Description

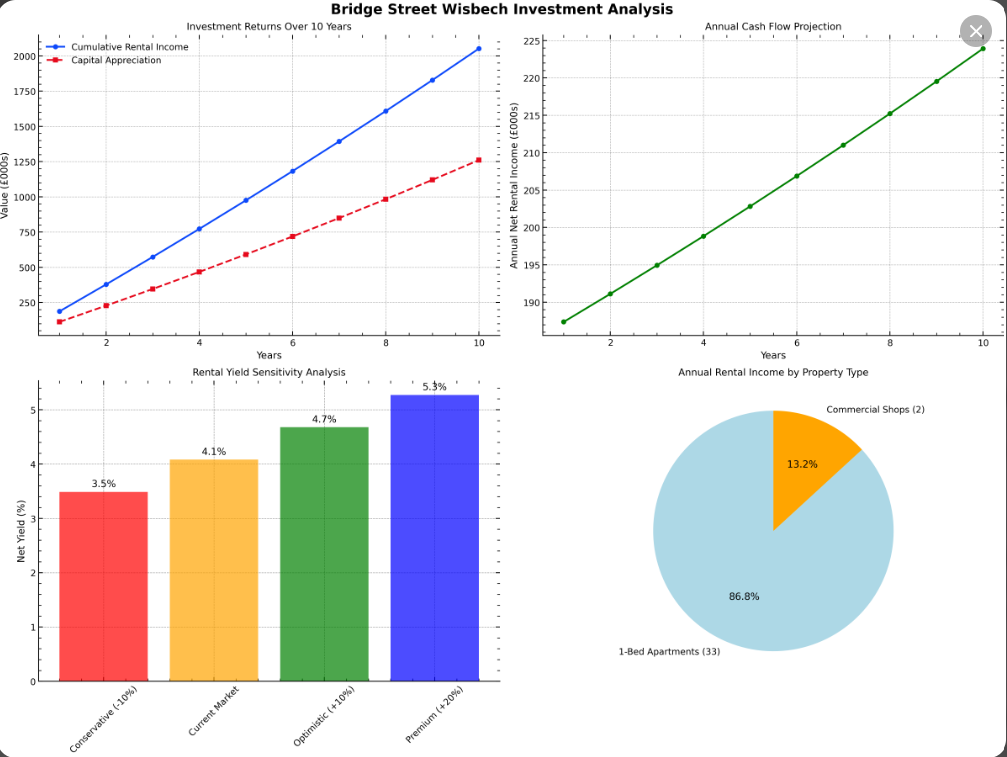

Secure a prime freehold Bridge Street Wisbech investment featuring 33 one-bedroom apartments and 2 commercial shops for £4.5 M + 2% fee, delivering a 6.07% gross and 4.08% net yield. This Bridge Street Wisbech investment Will present a fully renovated mixed-use block comprising 33 one-bedroom apartments and two street-front retail units. Nestled in the heart of Wisbech’s town centre (PE13 1AF), the asset benefits from strong local rental demand—average one-bed rents of £599 pcm—resulting in projected residential income of £237,204 per annum. Meanwhile, the two commercial shops yield £36,000, bringing total annual rental income to £273,204 and underpinning a 6.07% gross yield (5.95% after fees). Moreover, this block sits within Bridge Street’s bustling retail and leisure corridor, surrounded by cafés, independent shops and heritage landmarks. Investors will appreciate low vacancy (1% market rate), minimal cap-ex requirements and on-site management potential. Furthermore, Wisbech’s £10.5 M transport upgrades and the Growing Fenland Masterplan—backed by £6.5 M for Garden Town feasibility—ensure ongoing regeneration and capital growth prospects. The apartments feature modern kitchens with integrated appliances, double-glazed sash windows, high-speed broadband and secure communal entrances. Residents enjoy easy access to Queensgate Shopping Centre, the River Nene riverside walks, and direct bus routes to Peterborough. Investors can command above-market rents or explore break-up sales at an estimated £92,000 per flat, unlocking an immediate uplift of 31.9% on guide price. Overall, this Bridge Street Wisbech investment offers stable cash flow, diversified income streams and multiple exit strategies—hold for yield, refinance or dispose unit-by-unit—making it an unmissable opportunity in Cambridgeshire’s most affordable market town.Investment Highlights

| Metric | Value |

|---|---|

| Purchase Price | £4,500,000 |

| Sourcing Fee (2%) | £90,000 |

| Total Investment Cost | £4,590,000 |

| Residential Income | £237,204/pa |

| Commercial Income | £36,000/pa |

| Total Annual Income | £273,204/pa |

| Gross Yield | 6.07% |

| Gross Yield After Fees | 5.95% |

| Operating Expenses | £85,837/pa |

| Net Annual Income | £187,367/pa |

| Net Yield After Fees | 4.08% |

| Break-Even Occupancy | 31.4% |

| Simple Payback Period | 24.5 years |

| Yield, net income and break-even analysis for Bridge Street Wisbech investment |

Financial Overview

The table above summarizes gross/net yields based on current rents. Operating costs include 10% management, 5% maintenance, 8% vacancy allowance, insurance (£8k) and service charges, totaling £85,837 pa. Investors can target a 4.08% net yield after fees, with 10-year projections demonstrating cumulative net income of £2.05 M and capital appreciation underpinning long-term returns.Location

Bridge Street sits in the centre of Wisbech, offering:- Firstly, 🚶♂️ Walking access to shops, cafés & The Crescent cinema

- Secondly, 🚌 Frequent bus routes to Peterborough & King’s Lynn

- 🌉 Riverside walks along the Nene and Wisbech Park

- 🚗 Road links via A47 to Peterborough (30 mins) & Kings Lynn

Outbound Links

- Fenland District Council – Regeneration Plans → https://www.fenland.gov.uk/regeneration

- Planning Portal (UK Government) → https://www.planningportal.co.uk

- Heritage Lottery Fund – Wisbech High Street Project → https://www.heritagelotteryfund.org.uk

- College of West Anglia – Construction Training → https://www.cwa.ac.uk