Description

off-market Birmingham block investment: Firstly consider, two freehold residential blocks, each with five one-bedroom flats, all vacant and ready for a hands-on refurbishment play. Investors benefit from tenants on rolling two-month notices, enabling immediate works to unlock premium rents and significant capital growth. Secondly , the blocks situated in high-demand neighbourhoods such as the Jewellery Quarter and City Centre, these blocks deliver above-average Birmingham yields (citywide 5.2%–5.4%). Thirdly each block comprises five self-contained one-bed flats in sound structural condition but requiring modernisation. In addition the £100k per-block refurbishment budget targets kitchens, bathrooms, communal areas and external façades—well below the £164,640 average cost for standard block refurbishments in Birmingham. Post-refurb, each block is independently valued at £675,000, representing a 28.6% uplift on total investment. [caption id="attachment_15401" align="aligncenter" width="550"] birmingham-blocks-rent-by-palace-auctions-london-[/caption]

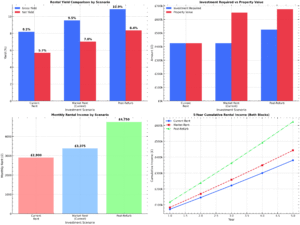

Figure: ROI scenario comparison & 5-year cumulative income projections for both blocks.

birmingham-blocks-rent-by-palace-auctions-london-[/caption]

Figure: ROI scenario comparison & 5-year cumulative income projections for both blocks.

💼 Investment Analysis

| Scenario | Investment Required | Annual Rent | Gross Yield | Net Yield* | Valuation | Equity Gain |

|---|---|---|---|---|---|---|

| Current Rent (£2,900 pcm) | £425,000 | £34,800 | 8.19% | 5.69% | £425,000 | £0 |

| Market Rent (£3,375 pcm) | £425,000 | £40,500 | 9.53% | 7.03% | £650,000 | £225,000 |

| Post-Refurb (£4,750 pcm) | £525,000 | £57,000 | 10.86% | 8.36% | £675,000 | £150,000 |

| *Net yields assume 2.5% for management & voids. |