Description

Key Takeaway: Acquire Flat, upon 18 Molyneux Street, W1H 5HN at £330,000 (22.4% discount) for an immediate equity gain of £95,000 and a mid‐gross rental yield of 7.09%.Introduction

The Marylebone studio flat investment at Flat 5, 18 Molyneux Street offers buyers a recently renovated lower-ground-floor studio with share of freehold on one of London’s most desirable streets. Priced at £330,000 plus fees, this property is listed at £425,000 on the open market, delivering a £95,000 immediate equity gain (28.8%) and potential for strong rental returns.Features

• Share of freehold studio flat • Lower-ground floor with private rear terrace • Open-plan living/bedroom and separate kitchen • Modern shower room and hallway • Immediate equity gain of £95,000 • Mid-gross rental yield of 7.09% p.a. (purchase price basis) • Estimated net yield of 4.31% after costsDescription

Flat 5 is a bright, clean, and well-ventilated studio with direct access to a small rear terrace. The generous living/bedroom area flows into a contemporary kitchen, while the tiled shower room completes the layout. Recent refurbishment ensures minimal capex for future owners. Investors benefit from a share of freehold structure, removing onerous ground rent and enabling direct control over management decisions. Moreover, the sub-£350k price point in Zone 1 Marylebone represents a rare opportunity to buy below market value. Adjacent to high-end boutiques, cafés, and community gardens, the property will appeal to professional tenants and long-term buy-to-let portfolios. Original Property Listing URL: rightmove.co.uk/properties/162832430#/?channel=RES_BUYIncome & Yield Analysis

| Metric | Value |

|---|---|

| Purchase Price | £330,000 |

| Current Market Value | £425,000 |

| Immediate Equity Gain | £95,000 |

| Mid-Point Annual Rent Estimate | £23,400 |

| Gross Yield (Purchase Price) | 7.09% |

| Net Annual Income (After Costs £9,180) | £14,220 |

| Net Yield (Purchase Price) | 4.31% |

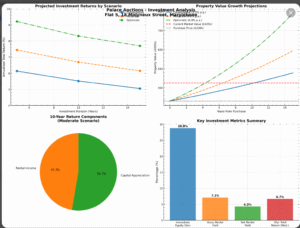

Investment-analysis-dashboard[/caption]

This dashboard illustrates gross vs. net yields, immediate equity, and projected annualized returns under conservative (2.5%), moderate (4.0%), and optimistic (6.0%) capital growth scenarios:

Investment-analysis-dashboard[/caption]

This dashboard illustrates gross vs. net yields, immediate equity, and projected annualized returns under conservative (2.5%), moderate (4.0%), and optimistic (6.0%) capital growth scenarios:

- 5-Year Returns: 6.14%–9.21% p.a.

- 10-Year Returns: 5.52%–8.31% p.a.

Capital Appreciation Scenarios

Over 10 years at 4.0% p.a., the flat could grow to £488,481, delivering a 6.69% annualized total return combining rental income and capital gain.Location

Flat 5 sits in the heart of Marylebone, W1H:- Baker Street Station (Bakerloo, Circle, Hammersmith & City, Metropolitan)

- Marylebone Station (Chiltern Railways & Mainline)

- High-end shopping on Marylebone High Street

- Regents Park, London Zoo and local cafés

- Walking distance to Oxford Street and Hyde Park