Description

Ashtead amenity land auction unlocks an exceptional opportunity to acquire approximately 1.0 acre of freehold land on Shepherds Walk, Ashtead (KT18 6BX). Located within the Ashtead Park ward and governed by Mole Valley District Council. This parcel sits in a suburban affluence zone. Just 14 miles south of central London and 3 km from Ashtead railway station. The site lies entirely within the Metropolitan Green Belt. This helps preserving its open-field character and mature hedgerow boundaries. Consequently, uses such as agriculture, woodland management and amenity-based activities (e.g., camping, community events). These uses permitted without the need for full planning consent, while other developments require “very special circumstances” to comply with local and national policy. Moreover, the land adjoins Ashtead Common—a 181-hectare nature reserve managed by the City of London Corporation. That draws walkers, cyclists and wildlife enthusiasts year-round. Meanwhile, Ashtead Park House and the 54-hectare historic parkland lie within a short drive, offering tranquil settings and heritage appeal. Investors and community groups will appreciate the ease of access, with Shepherds Walk connecting directly to nearby retail, schools and leisure facilities in Epsom. The legal pack—including registered title SYXXXXXX, detailed site surveys and boundary plans—is available for immediate download, and online bidding ensures a seamless acquisition process. Whether you are seek a long-term land-banking investment. A timber and carbon-credit woodland project, or a recreational amenity site. This land promises strategic value.

In addition, proximity to London and strong regional demand underpin enduring capital growth potential.

What3words – agent.ready.pulled.

Whether you are seek a long-term land-banking investment. A timber and carbon-credit woodland project, or a recreational amenity site. This land promises strategic value.

In addition, proximity to London and strong regional demand underpin enduring capital growth potential.

What3words – agent.ready.pulled.

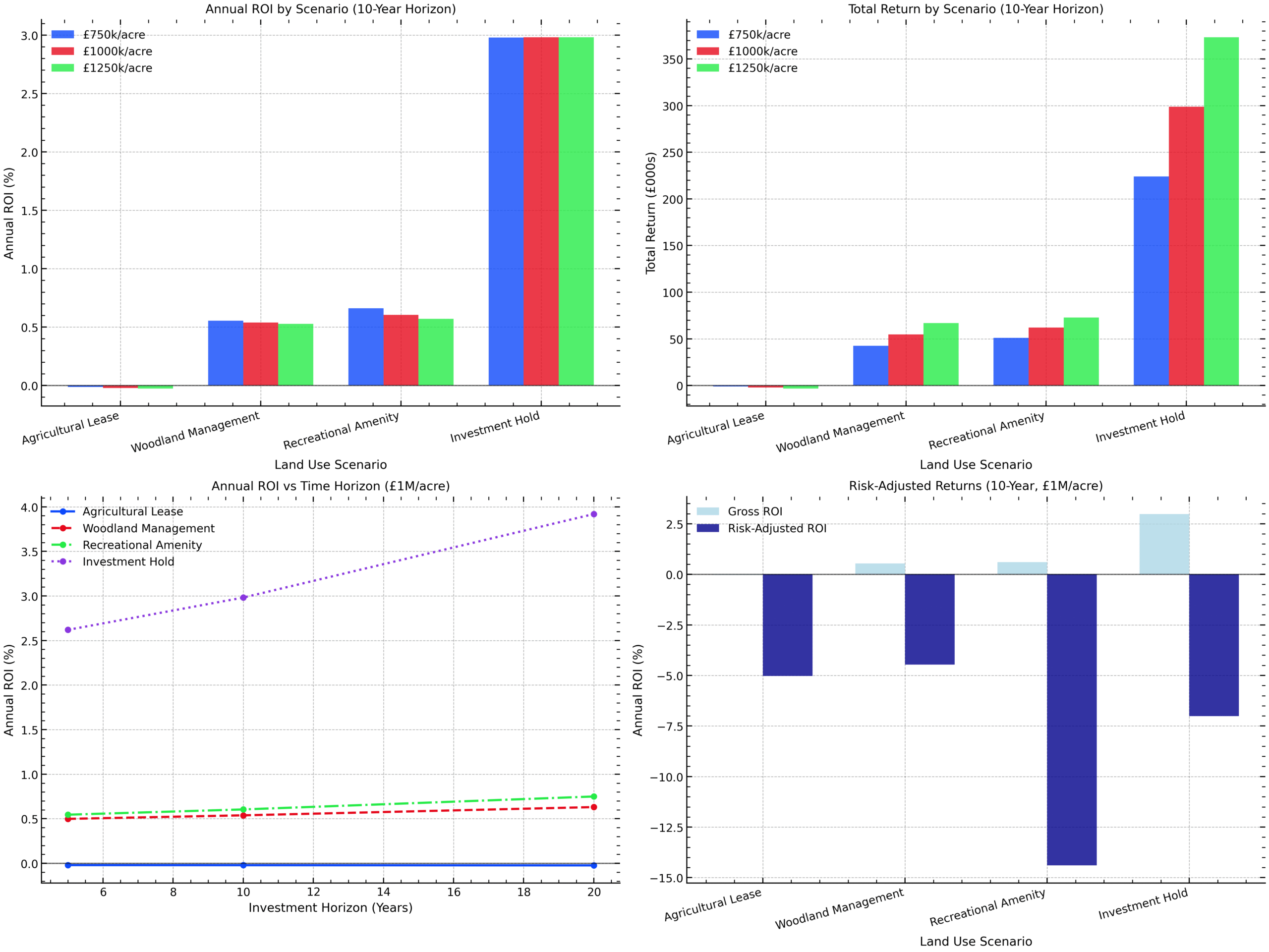

ROI Analysis & Investment Scenarios

Final Investment Recommendations

- Investment Hold (Land Banking) – Annual ROI: 2.5–4.0% | Risk: Medium (planning policy changes) – Capital: £750k–£1.25M + £2k setup

- Recreational Amenity Use – Annual ROI: 0.5–0.8% | Risk: Higher (permissions, operations) – Capital: £750k–£1.25M + £25k setup

- Woodland Management – Annual ROI: 0.5–0.6% | Risk: Low (permitted use) – Capital: £750k–£1.25M + £15k setup

- Agricultural Lease – Annual ROI: ~–0.02% (not recommended at standard land values).