Description

Key takeaways for the Boutique Hotel, Chelsea – SW3 Freehold Investment Opportunity. • Rare freehold hotel in prime Kensington/Chelsea at 73 Oakley Street, SW3. • £7.5 million guide price plus fees—vacant possession on completion. • 5,000 sq ft over 15 keys in a Victorian townhouse owned for 40 years. • Average ROI ~2.9%, best-case 4.2% at high ADR/occupancy—below market but with repositioning upside.Description

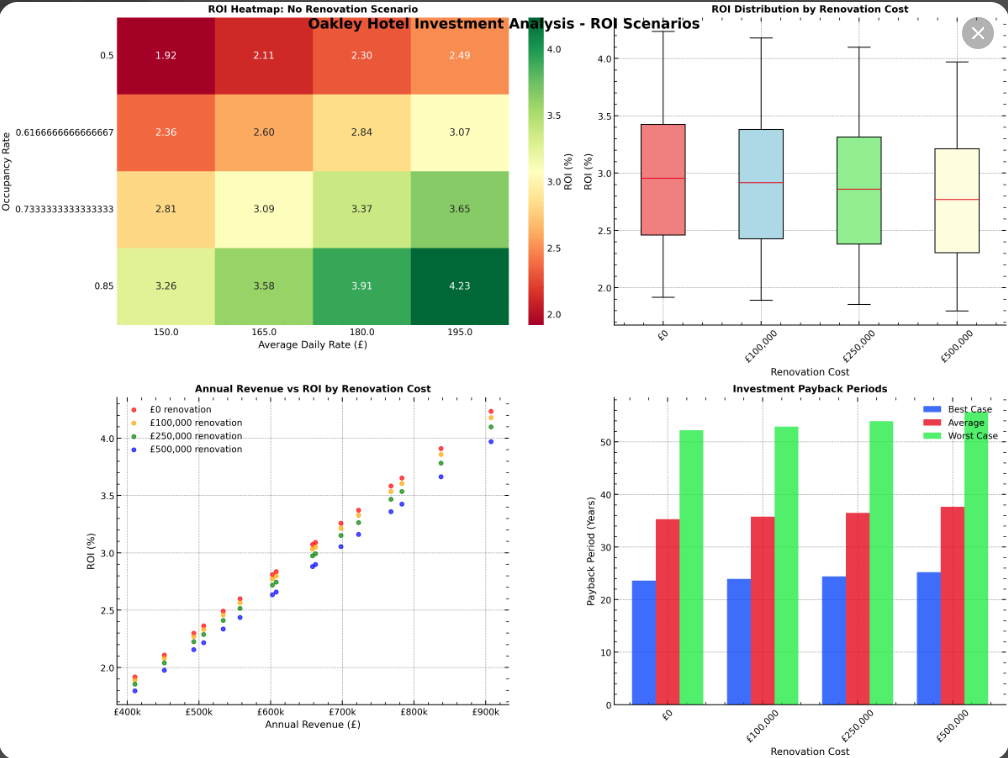

The Boutique Hotel Chelsea presents a unique budget-hotel freehold opportunity. Firstly situated in one of London’s most prestigious neighbourhoods. Housed in a Victorian redbrick townhouse. Once part of Henry VIII’s palace gardens, the property extends to circa 5,000 sq ft. Across 15 en-suite bedrooms, breakfast room and guest lounge. It offers immediate vacant possession and is ripe for refurbishment and re-branding as a boutique or serviced apartment asset. Located just 150 meters from Albert Bridge on the River Thames and immediately adjacent to Battersea Park, the hotel sits 100 meters from the famed King’s Road retail and dining district. Sloane Square and South Kensington Tube stations are each a 10-minute walk, while six major bus routes stop within 2 minutes on Oakley Street. Heathrow and Gatwick airport transfers are readily available. However, current trading metrics yield modest returns under a budget-hotel model. Our financial analysis indicates an average net operating income of £223,000 and average ROI of 2.89%, with best-case ROI of 4.23% (ADR £195, 85% occupancy) and a worst case of 1.8% under low-ADR, low-occupancy scenarios. Investors may consider a premium-brand repositioning, mixed-use conversion or operational efficiencies to boost returns.Investment Summary

| Metric | Value |

|---|---|

| Purchase Price | £7,500,000 |

| Freehold Status | Yes |

| Vacant Possession | Yes |

| Building Area | 5,000 sq ft |

| Number of Keys | 15 |

| Price per Key | £500,000 |

| Price per Sq Ft | £1,500 |

| Figure: Boutique Hotel ROI scenarios by ADR, occupancy and renovation cost. | |

| Scenario | Total Investment |

| ------------- | -----------------: |

| Best Case | £7,500,000 |

| Average | £7,712,500 |

| Worst Case | £8,000,000 |