Description

Edgeware Road Office Development for Sale as a Whole or in part.

(please make enquiries with the auctioneers).

Edgeware Road office development Beginning with this exceptional opportunity to purchase a 15,000 sq ft freehold office building in London’s Major Town Centre Growth Area. Situated on one of Central and West London’s busiest commercial corridors, this asset benefits from robust occupier demand, with West End office vacancy at just 3.1% in Q3 2024, and professional services driving take-up 87% above the ten-year quarterly average.The London Plan

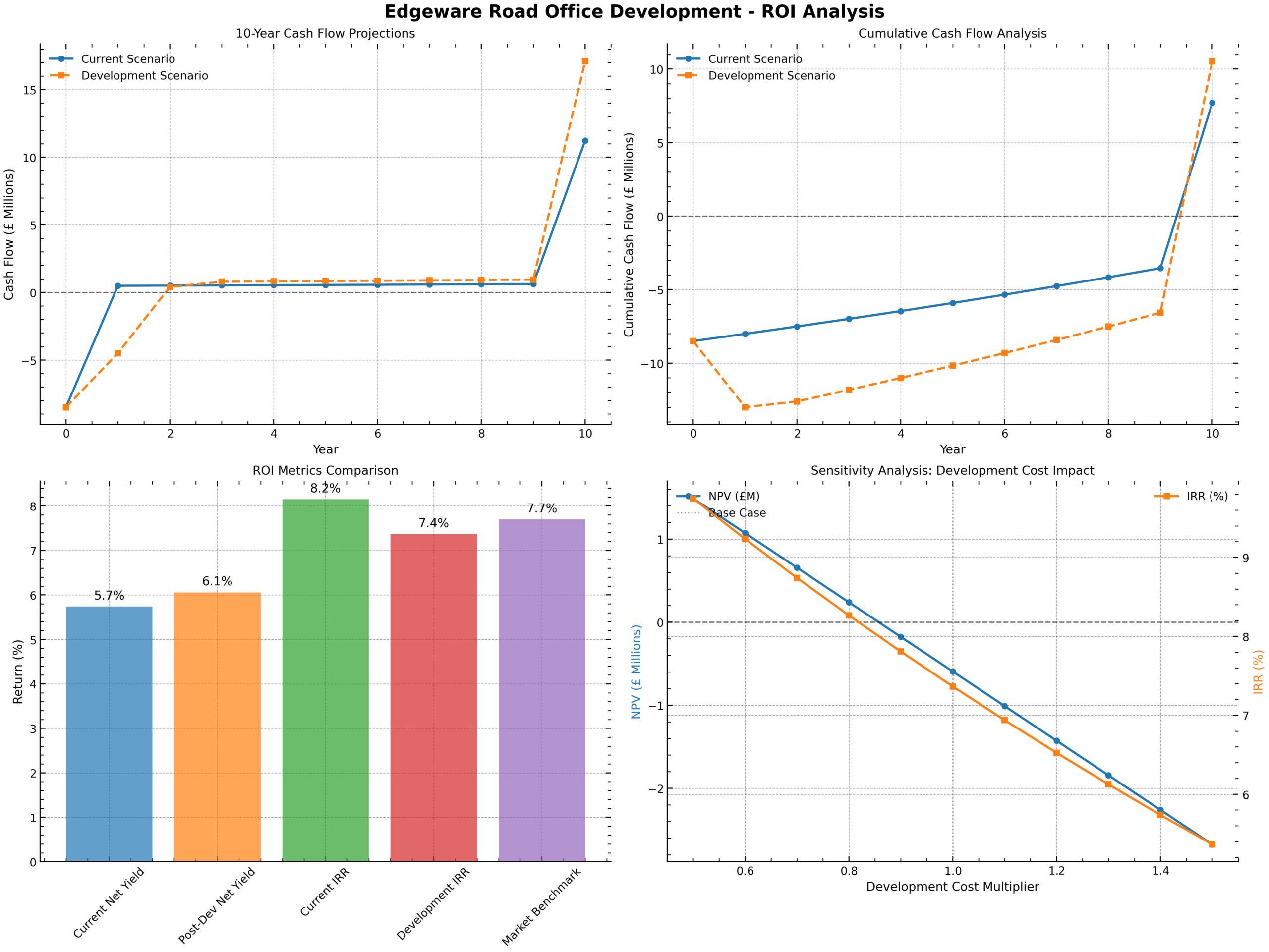

Firstly considering the London Plan and the Edgware Growth Area SPD, this site is earmarked for high-density, mixed-use regeneration. Supporting up to 22 storeys of new homes, workspace, and public realm enhancements. While refurbishment can lift headline rent from £45 psf to £65 psf. Post-development net yield rises only modestly to 6.06%. Below the UK commercial benchmark of 7.7%, indicating that large-scale redevelopment requires significant cost reduction to be viable. Transport & Amenities Secondly, Edgware Road is served by two tube stations (Bakerloo; Circle, District & Hammersmith & City lines). Providing rapid connections to Paddington, Marylebone, Oxford Circus, and beyond. Paddington and Marylebone mainline stations offer Heathrow Express and national rail routes. Numerous bus services (6, 16, 18, 23, 27, 36, 98, night buses) run along Edgware Road. Nearby Hyde Park and Marylebone Green deliver recreational space, while a vibrant dining scene—particularly Middle Eastern cuisine—caps proximity amenities. Planning & Development Moreover As part of the Edgware Town Centre Growth Area, outline consent for 3,365 new homes (including 1,150 affordable), student housing. Major public realm works underscores the area’s regeneration momentum. In addition, the SPD’s nine development principles emphasize sustainable design, active travel, and public space enhancement. Besides, Prospective buyers should consult the Edgware Growth SPD and London Plan for pre-application advice via the Barnet and Harrow planning portals. Investment Considerations Current rent roll generates £573,750 pa, yielding 6.75% gross (5.74% net). Development costs of c.£4.5 million would produce post-refurb net yield of 6.06%—below expectations—and a negative NPV of £-593,430. In addition the figures suggest value is best unlocked through rental optimization rather than full redevelopment. A 50% reduction in development cost is required for value-add viability. (break-even cost £2.25 million) based on break even analysis. For similar London opportunities, see our London commercial auctions guide.