Description

Introduction

The Paddington w2 apartment hotel investment offers a prime freehold, end-of-terrace corner building. Opposite Hyde Park, fully refurbished and configured as six serviced flats. This off-market opportunity delivers potential Airbnb income of £600,000 per year. Available subject to a £8.5 million guide price. Translating to a 7.06% gross yield and a competitive £1,181 per sq ft price point.Property Overview

Status: Distress Quick Sale – Highly Private & Confidential Property Type: Apartment Hotel (Serviced Flats) – Freehold Guide Price: £8,500,000 (Finder’s Fee: 2%) Total Size: 7,200 sq ft Units: 6 flats • 2× 3 bed / 3 bath (1,390 sq ft each, balconies) • 4× 2 bed / 2 bath (800–1,200 sq ft each, dual-aspect windows, balconies) Building: Lift, corner position with dual-street views.Financial Metrics

| Metric | Value |

|---|---|

| Purchase Price | £8,500,000 |

| Potential Annual Income | £600,000 |

| Gross Rental Yield | 7.06% |

| Net Rental Yield (45% expenses) | 3.88% |

| Price per Sq Ft | £1,181 |

| Break-Even Occupancy | 81.8% |

| Market Avg. Occupancy (Serviced) | 81% |

| Prime Central London Gross Yields | 3%–4.6% |

Investment Analysis

Gross vs. Net Yields

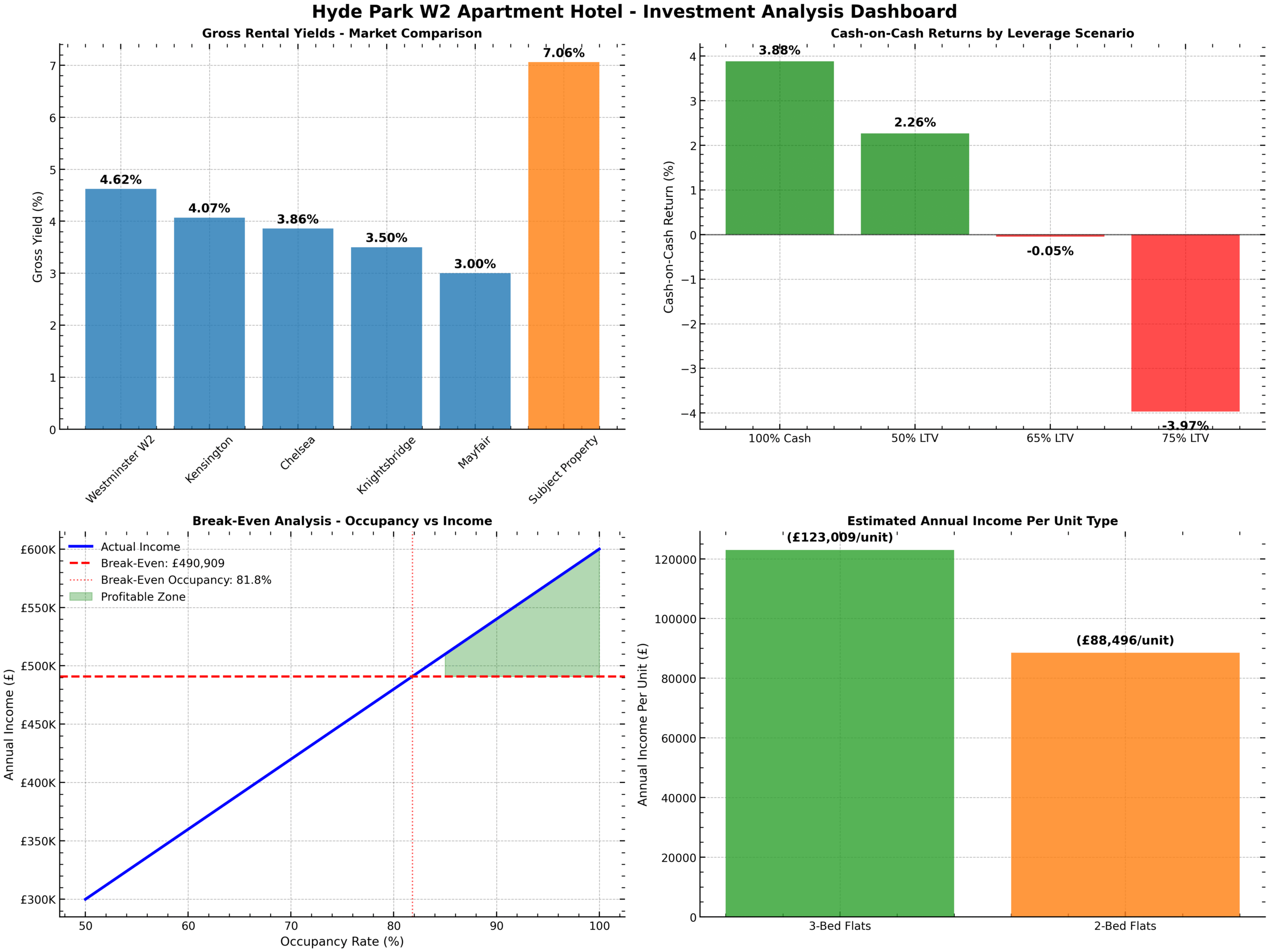

In addition, this scheme’s 7.06% gross yield markedly outperforms typical prime Central London. Moreover, yields of 3%–4.6%. After operating expenses (45% based on serviced-apartment norms), the net rental yield remains robust at 3.88%. Well above hotel sector margins.Occupancy & Break-Even

- Average occupancy for London serviced apartments is 81%.

- Break-even occupancy for this asset is just 81.8%, a level routinely exceeded in prime markets.

Market Comparison

[caption id="attachment_15615" align="aligncenter" width="750"] Hyde-park-apartment-hotel-Detailed-ROI-dashboard-comparing-gross-yields-leverage-scenarios-break-even-analysis-and-per-unit-income[/caption]

Figure: Detailed ROI dashboard comparing gross yields, leverage scenarios, break-even analysis, and per-unit income.

Hyde-park-apartment-hotel-Detailed-ROI-dashboard-comparing-gross-yields-leverage-scenarios-break-even-analysis-and-per-unit-income[/caption]

Figure: Detailed ROI dashboard comparing gross yields, leverage scenarios, break-even analysis, and per-unit income.

Internal & External Links

Internal Links:- Firstly How to Register to Bid → palaceauctions.com/buying-at-auction/how-to-register-to-bid/

- Secondly Auction Calendar → palaceauctions.com/auction-calendar/

- Thirdly London Area Guide → palaceauctions.com/the-worlds-key-real-estate-locations/uk-areas/london/

- Firstly, Greater London Authority: Short-Term Letting Guidance. https://www.london.gov.uk/

- Secondly, Westminster City Council Planning. westminster.gov.uk/planning-building-and-environmental-regulations

- Thirdly, Airbnb Regulations in London. airbnb.com/help/article/944/airbnb-short-term-rental-regulations-in-london

Next Steps: Firstly, - Arrange a private viewing (proof of funds required). Second job, Secure financing with our in-house team. Thirdly, Pay 2% finder’s fee to lock in this exclusive PCL investment.This Paddington W2 apartment hotel investment represents one of the rare, turnkey opportunities for prime serviced-accommodation returns in Central London. Secure this off-market deal today!