Description

Opportunity to Acquire a prime PR25 3EL JV development opportunity in Leyland for £260,000, delivering a GDV of £1.1 million with projected ROIs of 25%–67% and annual rental yields up to 17.7%.This JV development site at PR25 3EL in Leyland offers investors the chance to purchase land for 8 x 1-bed flats above a fully let Sainsbury’s Local retail unit. With a competitive site purchase price of £260,000 and a Gross Development Value of £1.1 million, the project promises robust returns under multiple cost scenarios.

Description

The subject site is located on a high-street parade in Buckshaw Village, Leyland (PR25 3EL), and benefits from:- An existing lease to Sainsbury’s Local—a 15-year, full repairing & insuring agreement with upward-only, RPI-linked rent reviews every five years.

- Strong local transport links: Leyland train station (1 km away) connects to Preston, Manchester & Liverpool.

- Proximity to Worden Park and Leyland town centre, supporting residential demand.

Investment Highlights

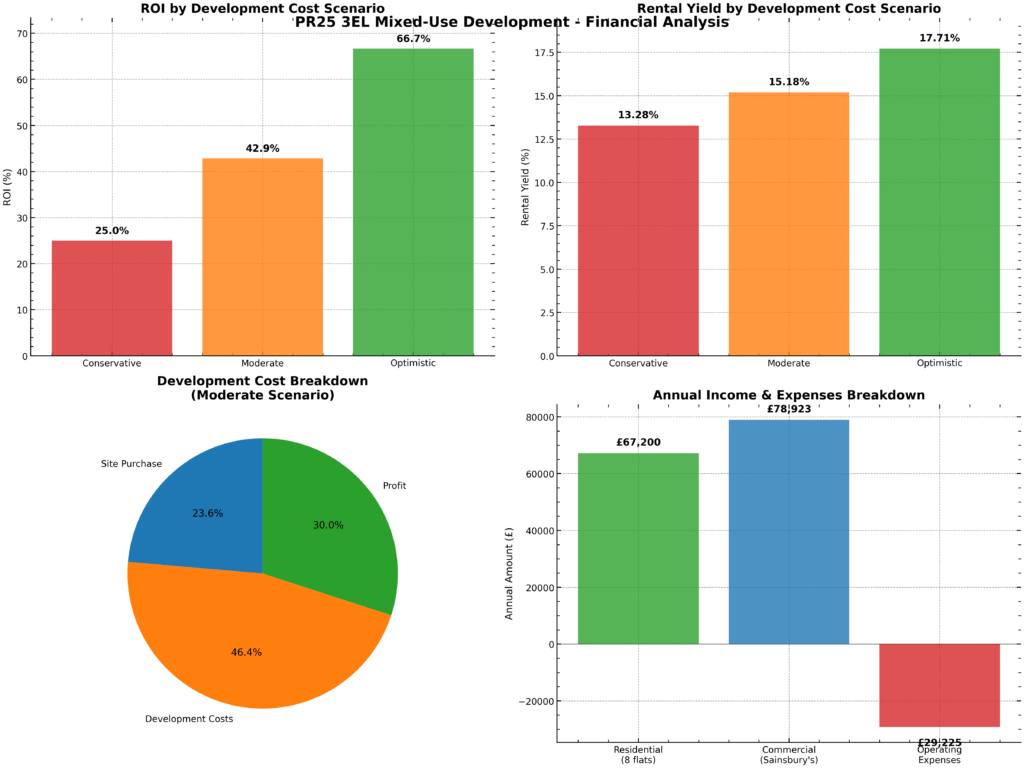

Site Purchase Price: £260,000 GDV: £1,100,000 Number of Units: 8 x 1-bed flats + 1 retail unit Retail Covenant: Blue-chip Sainsbury’s Local lease to 2030 Licence: FRI, 15-year term, RPI-linked reviews Proposed JV Structure: Contractual JV or SPV Status: Available – JV Development Opportunity [caption id="attachment_15384" align="aligncenter" width="1024"] PRESTON-JOINT-VENTURE-FINANCAL-CALS[/caption]

Figure: ROI and rental yield comparisons under Conservative, Moderate, and Optimistic cost scenarios.

PRESTON-JOINT-VENTURE-FINANCAL-CALS[/caption]

Figure: ROI and rental yield comparisons under Conservative, Moderate, and Optimistic cost scenarios.

| Scenario (Cost % of GDV) | Total Cost | Profit | ROI | Rental Yield | Payback (yrs) |

|---|---|---|---|---|---|

| Conservative (80%) | £880,000 | £220,000 | 25.0% | 13.3% | 7.5 |

| Moderate (70%) | £770,000 | £330,000 | 42.9% | 15.2% | 6.6 |

| Optimistic (60%) | £660,000 | £440,000 | 66.7% | 17.7% | 5.6 |