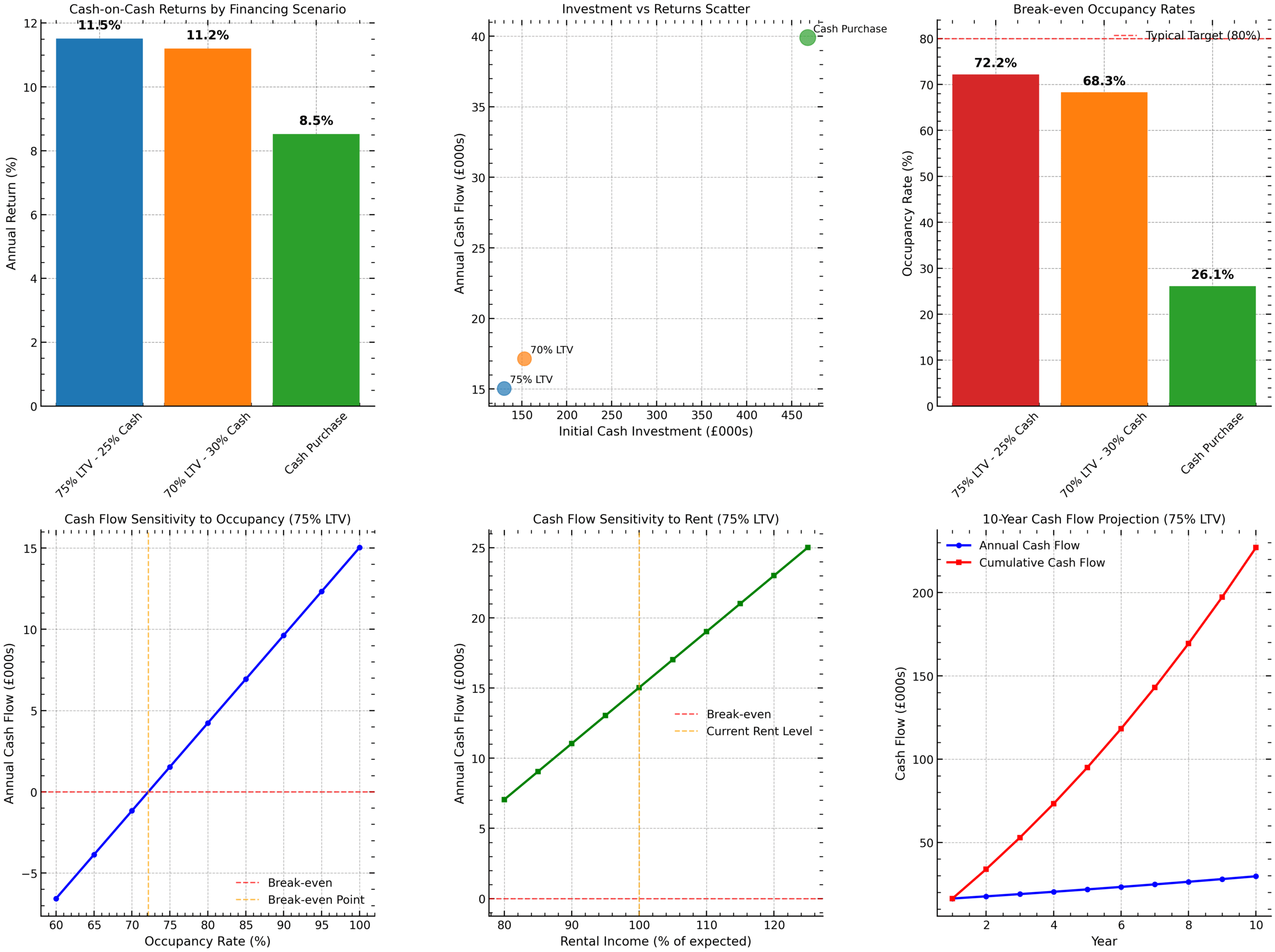

This Wisbech HMO investment at upon Bridge Street, PE13 1AF, represents a turnkey, high-yield opportunity. In the heart of Wisbech. Comprising nine ensuite bedrooms, seven modern bathrooms and communal living space. Set over three floors, the property is fully licensed as an HMO. In addition benefitting from robust tenant demand. Moreover, rents of £500 per room per month deliver a projected annual income of £54,000. Equating to a 12% gross yield and 8.87% net yield on guide price. Situated steps from Westgate shopping, cafés and Elm Tree Inn. The location offers unrivalled convenience for tenants. Frequent bus links connect to Peterborough and Kings Lynn via the A47 corridor. While March rail station is just eight miles away. The property is also poised to benefit from Wisbech’s major £20 M regeneration programme, including town-centre revitalisation and public-realm upgrades, underpinning long-term capital growth. Tenants enjoy high-speed broadband, double-glazed windows, modern communal kitchens and secure entry with CCTV. In addition, vacancy risk is minimal—fully let HMOs are common in Wisbech’s professional and student market, where average HMO yields run 6%–8%. Consequently, investors can target stable cash flow with significant margins and multiple exit strategies: hold for rental income, refinance or sell individual units. Key Takeaways: • Prime Wisbech HMO investment – 9 bedrooms, 7 baths, freehold. • Marketing Price: £450,000 + 3% sourcing fee. Expected Rent: £4,500 pcm / £54,000 pa → 12% gross yield, 8.87% net yield. • Low break-even occupancy: 26.1% (cash purchase). • Strong local demand & ongoing £20 M regeneration funding.ROI Analysis

| Metric | Value |

|---|---|

| Purchase Price | £450,000 |

| Sourcing Fee (3%) | £13,500 |

| Legal & Survey Fees | £4,500 |

| Total Investment (Cash) | £468,000 |

| Annual Rental Income | £54,000 |

| Total Operating Costs | £14,100 |

| Net Annual Income | £39,900 |

| Gross Yield | 12.00% |

| Net Yield (cash purchase) | 8.87% |

| Net Yield (inc. purchase costs) | 8.53% |

| Break-even Occupancy (cash) | 26.1% |

| Optimal Cash-on-Cash Return (75% LTV) | 11.52% |

| Figure: ROI scenarios, yields & break-even occupancy for Bridge Street HMO |

Location & Transport

4 Bridge Street sits at the centre of Wisbech’s retail and civic quarter:- 🚶♂️ Walking distance to Westgate Dept Store, Tesco & Elm Tree Inn

- 🚌 Bus routes to Peterborough, March & Kings Lynn via A47

- 🚂 March station (8 miles) & Kings Lynn station (13 miles)

- 🚗 Easy A47 access to regional hubs

- 🚕 Town-centre taxi ranks at Horsefair & East Street

Outbound Links

- Fenland District Council Regeneration → https://www.fenland.gov.uk/regeneration

- UK Planning Portal → https://www.planningportal.co.uk

- Anglian Water Community Projects → https://www.anglianwater.co.uk/your-local-area/community-projects/

- Stagecoach Bus Services Wisbech → https://www.stagecoachbus.com